The situation still looks bleak for Powerband Solutions (Powerband Solutions Stock Quote, Charts, News, Analysts, Financials TSXV:PBX), where the stock is mired in all-time lows. And Desjardins Capital Markets analyst Gary Ho is staying cautious on the name, reiterating in a Tuesday note to clients a “Hold” rating and saying a number of factors have to fall into place before this thing turns around.

Powerband, whose platform allows for cloud-based transactions on autos, announced its first quarter 2023 earnings on Wednesday, with revenue at $839K versus $6.0 million a year ago and an adjusted EBITDA loss of $2.3 million compared to a loss of $1.9 million a year earlier.

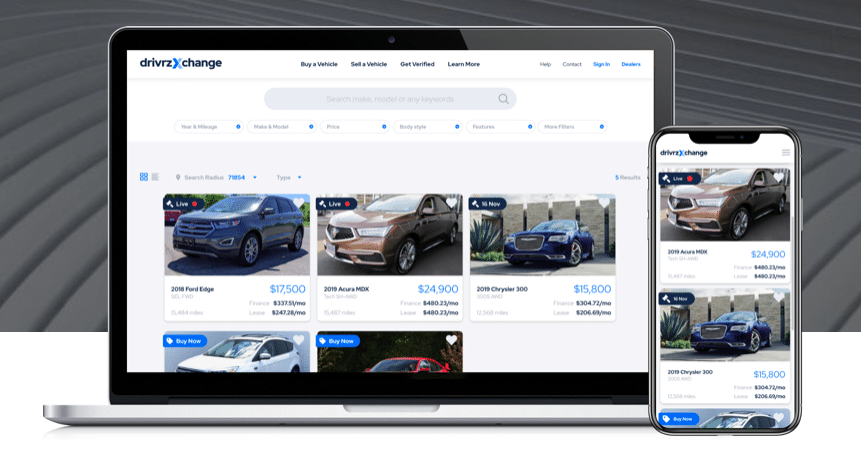

Powerband had provided a business update in late April which said there was an issue with one of the financial institutions providing lease financing to its DrivrzFinancial (DF) platform. That institution said some vehicles with leases through DF fell within the repurchase criteria, with the outcome that the institution has suspended funding to DF for lease originations.

Powerband said that it’s in the process of negotiating with the institution to restart the originations and that over the Q1 it hadn’t been able to obtain alternative funding sources and will not be self-funding any additional leases at the moment. And the company further said that it has implemented measures to prevent such repurchases in the future, including terminating employment of some employees and executives related to the issue.

“PowerBand’s management team continues to work diligently with the Financial Institution to resolve issues with the repurchasing of vehicle leases and to re-commence the origination of leases through the Forward Flow Purchase and Security Agreement. The Company is also seeking to secure additional funding lines for DrivrzFinancial,” the company said in an April 25 statement.

For Ho, the first quarter results from PowerBand were in-line with estimates, but he said the impact of the results was neutral, as there was no news in the quarterly press release about the re-starting of relationships with a lender in order to get vehicle originations up and running.

“Our cautious views are predicated on: (1) limited visibility on a meaningful turnaround in lease originations (although we recognize the massive market opportunity); (2) the continued going concern note, with the company’s opex running at ~C$3m/quarter; and (3) re-establishing existing/new lending relationships is needed to restart originations,” Ho wrote.

With the update, Ho lowered his target price on PBX to $0.02 per share, representing a projected return at the time of publication of negative 33.3 per cent.

Share

Share Tweet

Tweet Share

Share

Comment