Leede Jones Gable provided an update on Thursday on Canadian regenerative medicine company Sernova (Sernova Stock Quote, Charts, News, Analysts, Financials TSX:SVA), with analyst Douglas W. Loe commenting on a recent acquisition in the regenerative biotech space that bodes well for industry interest in companies like Sernova.

Pharma giant Eli Lilly announced on Thursday the acquisition of Sigilon Therapeutics, a preclinical-stage company with product candidates to replace islet cells in the treatment of diseases such as type 1 diabetes and hemophilia A. The deal values Sigilon shares at a cumulative value of $338 million or $135 per share, although most of that value is based on tradable contingent value rights that could be paid out over time, depending on Sigilon’s technology meeting developmental milestones.

Sigilon’s share price shot up from $4 to $21 in trading on Thursday.

Eli Lilly said in a statement that people with type 1 diabetes contend with a high disease burden despite medical advances in treatment to date.

“By combining Sigilon’s talent and expertise in cell therapy with the knowledge and skills of Lilly’s research and development teams, we will enhance opportunities to create innovative islet cell therapy solutions to improve the care of people living with diabetes,” said Ruth Gimeno, Ph.D., group vice president, diabetes, obesity and cardiometabolic research at Lilly.

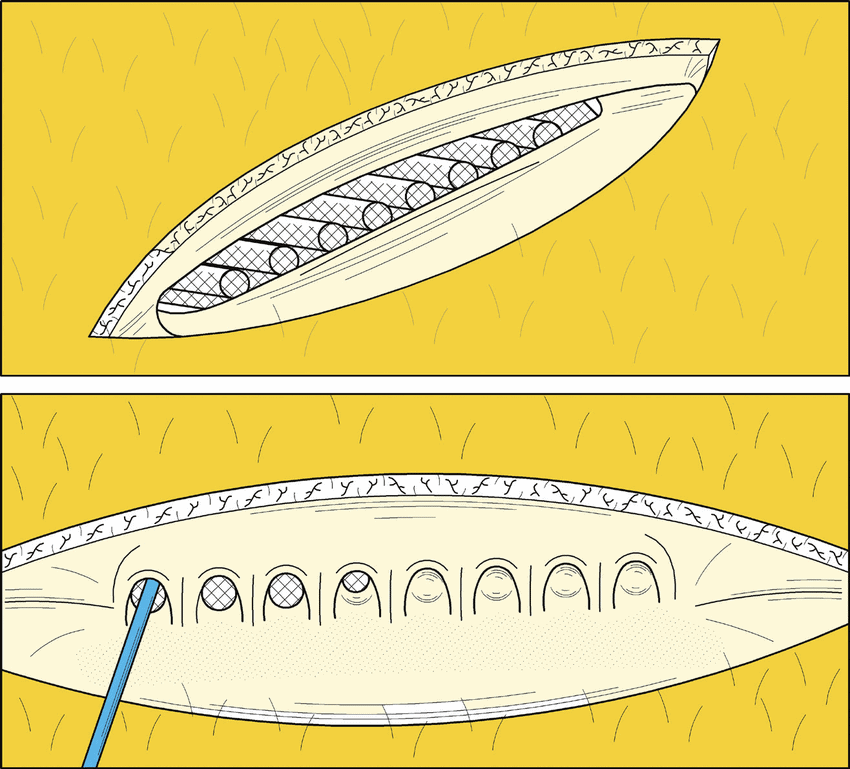

The news has implications for Sernova, according to Loe, where SVA’s lead candidate is an implantable cell reservoir platform called Cell Pouch currently in early development and targeting type 1/2 diabetes, hemophilia A and hypothyroidism. Loe said Sigilon is a regenerative medicine peer of Sernova’s, although the companies are developing complementary rather than competitive technologies.

Loe said Sigilon’s approach involves creating functional cell therapies from stem cell precursors whereas Sernova’s Cell Pouch is a cell therapy-enabling tech, one which “has already shown itself to be capable of sustaining biological activity (for years in some clinical cases) of cell therapies deployed within it.” Loe also noted SVA’s diabetes-focused stem cell therapy alliance already in place with Germany-based Evotec, a partnership which has already yielded “impressive” preclinical data, according to Loe.

“Sigilon’s acquisition value is less relevant to us than the mounting interest exhibited by well-capitalized endocrinology-focused drug developers like Eli Lilly & Vertex in regenerative medicine,” Loe wrote.

“Our key takeaway for Sernova is that the interest in regenerative medicine in diabetes care is clearly mounting and at a stage when virtually all competitive therapies are either in Phase I testing or about to be and thus are still in the early-stages of clinical development,” he said.

With the update, Loe maintained a “Speculative Buy” rating and $3.30 target price on Sernova, which at press time represented a projected one-year return of 263 per cent.

Share

Share Tweet

Tweet Share

Share

Comment