Greenlane Renewables is our Top Pick, says Haywood

Haywood Capital Markets analyst Colin Healey has renewed optimism regarding Greenlane Renewables (Greenlane Renewables Stock Quote, Charts, Analysts, News, Financials TSX:GRN), maintaining a “Buy” rating and Top Pick status, along with a $3.75/share target price for a projected return of 351.8 per cent in an update to clients on Thursday.

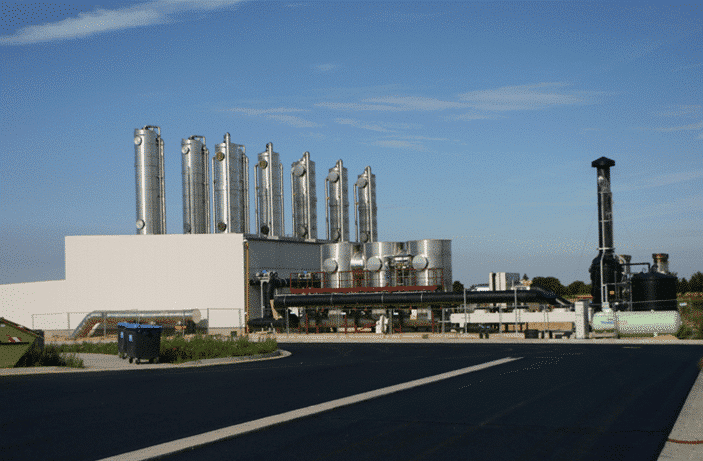

Burnaby, B.C.-based Greenlane Renewables designs, develops, sells and services a range of biogas upgrading systems for landfills, wastewater treatment plants and farms and for injection into the natural gas grid or for direct use as vehicle fuel.

Healey’s analysis comes on the heels of Greenlane announcing its first deployment of development capital to an unnamed project developer focused on dairy cluster renewable natural gas (‘RNG’) projects in California.

“Today’s announcement is a significant milestone for Greenlane as it marks the advancement of its strategy of expanding into a larger participating role in the projects it builds for its clients which should eventually lead to a larger recurring revenue component in its business,” Healey said.

The initial round of funding comes in the form of a convertible loan up to US$0.9 million based on the project developer hitting certain earnout milestones, with an expectation that the funding will be used to progress the development company’s dairy cluster project to construction financing, expected in the fourth quarter of 2022, as well as to advance the developer’s pipeline of project development opportunities.

Under the terms of the loan agreement, Greenlane has an option to convert the note into an equity interest in the company, along with a return of capital.

According to Greenlane, a dairy cluster project requires the installation of a digester and biogas upgrading system, both supplied by Greenlane, at the host site to produce RNG from manure delivered from proximal farms. In this case, the dairy cluster project is sited in California and is scoped to produce an estimated 80,000 MMBtu of RNG annually. The project, when built, would generate revenue from multiple sources, including from the sale of D3 Renewable Identification Numbers (D3 RINs) under the US Renewable Fuel Standard (RFS) program, credits under California’s Low Carbon Fuel Standard (LCFS) program, and physical gas commodity.

All told, the total project capital expenditure to be provided by third parties is expected to be approximately US$15 million.

“We launched this program with the aim of adding incremental value to the community of project developers around the world to help de-risk projects and to build scale in RNG origination,” said Brad Douville, President and CEO of Greenlane in the company’s June 2 press release. “This is the first of what we expect to be many opportunities to provide specialized RNG project development capital to accelerate RNG projects to the ready-for-construction phase, securing Greenlane system sales, and providing on-going services for each project.”

Healey forecasts solid financial growth for Greenlane, calling for revenue to come in at $69.8 million in 2022 for a potential year-over-year increase of 26 per cent. Looking ahead to 2023, Healey projects a jump to $93.7 million for a potential year-over-year increase of 34.2 per cent.

From a valuation perspective, Healey forecasts the company’s EV/Revenue multiple to come in at 1.4x in 2022, followed by a projected drop to a multiple of 1.1x in 2023.

On the margins, Healey is calling for gross profit of $17.6 million in 2022 for a 25 per cent margin in 2022, down from the 26 per cent margin reported in 2021 and followed by a jump to a 27 per cent margin ($25.1 million) in 2023.

Meanwhile, Healey projects Greenlane’s EBITDA will be $1.7 million in 2022 with an EV/EBITDA multiple of 57.3x, followed by a significant drop to a projected 14.1x in 2023, paired with an EBITDA estimate of $7 million.

Going forward, Healey is looking for Greenlane to take advantage of expanding market demand for development of its global initiatives, including a push across Europe to decouple from reliance on Russian natural gas, providing an opportunity for the company to surpass Haywood estimates in the next two years.

“Today’s announcement, while small, demonstrates a long-awaited strategic move for GRN into expanding its recurring revenue profile through investment/ownership exposure to the projects it builds for clients. We believe Greenlane will accelerate these efforts in coming months and years, reducing risk by diversifying its streams of income,” Healey said.

“Greenlane remains a Top Pick, as we expect the company to continue to grow its international footprint of project installations. We like GRN’s positioning in the renewable natural gas infrastructure space as a global leader in project depoyments. Greenlane offers the broadest range of technologies, providing a strategic advantage. We see RNG as a critical component of the green energy revolution and continue to see governments worldwide prioritizing it,” Healey wrote.

Greenlane Renewables has seen its stock price slip by 29.2 per cent this year, gradually dropping after starting the year trading at $1.30/share and hitting a 2022 low of $0.72/share on May 24, though the share price has risen by 27.8 per cent since then.

Geordie Carragher

Writer

Geordie Carragher is a staff writer for Cantech Letter