Plurilock Security is a Buy, says iA Capital

A new contract win bodes well for Canadian cybersecurity name Plurilock Security (Plurilock Security Stock Quote, Charts, News, Analysts, Financials TSXV:PLUR), according to iA Capital Markets analyst Neehal Upadhyaya who delivered an update to clients on the company on Wednesday.

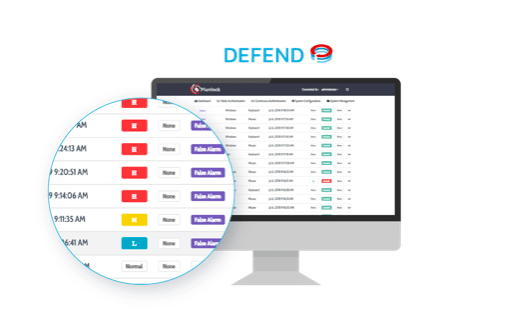

Vancouver-based Plurilock offers identity-centric cybersecurity solutions along with its patented endpoint security technologies Plurilock ADAPT and Plurilock DEFEND. The company announced on Tuesday that it had secured a DEFEND order with customer service and call centre platform provider Agents Only for the continuous authentication solution DEFEND Persisted, a partnership technology between Plurilock and endpoint security company Absolute Software.

“Agents Only has selected Plurilock’s DEFEND Persisted continuous authentication solution to deliver true zero trust authentication for our distributed workforce,” said Ben Block, Co-Founder and CEO of Agents Only, in a press release. “Our agents operate on a bring your own device model, which means limited physical access and security controls are available at the endpoint.”

“By implementing DEFEND Persisted, we add tamper-proof continuous authentication for our agents while they are working in our customer’s systems, combating identity threats, ensuring compliance with regulations, and providing Agents Only with a competitive advantage in protecting our customer’s data. DEFEND Persisted proved during evaluation that it was the only solution out there that actually delivered what we needed,” Block said.

Commenting on the win, Upadhyaya called it a positive for PLUR, saying that Agents Only’s so-called Bring-Your-Own-Device (BYOD) policy carries with it an increased level of cybersecurity risk with employees acting as call centre agents through their own laptops and desktops. The analyst said Agents Only was also looking for a solution to help combat internal fraud, also a capability of DEFEND.

“Agents Only selected the DEFEND Persisted solution after going through a process of identifying and evaluating other endpoint security management solutions,” Upadhyaya said. “PLUR’s partnership with Absolute Software proved invaluable in this contract win as Absolute is the only endpoint platform directly embedded in more than half a billion devices while being automatically installed on each device directly from the OEM manufacturing facility — crucial for any organization that is employing a BYOD policy.”

With a market cap currently at about $12.5 million, Plurilock has seen its share price head south over the past year and a half, going from about $0.80 per share in February, 2021, to now around $0.20 per share. The stock began trading in September, 2020 and since then has lost about a third of its value.

But Upadhyaya sees upside to PLUR, reiterating in his report a “Buy” rating on the stock and $0.65 per share target price, which at the time of publication represented a projected one-year return of 261.1 per cent.

“PLUR continues to build momentum within its technology solutions division through selling its DEFEND™ solution. We would like to note that this was not a cross-selling win, which bodes well in terms of overall interest in the Company’s products. Finally, with PLUR’s technology being so new and unique, we expect multiple applications and use-cases to slowly develop similar to fraud prevention, which will only help increase the adoption of PLUR’s proprietary products,” Upadhyaya wrote.

Looking ahead, Upadhyaya forecasts Plurilock Security to deliver 2022 revenue of $46 million, an adjusted EBITDA loss of $5.3 million and EPS of negative $0.10 per share. For 2023, he is calling for $50 million in revenue, negative $2.9 million in EBITDA and negative $0.06 per share in earnings.

Plurilock reported its first quarter 2022 in late May which featured revenue of $7.0 million compared to $75,761 a year earlier as the company built up its business with the acquisition of wholly-owned subsidiary Aurora Systems Consulting, completed in April, 2021. The result was hardware and systems sales for PLUR’s Q1 accounted for 93 per cent of total revenues, while adjusted EBITDA for the quarter was negative $1.9 million compared to negative $1.0 million a year earlier. Plurilock said it finished the Q1 with cash and equivalents of $6.0 million compared to $9.5 million at the end of December, 2021.

“Throughout this quarter, we achieved significant organic and inorganic growth through M&A, most notably, the acquisition of Integra Networks, a cybersecurity solutions provider with a large Canadian federal presence as well as strategic partnerships,” said Plurilock CEO Ian Paterson in a May 30 press release. “Furthermore, we expanded our leadership and advisory team with the addition of two seasoned executives and advanced our zero-trust technology program by submitting two non-provisional US patent applications and announcing a new product release for Spring 2022.”