Paradigm Capital Markets analyst Scott McAuley continues to see a future for Perimeter Medical Imaging AI (Perimeter Medical Stock Quote, Chart, News, Analysts, Financials CVX:PINK), as he maintained a “Speculative Buy” rating while reducing his target price from $5.50/share to $5.20/share in an update to clients on Thursday.

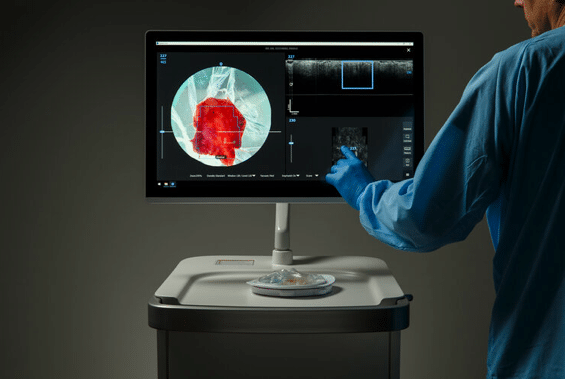

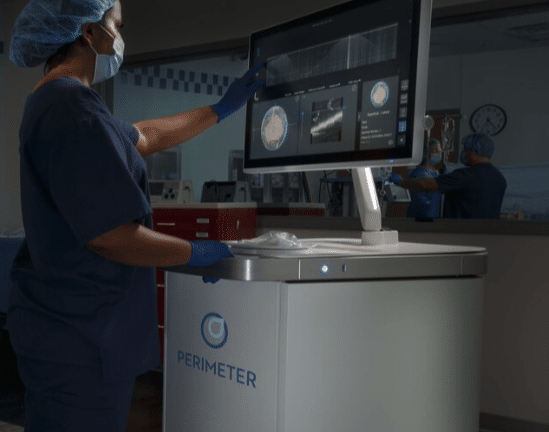

Toronto-based Perimeter Medical develops and commercializes advanced imaging tools that allow surgeons, radiologists and pathologists to visualize microscopic tissue structures during a clinical procedure. The company’s Optical Coherence Tomography (OCT) system can help doctors see just below the surface of an excised specimen, while its ImgAssist tool enhances the efficiency of image review through artificial intelligence.

McAuley’s latest analysis comes as Perimeter Medical has remained busy from a business perspective, namely with an influx of additional financing since December, which was the primary catalyst for the target drop.

“This added cash allows the company to expand its commercial footprint, accelerate its transition to other tissue types beyond breast cancer and to focus on a pay per-use economic model,” McAuley said.

All told, the new financing comes in at $48.7 million, composed of 16.2 million units at $3/share, with each unit including one share and one warrant exercisable until January 2027. Of the new warrants, 80 per cent carry a strike price of $3.99/share, while the remaining 20 per cent have a strike price of $4.50/share.

Of the new financing, $43.4 million of it comes from Social Capital, which is now the second-largest shareholder at 24 per cent of outstanding shares, which grows to a top-ranking 33 per cent on a fully diluted basis.

The funding from the California-based venture capital firm comes with the expectation that Perimeter’s imaging technology will improve surgical outcomes, with significant opportunities to expand into new surgical markets as well as both upstream (biopsy) and downstream (pathology) of surgery.

“We are extremely excited to have completed this transformative, pivotal event for Perimeter and to welcome Social Capital as a shareholder of Perimeter,” said Jeremy Sobotta, Chief Executive Officer of Perimeter Medical in the company’s January 27 press release. “This strategic partnering with Social Capital comes at a time when we are ramping up our Perimeter S-Series market development activities and commercialization efforts across the U.S., while also supporting the ongoing clinical development of our next-gen AI technologies.”

Perimeter Medical has also made a notable shift to being a commercial-stage company, having completed the installation of its first S-Series machine, which has FDA clearance and can quickly and easily image the tumour to determine if the surgeon needs to remove more tissue before the procedure is completed, for Dr. Amelia Brooke Tower at Texas Health Resources in December, with Dr. Tower indicating she has not had to perform a re-excision since switching to the S-Series, compared to a previous re-excision rate of 20 to 25 per cent.

According to McAuley, Perimeter also continues to progress on its B-Series platform, which uses its own ImgAssist image analysis algorithm, as it is now being evaluated in a randomized control trial, with an expectation for the 300-patient study to run through the rest of 2022, with FDA submission and review on the horizon in the second half of 2023. B-Series approval could accelerate adoption by making the system easier to use for surgeons who are less experienced in image-guided technology during surgery, according to McAuley.

McAuley has also revised some of his financial estimates, as he forecasts minimal revenue of $0.1 million for the company to wrap up 2021 after previously being listed as n/c, while he has lowered his 2022 revenue projection from $2.3 million to $0.4 million, which is well below the consensus expectation of $1.3 million in revenue.

McAuley has also shifted his expectations in relation to the company’s EBITDA projections, as he now forecasts a loss of $13 million to wrap up 2021, a shift from its previous estimate of a $12.8 million loss while being more conservative than the consensus projection of a $10.3 million loss. Looking ahead to 2022, McAuley projects a $15.3 million loss, a change from the previous estimate of a $13.3 million loss while remaining more conservative than the consensus estimate of an $11.9 million loss.

Overall, McAuley believes Perimeter will see increased interest over the next year on account of accelerating commercial installations and progress on its ImgAssist trial.

“While COVID-related hospital restrictions have been easing, a resurgence of cases, staff shortages and return to restrictions are risks to our rollout assumptions,” McAuley said. “However, the enthusiasm and results from Dr. Tower is an example of the opportunity for PINK’s products to improve patient outcomes and provide significant returns to investors.”

Perimeter Medical’s stock price has plummeted to a 28.9 per cent loss since the start of 2022, having started the year trading at $4.09/share. However, since falling to $2.30/share on March 7, the stock has shown signs of life with a 26.5 per cent return since then. At the time of publication, McAuley’s $5.20 target represents a potential one-year return of 69 per cent.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment