Despite a languishing share price, Echelon Capital Markets analyst Stefan Quenneville continues to beat the drum for Canadian biotech company Sernova (Sernova Stock Quote, Charts, News, Analysts, Financials TSX:SVA), saying in a Thursday report that a recently announced collaboration with drug company AstraZeneca is validation for SVA’s technology.

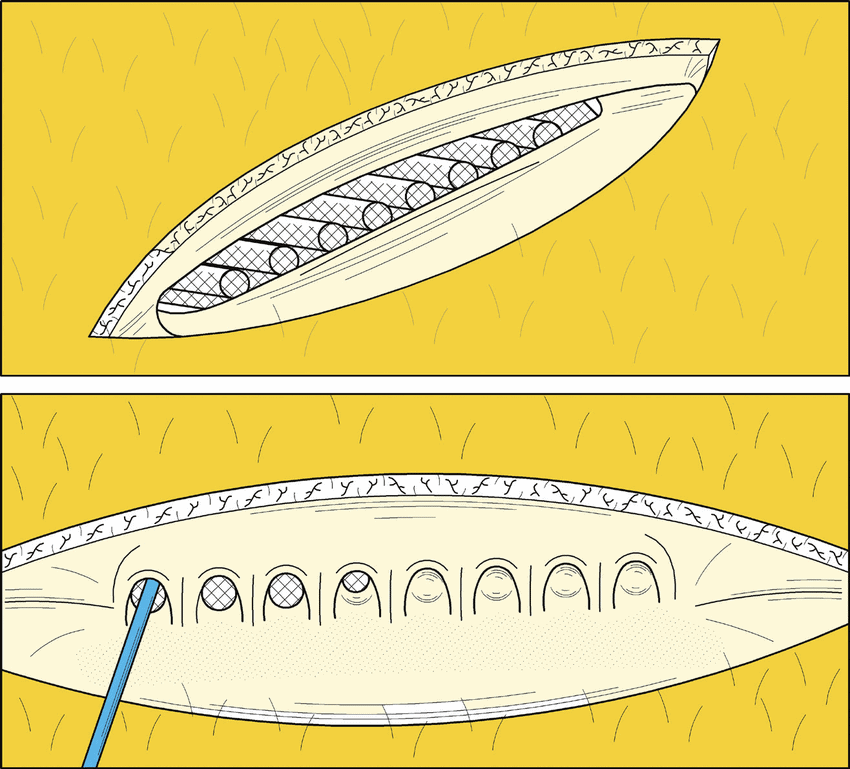

London, ON-based Sernova is developing its Cell Pouch System, which creates a vascularized tissue environment for the transplantation of therapeutic cells or tissues to treat chronic diseases such as diabetes, hemophilia and hypothyroid.

The company recently reported its fiscal second quarter 2023 financials, coming in with a total spend of $8.8 million and ending the Q2 with about $37 million in cash. &D costs were $7.0 million and operating cash burn was $9.0 million.

Last month, Sernova announced it has entered into a preclinical research agreement with AstraZeneca to evaluate the use of the Cell Pouch System in combination with AZN’s novel therapeutic cells for a number of indications outside of Sernova’s focus on diabetes, hemophilia and hypothyroid.

The agreement will see AstraZeneca lead and completely fund the development of the cell technologies and preclinical activities in conjunction with SVA.

Quenneville said that while the agreement appears to be relatively preliminary, he thinks it could potentially lead to a commercial agreement if the collaboration proves successful.

“[T]his type of Big Pharma scientific validation further supports our thesis that SVA’s Cell Pouch remains the best-in-class and most clinically proven cell therapy device for Type 1 diabetes and other potential indications,” Quenneville wrote.

Quenneville said there’s an upcoming catalyst for SVA in the form of updated results from the company’s ongoing diabetes Phase 1/2 trial with the Cell Pouch System, with the results to be presented at the American Diabetes Association 83rd Scientific Sessions on June 24.

Quenneville said he expects the results to continue to impress, while on the recent Q2 results, he said the quarterly cash burn was larger than expected, where the $7.0 million in R&D was above his estimate at $4.5 million.

Quenneville reiterated a “Speculative Buy” rating on SVA and $3.75 target price, which at press time represented a projected one-year return of 326 per cent.

“We continue to believe SVA is significantly undervalued as its Cell Pouch remains the best-in-class and most clinically proven cell therapy device for T1D and other potential indications. The recent preclinical research collaboration with AstraZeneca further supports our thesis,” he wrote.

In other SVA news, the company recently announced the appointment of a new Board Chair as well as two new Board members, while retaining Philip Toleikis as President and CEO.

Quenneville framed the moves as a shareholder-led proxy battle but downplayed concerns over SVA’s share price.

“While we understand the shareholder frustration with the stock price, we believe that this was largely due to a difficult biotech market, as management has executed ably on the clinical and business development front in recent years. Nevertheless, we welcome the increased investor scrutiny and the minor incentive changes that better align management and the board to create shareholder value,” Quenneville wrote.

Share

Share Tweet

Tweet Share

Share

Comment