Perimeter Medical is a Buy, says Paradigm

Despite the wild ride the stock has taken over the past half-year, Paradigm Capital Markets analyst is staying positive on Perimeter Medical Imaging AI (Perimeter Medical Stock Quote, Chart, News, Analysts, Financials CVX:PINK), maintaining a “Speculative Buy” rating and $5.20/share target price in an update to clients on Friday.

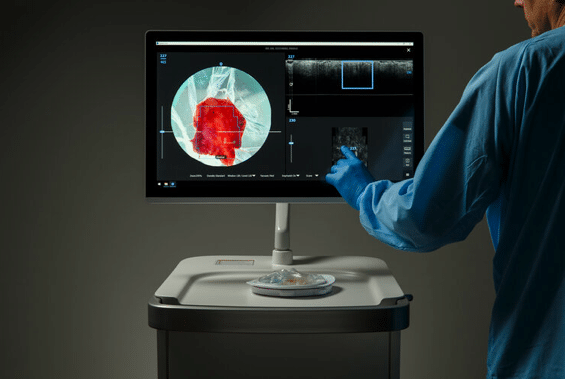

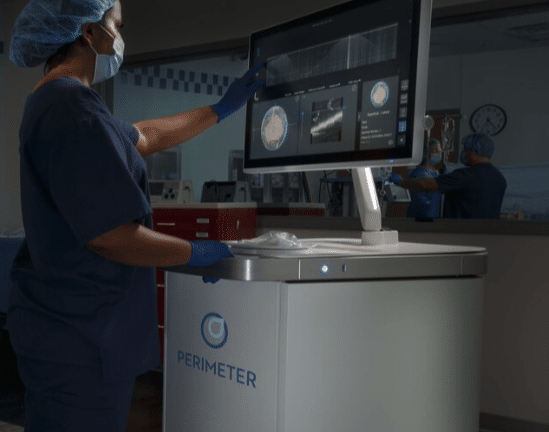

Toronto-based Perimeter Medical develops and commercializes advanced imaging tools to help surgeons, radiologists and pathologists see microscopic tissue structures during a clinical procedure. The company’s Optical Coherence Tomography (OCT) system helps doctors see just below the surface of an excised specimen, while its ImgAssist tool enhances the efficiency of image review through artificial intelligence.

McAuley’s latest analysis comes as Perimeter Medical released its first quarter financial results for the 2022 fiscal year.

With the company still being in its clinical stage and just having its first S-Series system installed in December, it did not report significant revenue in the quarter, though its EBITDA was relatively in line at a $4.2 million burn compared to the Paradigm projection of a $4 million burn, with increased spending in both sales and marketing ($1.4 million versus $1.1 million estimate) and research and development ($1.6 million versus $0.5 million estimate) being nearly completely offset by cuts to general and administrative spending ($1.2 million versus $2.5 million estimate).

Perimeter is presently in Phase 3 of its clinical timeline, which calls for a randomized trial of 300 breast cancer patients to test the efficacy and impact of its ImgAssist AI software add-on, with five of its eight trial sites being online with a sixth expected imminently, and the remaining two by the end of the month. Pending the success of Phase 3, the final step would be to seek De Novo 510(k) approval from the U.S. Food and Drug Administration for its software to be used specifically for breast cancer surgical procedures.

In terms of procedures, the company noted that Dr. Amelia Tower, the first surgeon to use Perimeter’s S-Series devices commercially, still has not had to perform a re-operation while using the device since December, compared to a re-perform rate of between 20 and 25 per cent using previous methods.

Dr. Tower’s success bolstered Perimeter’s aim of having 15 to 20 new S-Series systems installed by the end of the year, with double-digit demo systems currently under evaluation across some brand name hospitals.

“This past quarter we have made considerable progress across both the clinical development and commercial fronts,” said Jeremy Sobotta, Chief Executive Officer of Perimeter Medical in the company’s June 1 press release. “Our sales team has been extremely active at key industry and scientific meetings, including showcasing our S-Series OCT at the annual meetings of the Society of Surgical Oncology, the National Consortium of Breast Centers, and the American Society of Breast Surgeons.”

In connection with the quarterly release, Perimeter also made an executive addition, bringing in Chris Scott as its new Chief Financial Officer after previously serving in the same role with iRadimed, with Semple noting his success in growing the company’s market cap from US$60 million to US$600 million as a sign that Perimeter is continuing to prepare ahead of a potential NASDAQ listing.

“I am excited to join Perimeter and their efforts to bring Perimeter’s transformative ultra-high resolution medical imaging technology to market with the aim of improving patient outcomes and reducing healthcare costs,” Mr. Scott said in a separate June 1 release. “Perimeter has many opportunities for growth, and I look forward to contributing to the advancement of this game-changing technology.”

With the release of the quarterly results, Semple left his financial projections unchanged, as he maintained a $0.4 million revenue target for 2022 that presents as a touch conservative compared to the consensus expectation of $0.9 million. However, McAuley’s expectations shift dramatically to $9.9 million for 2023, significantly ahead of the consensus projection of $6.5 million.

Meanwhile, McAuley continues to forecast EBITDA losses of $15.3 million and $12 million for 2022 and 2023, respectively, with both numbers being slightly more optimistic than the corresponding consensus loss estimates of $16 million and $16.2 million.

McAuley forecasts EPS losses of $0.29/share in 2022 and $0.22/share in 2023, again coming in optimistic compared to the consensus loss projections of $0.32/share in 2022 and $0.28/share in 2023.

“PINK has a management team that knows the market, a product that improves outcomes for patients, payers and providers, and multiple future opportunities to expand beyond breast cancer while layering on new image analysis algorithms,” McAuley said.

Perimeter Medical’s stock price has plummeted to a 49.9 per cent loss over the course of 2022, dropping off after starting the year trading at $4.09/share and falling as low as $1.70/share on May 12, though it has recovered 20.6 per cent of its value since that date.

At press time, McAuley’s $5.20 target represented a projected one-year return of 139 per cent.

Geordie Carragher

Writer

Geordie Carragher is a staff writer for Cantech Letter