Raymond James analyst Rahul Sarugaser is staying bullish on medical tech company Perimeter Medical Imaging AI (Perimeter Medical Imaging AI Stock Quote, Charts, News, Analysts, Financials TSXV:PINK) after the company delivered its latest quarterly results. In a Thursday update to clients, Sarugaser reiterated his “Outperform” rating on Perimeter, saying the company is priming the market for the launch of its Artificial Intelligence-enabled imaging system in 2024.

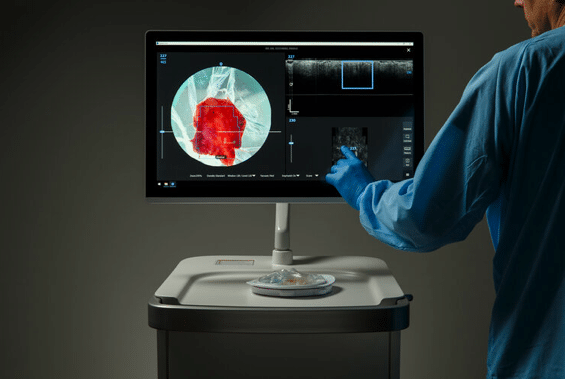

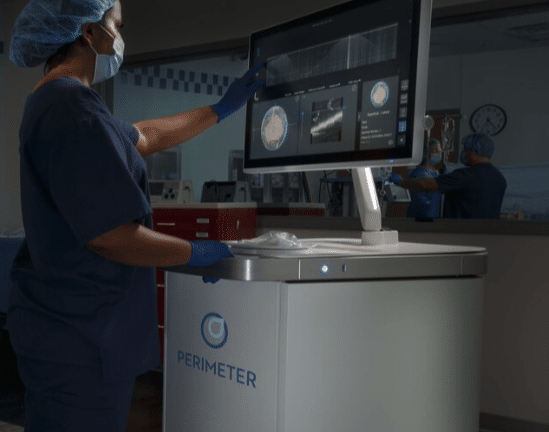

Perimeter Medical, based in Toronto and Dallas, Texas, is commercializing its optical coherence tomography (OCT) imaging systems for use by surgeons, radiologists and pathologists to see microscopic tissue structures using ultra-high resolution and real-time imaging tools. Perimeter’s FDA-cleared S-Series OCT system provides cross-sectional, real-time margin visualization of one to two millimetres below the surface of an excised tissue specimen to help surgeons ensure that all cancer has been removed during surgery, thereby reducing the rates of re-operation. Perimeter’s B-Series OCT with ImgAssist AI, which was granted an FDA Breakthrough Designation in 2021, uses proprietary predictive algorithms to improve the efficacy of margin assessment during surgery.

Perimeter released its second quarter 2022 financials on Wednesday, showing revenue of $19,500 with a net loss of $0.4 million. The company had cash and equivalents at the end of the Q2 of $45.0 million with $0.2 million of debt.

Perimeter placed its first commercial S-Series OCT during the quarter, a placement at the Pavilion Surgery Center in California, to be used in breast conservation and other surgeries, representing the first commercial use of the S-Series in a standalone ambulatory setting. Management updated its guidance on full 2022 installations and is now calling for between ten and 20 placements versus the previous forecast of between 15 and 20.

Meanwhile, Perimeter is continuing with patient recruitment for its multi-centre, randomized, two-arm pivotal clinical trial on the B-Series OCT combined with ImgAssist AI Software, with seven of the eight clinical sites now activated. Management said it looks to gather data from about 330 patients, with enrolment now to be completed in early 2023.

Summing up the quarter, Perimeter CEO Jeremy Sobotta said the sales cycle has been lengthened on the S-Series even as commercialization is proceeding very well.

“We remain highly confident about the market reception of our technology, including a pipeline where the average deal size is growing and exceeding our expectations. However, this creates a lengthened sales cycle as we navigate the broader procurement processes, and as such, we have expanded the range for our anticipated commercial installations due to that uncertainty,” Sobotta said in a press release.

“With a strong balance sheet and our driven team, Perimeter is well positioned to execute on our goal of transforming cancer surgery by advancing the standard of care, improving patient outcomes, and reducing healthcare costs with the use of our innovative technologies,” he said.

Tallying up the timelines for the B-Series trial and regulatory review, Sarugaser said there’s likely to be one quarter of post-trial data analysts followed by two quarters of regulatory review. That would mean FDA clearance is now likely to be in the late fourth quarter 2023 or early first quarter 2024, compared to the previous estimate at late third quarter 2023 to early fourth quarter 2023. Sarugaser said that leaves Perimeter with about 18 months to prime the market for the adoption of its AI-enabled B-Series device.

“In its FY21 corporate update, PINK guided toward 15-20 Perimeter S-Series OCT installations by the end of CY2022 (and reiterated during 1Q22 earnings), aiming to place the technology with US [Key Opinion Leaders] at leading breast cancer hospitals. PINK expects these early KOL installs to motivate the adoption and sales of its next-gen B-Series device upon approval (~4Q23/1Q24), seeding power users that would appreciate the performance lift of AI guidance, and that would serve as advocates and trainers for new adopters of the device,” Sarugaser wrote.

“PINK’s early adopters are already on the conference circuit discussing experiences with the S-Series; PINK’s first commercial user indicates that she reduced lumpectomy re-excision rates from 25 per cent to zero per cent during the first half-year using the device. PINK’s pivotal trial of the B-Series OCT will serve to provide physicians the large-population data they lean on when making technology adoption decisions,” he said.

As for his forecast, Sarugaser is calling for Perimeter to generate full 2022 revenue of $1 million, with his EV/Revenue multiple going from 1,425.0x in 2021 to 199.5x in 2022.

With a current market capitalization of $144 million, Perimeter’s share price has had a 52-week range of $1.49-$5.20. Year-to-date, PINK is currently down about 54 per cent.

Share

Share Tweet

Tweet Share

Share

Comment