Arch Biopartners has a 94 per cent upside, says iA Capital

Blockbuster potential is how iA Capital Markets analyst Chelsea Stellick describes Canadian biotechnology company Arch Biopartners (Arch Biopartners Stock Quote, Charts, News, Analysts, Financials TSXV:ARCH), which Stellick started off with a “Speculative Buy” rating in a coverage initiation on Wednesday.

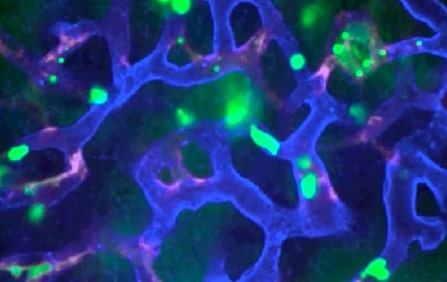

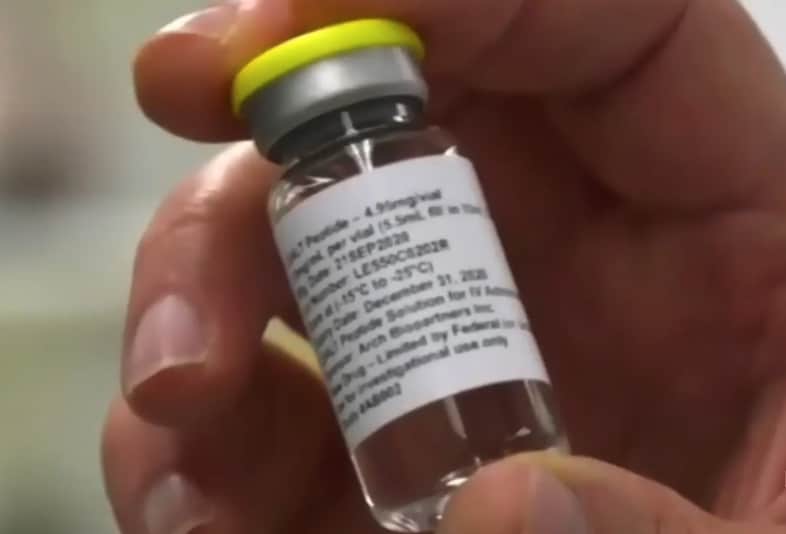

Arch Biopartners is a pre-revenue, mid-stage biotech company with lead drug candidate Metablok, an anti-inflammatory which treats dipeptidase-1 (DPEP1)-mediated organ inflammation in the lungs, liver and kidneys and is the first novel therapeutic treatment selected for the Phase 3 Canadian Treatments for COVID-19 (CATCO) clinical trial.

Arch published a paper in 2019 on DPEP1 which first identified as an adhesion receptor provoking inflammation and the company has a suite of proprietary DPEP1 inhibitors along with a portfolio of patents. Now, the company is putting Metablok through clinical research to determine its safety, tolerability and efficacy, with Stellick calling the results so far very promising.

“Because so many diseases or injuries cause inflammation in the lungs, liver, or kidneys, there are many possible permutations for Arch’s path to its first product approval. Acute kidney injury (AKI) is the Company’s lead indication, which affects over 6 million people annually in the United States,” Stellick wrote in her coverage launch.

“The optionality of holding a suite of drug candidates applicable to multiple indications will allow Arch to pursue the optimal combination of clinical trials to identify the best niches for DPEP1 inhibition given market size, capital, time, and regulatory considerations. For added diversification via possible future partnerships, developments or monetization opportunities, Arch also holds a small portfolio of unrelated early stage assets,” she said.

Stellick said Arch has a unique strength in its ability to operate out of academic settings with low-cost access to world-class research infrastructure. The analyst said Arch’s cash burn is modest despite the rapid progress the company is producing with Metablok where the drug has moved from preclinical to Phase 3 in two years.

“Vertical integration allows Arch to benefit from and support further academic research that provides supporting material for grant applications, which Arch has been very successful at securing. Similarly, the Phase 2 COVID-19 and Phase 3 COVID-19 Metablok trials were both funded by grants that minimized the need for capital while Arch proves its value with clinical data,” Stellick wrote.

The market for inflammation drugs is huge, listed at $100 billion in 2021 and currently composed of two main groups in NSAIDs (non-steroidal anti-inflammatory drugs) and corticosteroids. Stellick said given the prevalence of inflammation as a key determinant of outcomes across many indications, the market is large enough to allow for differentiated entrants such as, potentially, Metablok, to capture market share.

“We believe Arch can capture a substantial subset of this market upon approval given the unique mechanism of action, preliminary evidence of efficacy, and proven safety of the LSALT peptide (Metablok). Given that no competitors are working on DPEP1, we believe Arch is in a strong position to create a new segment of targeted anti-inflammatory medications beginning with development in the large unmet need of AKI,” Stellick said.

First listed on the TSX Venture Exchange in February of 2015, ARCH saw a big run-up over the second half of 2021 where the stock went from the $1.50 range to as high as $5.00 before falling back in December to about $3.50. ARCH has been up and down this year so far and currently sports a year-to-date return of negative three per cent.

Along with her “Speculative Buy” rating, Stellick is launching on Arch Biopartners with a target price of $6.00, which at the time of publication represented a projected one-year return of 93.5 per cent.

Stellick’s valuation stems from a sum-of-the-parts approach with the analyst anticipating Arch to put Metablok in a Phase 3 trial for AKI over the next four years with an added year for the FDA review process, altogether putting an AKI product launch at the year 2028. Putting together the potential revenue generation from Cardiac Surgery-Associated AKI and COVID-19-associated AKI, Stellick estimated probability-adjusted revenue for Arch for 2028 at $83 million and heading to $529 million by 20332. The company has other assets for a topical drug AB569 for wound care, biofilm inhibition products to prevent corrosion and brain tumour-targeting molecules, on all of which Stellick currently places no value in her assessment.

As to capital, Stellick said Arch has many paths to access including debt or equity financing and grants or other government support such as tax rebates and incentives.

“Arch has blockbuster potential to establish a new standard of care for preventing and treating organ damage, with its lead candidate (Metablok™) particularly well suited for AKI,” Stellick wrote.