Roth Capital Partners delivered an update on Monday on Universal Display Corp (Universal Display Stock Quote, Charts, News, Analysts, Financials NASDAQ:OLED), with analyst Scott W. Searle saying a new supply agreement with Samsung clears an overhang on the stock. Searle reiterated a “Buy” rating on OLED while lowering his target price from $197 to $191, representing at press time a projected one-year return of 69 per cent.

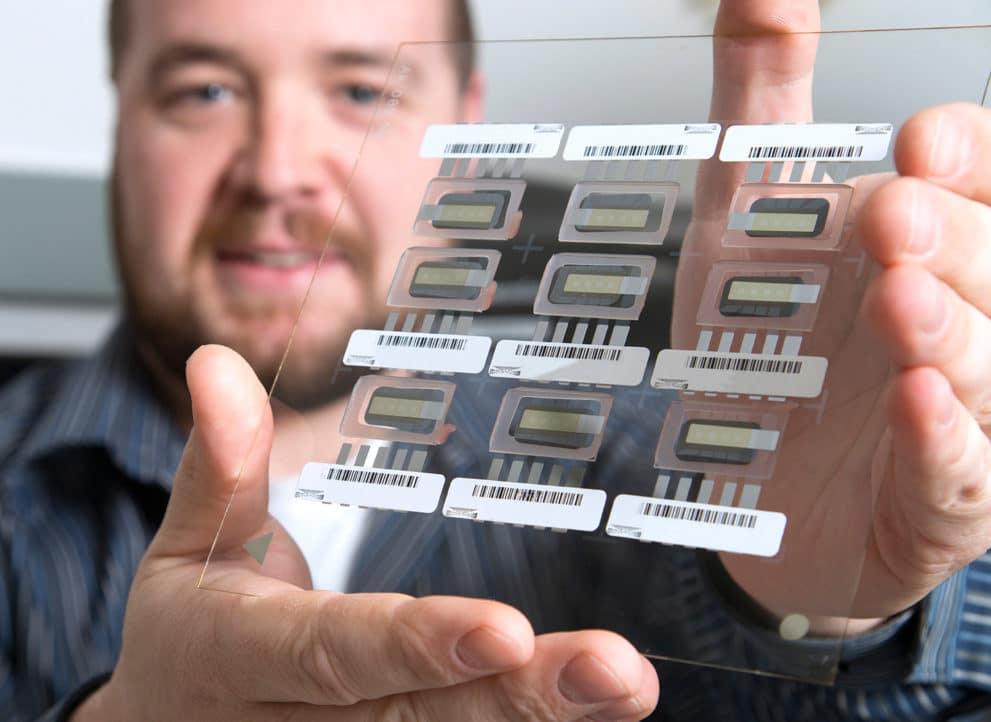

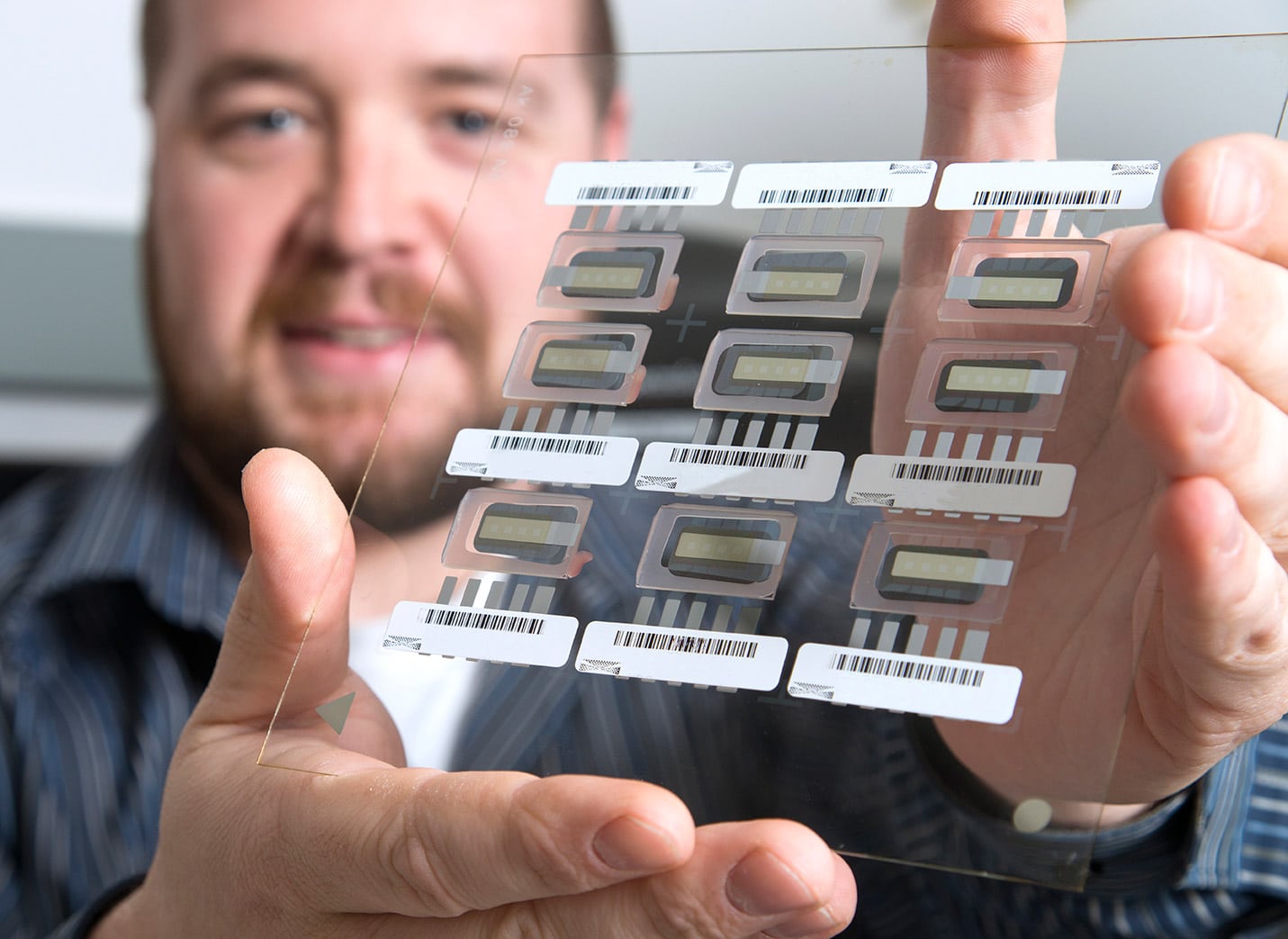

A leading supplier of tech and IP on organic light emitting diodes, New Jersey-based Universal Display made the announcement on Monday that it had signed a long-term agreement with Samsung to continue to supply emitters and tech (license and royalties) for OLED solutions. The agreement is for five years with an option for an additional two-year period, with no financial terms disclosed.

“As we enter new frontiers of the OLED revolution, we look forward to continuing to work hand-in-hand to support Samsung’s product roadmaps of advanced, inventive and beautiful OLED displays with our expanding portfolio of highly-efficient, high-performing proprietary OLED technologies and UniversalPHOLED materials,” said Steven Abramson, President and CEO of Universal Display, in a press release.

Commenting on the news, Searle called it a positive for the company and stock.

“We note that historically Samsung has been a 40 per cent plus customer (46 per cent in the most recent quarter). We view the agreement as positive and meaningful as concerns over timing for a new agreement (set to expire at year- end 2022) had been an overhang on the stock,” Searle wrote.

On Universal’s financials, Searle is expecting the company to deliver fourth quarter 2022 revenue of $150.8 million compared to $146.2 million a year earlier and $160.6 million for the previous quarter. On EPS, the Q4 call is for $0.97 per share in earnings compared to $0.96 per share a year ago and $1.12 per share for the previous quarter. Further afield, Searle thinks Universal will generate full 2023 revenue of $641.4 million compared to a projected $598.4 million in 2022 and 2023 EPS of $4.18 per share compared to $4.03 per share expected for 2022.

Searle said although he has lowered his target price, investors should view consumer weakness as an entry point to own Universal Display, an “OLED category killer,” in his words.

“Universal Display currently trades at a premium to IP comps based on our revised 2023 estimates. However, given the relatively limited penetration of OLEDs into the Mobile and TV market (~45 per cent and less than three per cent, respectively), we expect the growth rate of OLED to be higher (>25 per cent CAGR) and more sustained over the next five to ten years,” Searle wrote.

Share

Share Tweet

Tweet Share

Share

Comment