It’s been a rough couple of quarters for ProntoForms (ProntoForms Corp Stock Quote, Charts, News, Analysts, Financials TSXV:PFM), but investors can expect better times ahead, according to Beacon Securities analyst Gabriel Leung, who reviewed second quarter results in a report on Thursday. Leung reiterated his “Buy” rating on the stock, saying the pieces are in place for a stronger second half of the year.

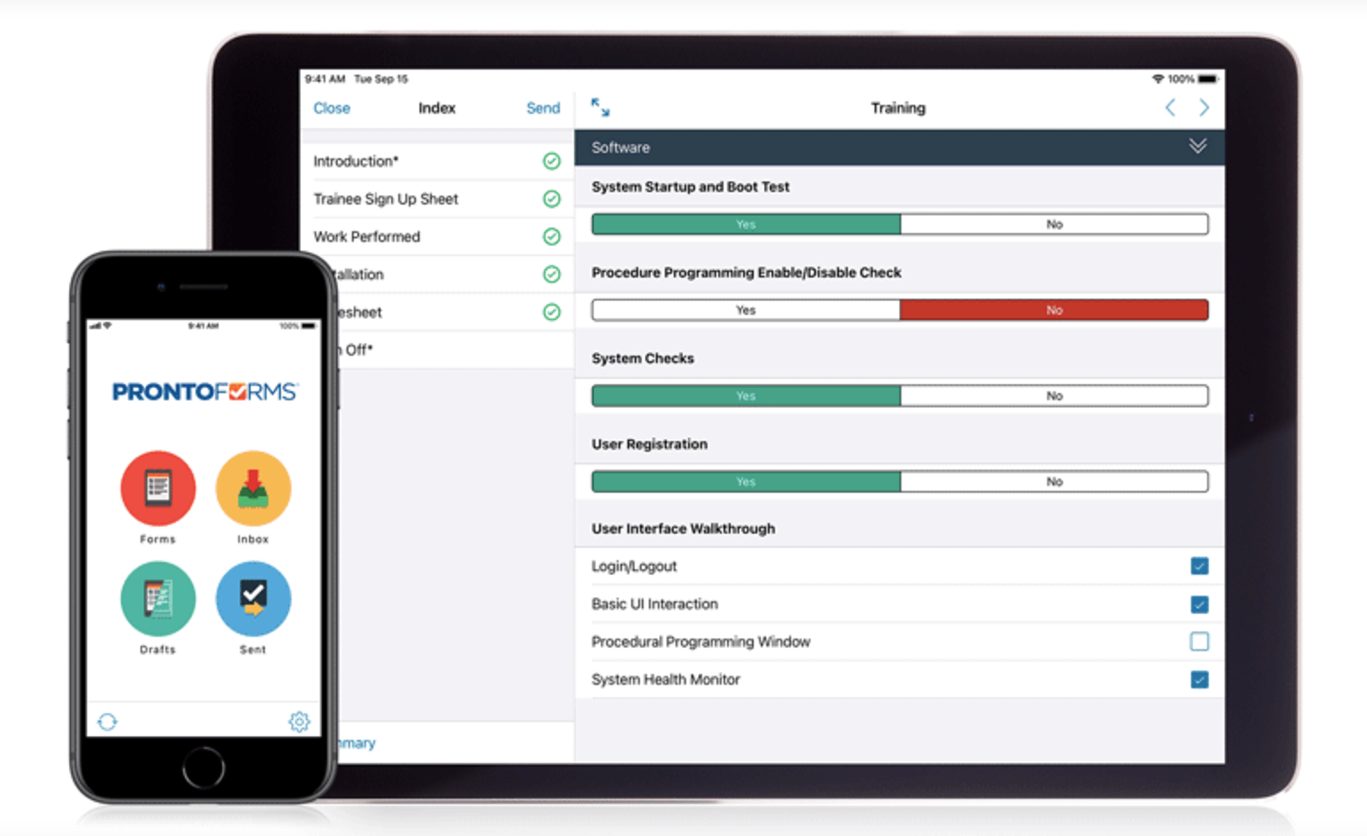

ProntoForms, which provides remote mobile solutions for employees such as field workers, sales teams, inspectors and delivery personnel, released its second quarter 2022 financials on Thursday, featuring revenue up eight per cent year-over-year and up three per cent sequentially to $5.21 million. Gross margin was 84 per cent compared to 85 per cent a year ago and the company reported a net loss of $1.34 million for the quarter compared to a net loss of $1.12 million a year earlier. (All figures in US dollars except where noted otherwise.)

In his quarterly comments, ProntoForms Founder and CEO Alvaro Pombo spoke of the changes made to the company’s sales team to try not to repeat the disappointing results of the first quarter. Now on the books, the Q2 showed improvement but “didn’t reflect the volume that we expected,” Pombo said in a press release.

“After the lag in bookings in the first half, we are seeing value building up,” Pombo wrote. “We had an important enterprise expansion in Q2 that added over $250,000 of ARR to bring that customer to over $940,000 in that quarter, and growth is expected to continue. We are seeing more new and expansion activity and are confident that we have a capable enterprise go-to-market structure that is scaling as our enterprise salespeople ramp.”

Chairman Terence Matthews said PFM is experiencing “unprecedented” levels of business activity with partners, clients, evaluations and contracts, saying ProntoForms’ tech is supporting businesses in their efforts to cut costs and automate field processes.

Operationally, ProntoForms highlighted increases in the company’s platform by a number of enterprise clients and the launch of new automation capabilities for Microsoft’s collaborative platform SharePoint.

Commenting on the Q2 results, Leung said the $5.2 million topline and negative $0.9 million in EBITDA compared to his forecast of $5.2 million and negative $1.1 million, respectively. Leung noted the company’s free cash flow at negative $730,000, which brought its quarter-ending cash to $7.5 million and debt of $6.3 million.

Leung said ProntoForms had an important enterprise client expand its commitment by adding over $250,000 in annual recurring revenue to bring that customer’s to over $940,000 for the quarter, with more growth expected to follow.

“The company has ~160 employees (including 20 quota sales reps) and we believe the plan is to maintain and optimize the current operating expense structure and return to higher levels of growth,” Leung wrote.

“We believe this will likely result in EBITDA remaining negative over the course of CY22, although the company alluded to reaching EBITDA breakeven around the end of CY23,” he said.

The analyst said the quarterly numbers were enough for Leung to maintain both his “Buy” rating and C$1.10 target price, which stems from a 4x 2023 EV/Sales estimate, compared to ProntoForms’ peer group at 5x. At the time of publication, Leung’s C$1.10 target represented a projected one-year return of 108 per cent.

“Although H1 CY22 was challenging for PFM (demand environment and internal sales restructuring), we believe the pieces are in place for a more productive H2, which could culminate to the company moving closer towards breakeven EBITDA in 2023,” Leung wrote.

Looking ahead, Leung is calling for ProntoForms to hit full 2022 revenue of $21.4 million compared to $19.4 million a year ago and then $25.6 million in 2023. On EBITDA, he is expecting negative $3.4 million compared in 2022 compared to negative $2.9 million in 2021 and moving to negative $1.3 million in 2023. On valuation, Leung is expecting PFM to go from an EV/Revenue multiple of 2.7x in 2021 to 2.5x in 2022 and to 2.1x for 2023.

With a current market cap of $70 million, PFM’s share price is down about 37 per cent year-to-date and down about 50 per cent for the past 12 months.

Share

Share Tweet

Tweet Share

Share

Comment