Autodesk is one of my Top Picks, this investor says

Design software company Autodesk (Autodesk Stock Quote, Charts, News, Analysts, Financials NASDAQ:ADSK) has been stuck in a post-COVID funk for about a year now, but investors should be thinking about the stock, as 2023 is set to be a big year, according to portfolio manager Kim Bolton of Black Swan Dexteritas, who recently nominated Autodesk as one of his top picks for the 12 months ahead.

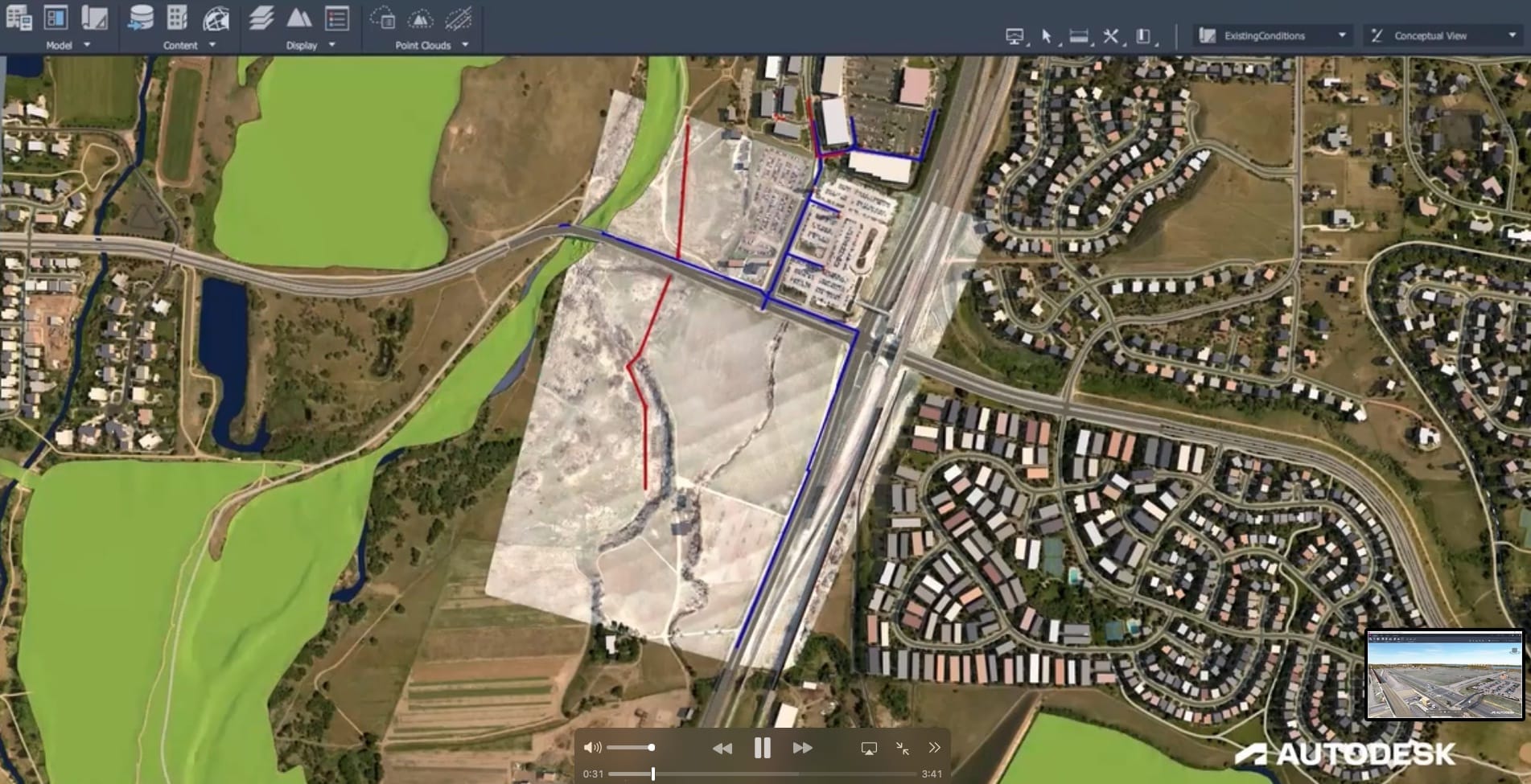

“They do 3D design, engineering and entertainment software and services worldwide and they’ve been around for ages,” said Bolton, speaking on BNN Bloomberg on Wednesday.

“It’s currently trading at about $220 and we have a 12-month price target of $260,” he said.

Like its competitor, Adobe, Autodesk has fallen a long way from its highs from late 2021 and hasn’t shown much sign of recovery. Both stocks did well in the early days of the pandemic, with ADSK gaining over 70 per cent in value over 2020 and 2021. But the downfall has been sharp and Autodesk has been trading for the past year at just a bit higher than its pre-pandemic levels.

That’s despite the company still being able to perform well operationally in a particularly challenging market. Revenue was up 14 per cent year-over-year in its most recently reported quarter, the company’s fiscal third quarter 2023, where Autodesk hit a topline of $1.280 billion. Diluted EPS was $0.91 per share compared to $0.62 a year earlier.

At the same time, Autodesk hasn’t been immune to the downsizing bug that’s bitten the tech industry on almost all fronts. Earlier this month, the company announced a just under two per cent reduction in its global workforce, about 250 jobs, although management has said that the drop in headcount is related to its key priorities rather than cost-cutting.

Ahead of Autodesk’s fiscal Q4, due on Wednesday, management has guided for revenue between $1.303 and $1.318 billion and EPS of between $0.99 and $1.05 per share.

Bolton says there’s exposure to the AI space through Autodesk, as is the case for Adobe, as well, making for another plus to owning the stock.

“It’s all about the earnings and so Autodesk expects its full-year billings to be between $5.5 and $5.7 billion and it expects free cash flow for the year to be between $2.0 and $2.2 billion,” Bolton said.

“So, this company is going to be around for a long time, and we believe Autodesk has the potential to benefit immensely from this whole generative AI revolution, especially when it comes to the 3D model generation,” he said.

Staff

Writer