The future looks bright for commercial-stage AI company DIAGNOS Inc (DIAGNOS Inc Stock Quote, Charts, News, Analysts, Financials TSXV:ADK), according to Echelon Capital Markets analyst Stefan Quenneville, who reviewed the latest quarterly results in an update to clients on Wednesday. Quenneville maintained a “Speculative Buy” rating, saying there are a number of catalysts on the near-term horizon.

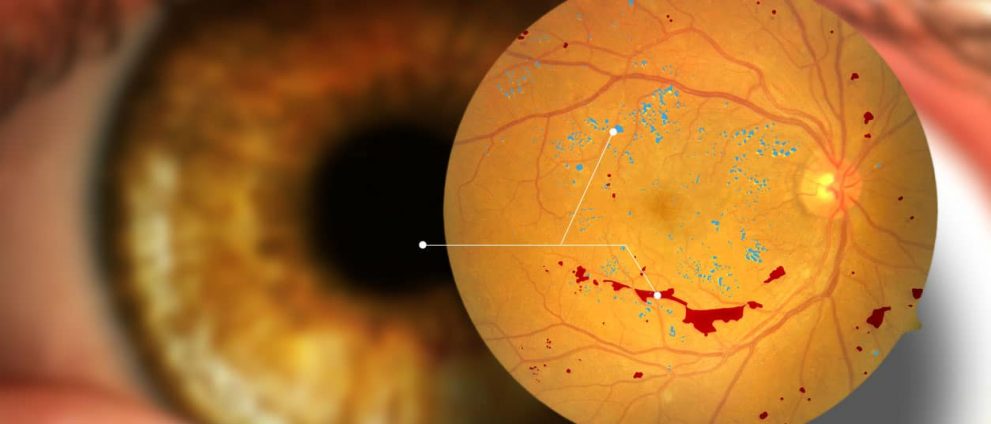

Diagnos is a Montreal-based company commercializing its AI analysis platform for image enhancement for the early detection, triage and monitoring of diabetic retinopathy (DR), the leading cause of blindness. ADK has an MOU with retail eyewear and eyecare giant EssilorLuxottica as well as a deal with New Look for its FLAIRE platform in Quebec.

Diagnos released on Wednesday operating results for its third quarter fiscal 2023 (period ended December 31, 2022), coming in with revenue at $122K, gross profit of negative $38K and EBITDA of negative $385K. The company’s net loss and EPS for the quarter were $514K and $0.01 per share, respectively.

By comparison, the quarterly numbers were below Quenneville’s expectations, which were calling for revenue of $147K and EBITDA of negative $162K. Quenneville said the roll-out across Quebec at New Look was slowed due to downtime associated with upgrades to provide the latest version of the software and complete integration with New Look’s own IT systems. The analyst said this work looks to now be largely completed and it’s expected that the company will have its tech installed in about 70 New Look locations by the end of March and about 400 by the end of the calendar year.

ADK stock has been jumping this past month and has essentially doubled since mid-December, but Quenneville sees more upside to come. The analyst maintained a 12-month target price of $1.00, which at press time represented a projected return of 170 per cent.

“[W]ith a meaningful Quebec government contract win potentially on the immediate horizon as well as the potential for a transformational deal with EssilorLuxottica, we maintain our Top Pick rating and $1.00/shr target price ahead of what we expect to be a catalyst-rich next twelve months,” Quenneville wrote.

By the numbers, Quenneville is forecasting full fiscal 2023 revenue of $0.6 million and EBITDA of negative $1.8 million, rising to fiscal 2024 revenue of $2.8 million and EBITDA of negative $259K. The analyst’s $1.00 target is based on the average of his discounted cash flow valuation with an 11 per cent discount rate and a five per cent terminal growth rate along with his EV/Sales at a 10x multiple of his fiscal 2023 estimates.

Share

Share Tweet

Tweet Share

Share

Comment