Lightspeed Commerce is still undervalued, says ATB

There’s light at the end of the tunnel for Lightspeed Commerce (Lightspeed Commerce Stock Quote, Charts, News, Analysts, Financials TSX:LSPD), according to ATB Capital Markets analyst Martin Toner, who reviewed the company’s latest earnings in an update to clients on Thursday. Toner retained an “Outperform” rating and $60.00 price target on LSPD, saying the stock is still undervalued.

Montreal-based Lightspeed announced its third quarter fiscal 2023 financials on Thursday for the period ended December 31, 2022, showing consolidated revenue of $188.7 million compared to $152.7 million a year earlier. Gross Transaction Volume (GTV) was $22.4 billion compared to $20.4 billion a year earlier, while adjusted EBITDA was a loss of $5.4 million compared to a loss of $7.1 million a year ago.

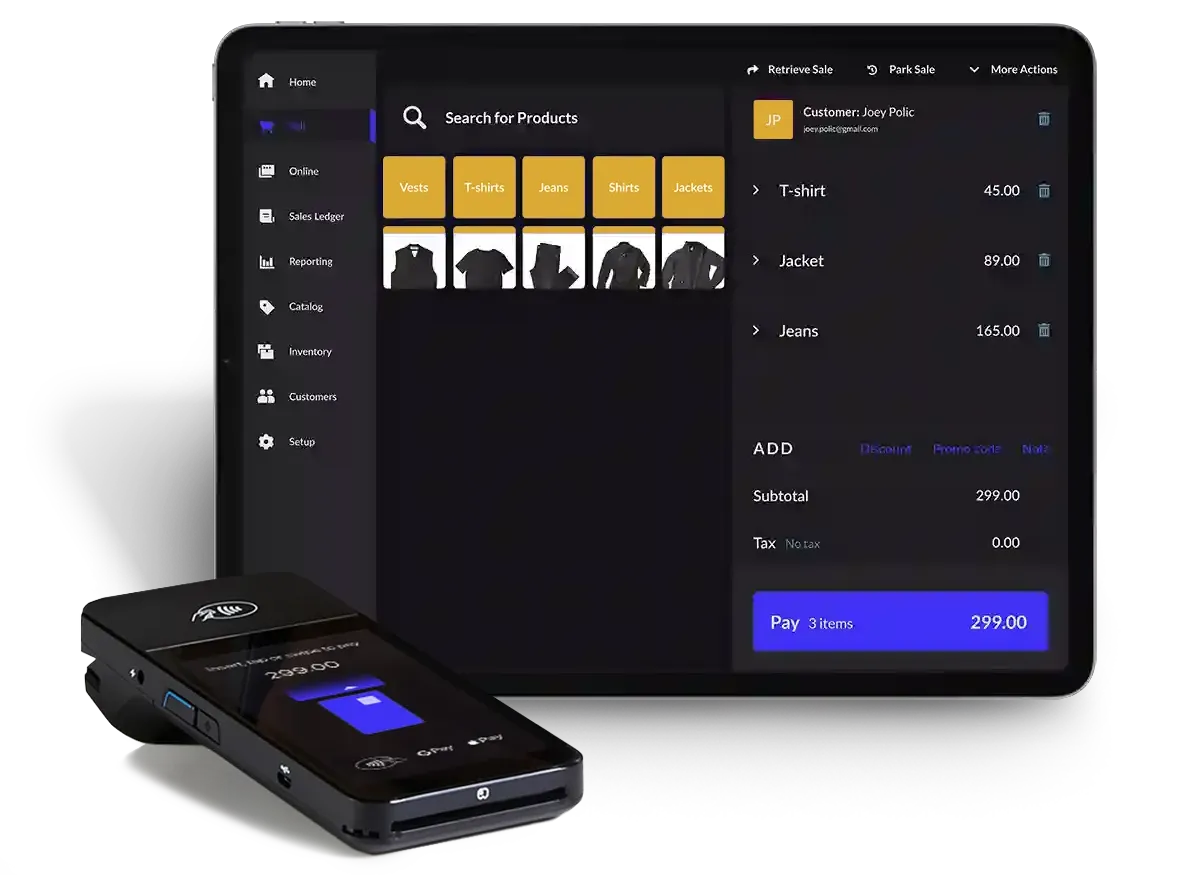

“We have spent the last two years building the most compelling commerce platform to help complex SMBs improve productivity, reduce costs, automate operations and use data driven insights to scale their business. We continue to be pleased with the growth we are seeing in this targeted customer base,” said JP Chauvet, CEO, in a press release.

Looking at the results, Toner declared them to be in-line with what he had forecasted, noting that the company had pre-announced numbers a couple of weeks ago. LSPD’s $188.5 million topline was a beat of Toner’s estimate at $185.0 million and even with the consensus call at $188.7 million, while the $5.4 million adjusted EBITDA loss compared to Toner’s estimate at negative $8.2 million and the Street at negative $8.3 million.

On guidance, Toner noted management’s statement that full fiscal 2023 revenue would come in at the lower end of its previous guidance of between $740 and $750 million on a constant currency basis, which would imply a modest decrease to its fiscal Q4 expectations. On the other hand, Lightspeed’s full 2023 adjusted EBITDA guidance was a little better at a loss of $37 million compared to a loss of $40 million previously stated.

Toner also noted that transaction-based revenue was $107.2 million for the fiscal third, which was up 41.3 per cent year-over-year and better than he had expected.

“The Company is growing well with larger merchants, and as those merchants become the majority of the customer base, we believe ARPU growth will accelerate,” Toner wrote. “We believe the stock remains undervalued relative to organic revenue and gross profit growth.”

At press time, Toner’s $60.00 target represented a projected one-year return of 141 per cent.

Staff

Writer