A takeover by Johnson & Johnson of a key customer of OpSens (OpSens Stock Quote, Charts, News, Analysts, Financials TSX:OPS) is a good sign for the Canadian medical technology company. That’s according to Raymond James analyst Rahul Sarugaser, who delivered an update to clients on OpSens on Wednesday, saying a recent pullback in the stock presents a great buying opportunity for investors.

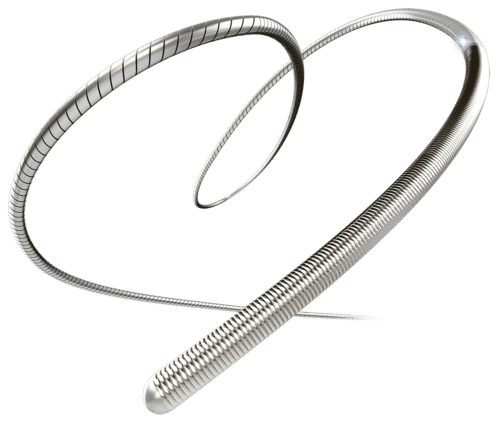

Quebec City-based OpSens develops and commercializes optical devices for the cardiovascular space, including the OptoWire, and the recent news is that Johnson & Johnson (JNJ) announced it’s acquiring med tech heavyweight Abiomed for about $17 billion. Abiomed makes and markets the Impella miniature heart pump, which makes up the majority of its revenue and for which OPS is a critical supplier of equipment. For over a decade now, OpSens has provided the optical sensors embedded in the Impella and the two companies recently extended their agreement to last through 2028, meaning that with the new deal, OpSens will be JNJ’s de facto supplier of optical sensors for the Impella.

Speaking to the deal readthrough for OPS, Sarugaser said the base case would see the status quo maintained with JNJ continuing the OEM supply agreement with OpSens. The upside scenario has JNJ consolidating its supply chain by acquiring OPS if and when JNJ decides to double down on interventional cardiology, while the downside scenario, one which Sarugaser posits as “very unlikely” is that JNJ terminates the agreement with OPS.

“Why fix something that ain’t broken? Plus, OPS’s IP portfolio on its optical sensors is broad and deep, likely precluding JNJ from developing its own optical sensors. We do not believe this scenario will come to pass,” Sarugaser wrote.

OpSens’ share price has had a superb run over the past couple of years, in contrast to many other names in the health tech space. The stock is up about 200 per cent over the past 24 months, although OPS is now down about 19 per cent since mid-September.

That makes for a buying opportunity, says Sarugaser.

“We expect SMID-cap medtech—including OPS—to outperform broadly in the near- and medium-term, given expectation for M&A to pick up during the coming months. With OPS down (20 per cent) from mid-Sep. highs (versus TSX down [0.5 per cent]), we see today’s price levels at an attractive entry point for clients to begin accumulating this thinly traded stock, particularly given our view on OPS’s medium-term growth profile,” he wrote.

With the update, Sarugaser reiterated a “Strong Buy” rating on OpSens and $6.00 target price, which at the time of publication represented a projected one-year return of 140 per cent.

Share

Share Tweet

Tweet Share

Share

Comment