Calling the stock an attractive high-risk, high-reward opportunity, Research Capital analyst Andre Uddin initiated coverage on Monday on Canadian biotech company Sernova (Sernova Stock Quote, Charts, News, Analysts, Financials TSX:SVA). Uddin started SVA off with a “Speculative Buy” rating and $3.50 target price, saying its therapeutic cell/device technology has the potential to become the holy grail of diabetes management.

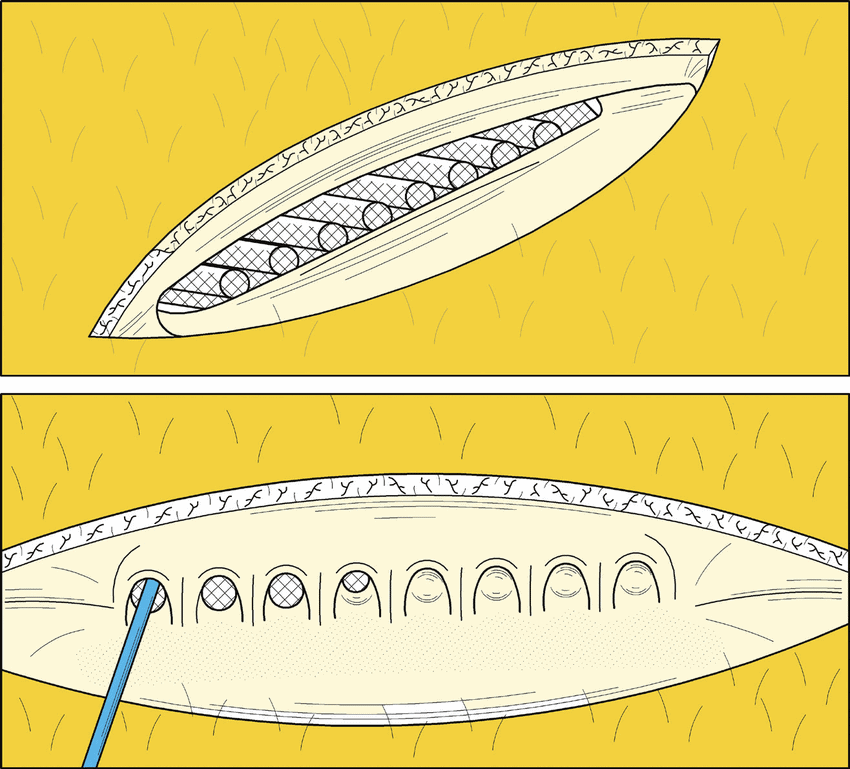

Founded in 1998 under the name Pheromone Science Corp, Sernova has been developing its Cell Pouch technology, a platform with three components: a cell pouch, therapeutic cells and immune protective technologies. The Cell Pouch provides a vascularized environment for therapeutic cells to grow in vivo to produce key proteins or hormones which are then released into the bloodstream. The approach prevents transplanted therapeutic cells from damage by the immune system.

Uddin said the Cell Pouch has generated promising interim and early data in a currently ongoing first generation Phase 1/2 trial. The company is conducting a single-arm Phase 1/2 trial in 13 Type 1 Diabetes patients who receive human donor islets that are transplanted into the Cell Pouch after implantation of the device and stable immunosuppressant activity has been established. The primary endpoint of the study being safety analysis. While secondarily the study is looking at islet cell survival in the Cell Pouch, the proportion of subjects with a reduction in severe hypoglycemic events (SHEs) and proportion of subjects with a reduction in HbA1c.

Uddin said SVA has so far released preliminary positive data from three patients in the study, finding surgical implantation was generally well tolerated with a favourable safety profile and all patients who had favourable immunosuppression achieved complete insulin independence. At the same time, the other three patients in the first cohort were not able to maintain optimal immunosuppression, but Uddin said this has now been resolved, enabling the three patients to receive further protocol-defined islet transplants.

“We view the Phase 1/2 trial as a proof-of-concept study with the 1st gen product as being a way to validate SVA’s Cell Pouch System technology and to find optimal dose levels (i.e. the number of islet cells) for further development,” Uddin wrote.

“It is our belief that the 3rd generation product (Cell Pouch System + iPSC-derived islet cells + local immune protection of iPSC islet clusters) would become SVA’s main focus for further development in the future. Investors should note, the company will need to make a go no/go decision regarding development of the first generation product in late 2023/early 2024,” he said.

Uddin said Sernova has a “game-changing” exclusive global strategic partnership with Evotec to develop beta cell islet replacement therapy in insulin-dependent diabetes, with additional data from the Phase 1/2 trial to be presented in late June at the American Diabetes Association conference.

At the time of publication, Uddin’s $3.50 target represented a projected one-year return of 307 per cent.

“With a market cap of approx. $260 million, the company should still represent an attractive high-risk, high-reward opportunity in light of the US$950 million Semma/Vertex and US$320 million ViaCyte/Vertex transactions,” Uddin said.

Share

Share Tweet

Tweet Share

Share

Comment