Investors can expect continued organic growth from ad tech company Sabio, according to Eight Capital analyst Kiran Sritharan. The analyst reviewed Sabio’s latest quarter in a report to clients on Thursday, maintaining a “Buy” rating on the stock and C$3.50 target price, which at press time implied a one-year return of 257 per cent.

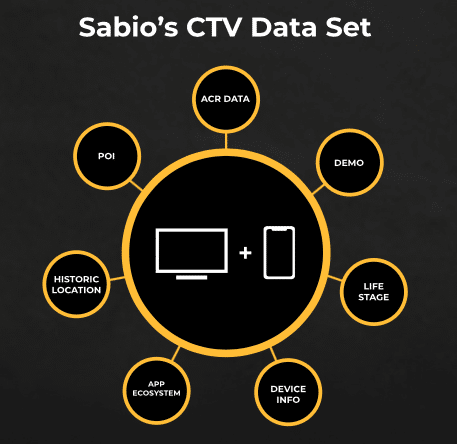

Sabio, which has Connected TV (CTV) and over-the-top (OTT) solutions for advertising, audience analytics and content monetization, released its first quarter 2023 financials on Tuesday. Sabio posted a 16 per cent year-over-year growth in revenue to $6.5 million, with CTV/OTT sales up a big 63 per cent to $3.8 million. (All figures in US dollars except where noted otherwise.)

The company said there were delayed starts to customer planning cycles that affected business over the first two months of the Q1, although there was a “significant” return to revenue growth in March, which along with improved gross margins and cost efficiencies helped propel SBIO to an adjusted EBITDA-positive quarter.

“Our ability to post double-digit revenue growth in a challenging economic environment is a testament to our ability to retain existing customers at high rates while securing new, Fortune 500 logos,” said CEO Aziz Rahimtoola in a press release.

Sritharan said Sabio’s $6.5 million topline was ahead of his estimate at $6.1 million as well as the consensus call at $6.0 million, while the Q1 adjusted EBITDA loss of $2.2 million was ahead of the Eight Capital forecast of negative $3.3 million and in-line with the Street at negative $2.4 million.

“Sabio’s reported 63% growth in their CTV segment, the majority being organic, highlights continued strength and share gains in the business. Positive updates on retention and new logo activity give us confidence in a seasonal sequential build through the year. We have an increasingly conservative view on the demand environment; however, we continue to believe Sabio will continue to deliver organic growth and that current investment in infrastructure will support wallet share gains.,” Sritharan wrote.

“Positive updates on retention and new logo activity give us confidence in a seasonal sequential build through the year. We have an increasingly conservative view on the demand environment; however, we continue to believe Sabio will continue to deliver organic growth and that current investment in infrastructure will support wallet share gains,” Sritharan said.

On a comps basis, Sritharan estimates SBIO to be currently trading at 0.6x 2024 EV/Revenue compared to its ad tech peers in Canada at 1.3x and its larger US peers at 5.0x. The analyst is expecting Sabio to finish 2023 with revenue of $48.0 million and adjusted EBITDA at $1.2 million.

“The company added significant headcount and infrastructure and we expect the company to be focused on organic growth and achieving profitability again this year,” Sritharan said.

Disclosure: Sabio Holdings is an annual sponsor of Cantech Letter.

Share

Share Tweet

Tweet Share

Share

Comment