Desjardins analyst Gary Ho has lowered his expectations for PowerBand Solutions (PowerBand Solutions Stock Quote, Chart, News, Analysts, Financials TSXV:PBX), maintaining a “Buy” rating with a “Speculative” risk lablelling but reducing his target price from $1.60/share to $0.85/share in an update to clients on Tuesday.

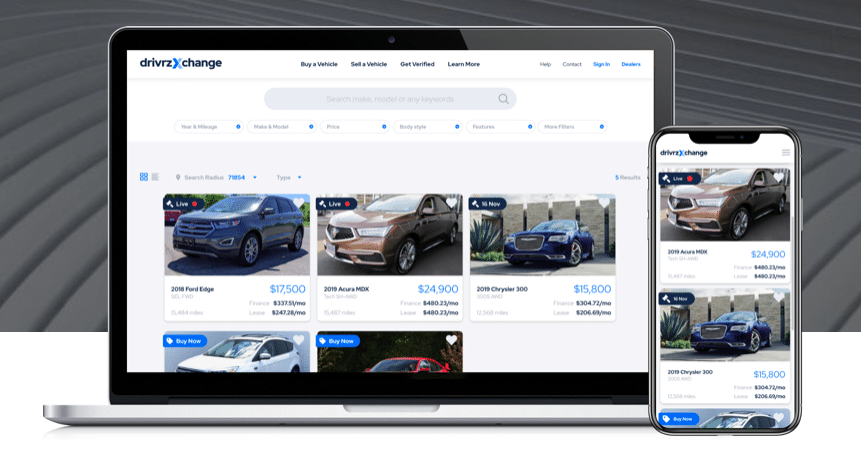

Headquartered in Burlington, Ont., PowerBand Solutions designs and develops cloud-based auction and finance portal software tools for car buying operations in Canada. Ho’s new report comes after PowerBand released its fourth quarter financial results along with 2021 year-end figures.

“The operating environment continues to suffer from low inventory, elevated prices and increased financing competition. While financing is a risk, we believe it is manageable,” Ho said. “Visibility on a near-term industry turnaround is limited, but we see medium- to longer-term value for patient investors.”

PowerBand’s quarter was headlined by $7.1 million in revenue for a 397 per cent year-over-year increase, which came in below the preliminary management guidance of $8 million set out in January, which Ho attributed to a $400,000 loss in customer lease provision and another $600,000 loss on its DX software revenue.

Meanwhile, the company also reported an adjusted EBITDA loss of $1.8 million, which came in slightly ahead of the Desjardins projection of a $2.1 million loss but also includes a $3.7 million unrealized loss on investments.

The company also reported a solid gross profit of $3.7 million for an implied margin of 52.1 per cent, beating the original Desjardins estimate of $3.4 million in gross profit and an implied margin of 42.5 per cent. PowerBands also exceeded expectations pertaining to its lease originations in the quarter, as its report of 797 outpaced the Desjardins estimate of 750.

Ho pointed out that the company’s current dealer relationship count has increased to approximately 1,200, and that management is presently focused on cost containment with an aim of reducing expenditures by approximately $1.5 million per month.

“We are continuing to dynamically manage our business while remaining focused on executing against our business strategy to drive long term growth,” said Kelly Jennings, CEO and Founder of PowerBand Solutions in the company’s May 3 press release. “While we have delivered outstanding performance this past year, our new targets indicate we have many more opportunities to increase revenue and reduce costs.”

However, Ho also pointed out a few ongoing concerns which resulted in a lowering of his originations estimate to 4,469 from 6,475 in 2022 and to 8,253 from 10,704 in 2023.

“While financing is a risk, we believe the founder/partners and other financiers are available to backstop the funding gap,” Ho said. “We expect continued challenges related to low inventories, and stubbornly high prices to hamper lease originations and impact management’s C $70–90 million 2022 revenue target. That said, we are seeing early signs of wholesale price easing (peaked in early January).”

With the results finalized, PowerBand wrapped up its 2021 fiscal year with $23.9 million in revenue for a year-over-year increase just south of 700 per cent. Looking ahead to 2022, Ho has lowered his revenue projection from $54.2 million to $37.4 million for a potential year-over-year increase of 56.5 per cent, then also lowering his 2023 estimate from $89.5 million to $70.6 million for a potential year-over-year increase of 88.8 per cent.

From a valuation perspective, Ho forecasts the company’s EV/Revenue to drop from the reported 2.3x in 2021 to a projected 1.5x in 2022, then to a projected 0.8x in 2023.

Meanwhile, Ho dropped his EBITDA estimate for 2022 from a $1.3 million loss to a $5.2 million loss, and also lowered his projection for 2023 from $9.8 million and an implied margin of 10.9 per cent to a revised total of $5 million and an implied margin of 7.1 per cent.

Ho also lowered his gross profit estimate for 2022 from $27 million to $19 million for an implied margin of 50.8 per cent. Meanwhile, Ho’s gross profit target for 2023 also dropped from $48 million to $37.6 million for an implied margin of 53.3 per cent.

“Our positive thesis is predicated on: (1) increasing dealer adoption and a better inventory situation should result in an acceleration in originations; (2) limited competition in an untapped used leasing market presents a massive opportunity; and (3) asset-light model with zero inventory or credit risk exposure,” Ho said.

PowerBand’s stock price has plummeted by 69 per cent since the start of 2022, dropping off from its starting point of $0.92/share on January 4 to its present trading price of $0.28/share, representing a low point for 2022. At the time of publication, Ho’s $0.85 target represented a projected one-year return of 193.1 per cent

Share

Share Tweet

Tweet Share

Share

Comment