Mogo sees a big target cut from Eight Capital

Canadian fintech company Mogo Inc (Mogo Stock Quote, Chart, News, Analysts, Financials TSX:MOGO) has been on a long slide over the past year, but Eight Capital analyst Adhir Kadve is still bullish on the stock, maintaining a “Buy” rating while lowering his target price in an update to clients on Friday.

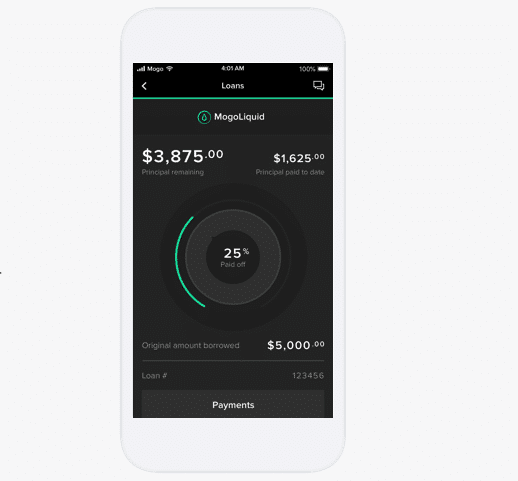

Headquartered in Vancouver, Mogo provides digital financial solutions to consumers, offering its Mogo app to access a digital spending account with Mogo Visa Platinum Prepaid Card, MogoCrypto for bitcoin transactions, MogoProtect, a free ID fraud protection, MogoMortgage, a digital mortgage experience, and MogoMoney, which provides access to personal loans.

Kadve’s new report comes after Mogo released its first quarter financial results for the 2022 fiscal year.

“The company lowered its revenue guidance because of a delay in the rollout of MogoTrade and its expected revenue contribution as well as a deferral of a customer rollout in the company’s Carta business,” Kadve said. “We continue to be excited about the release of MogoTrade as we believe this could be a major product catalyst for the company, which will potentially drive accelerated user growth, engagement and cross-sell opportunities for Mogo.”

Mogo’s financial quarter was headlined by $17.3 million in total revenue for two per cent sequential growth and a 51 per cent year-over-year increase, while matching the consensus projection and being in line with the Eight Capital estimate of $17.1 million. Mogo’s subscriptions and services revenue came in at $10.7 million to be sequentially flat, though it did represent a 78 per cent year-over-year increase; the remainder of the revenue came from loan interest, marking five per cent sequential growth and a 22 per cent year-over-year increase.

The company’s gross margin was also relatively in line with expectations, with the $12.3 million in gross profit translating to a margin of 71.4 per cent compared to the 72 per cent projection from Eight Capital, while being slightly below the 72.8 per cent margin projected by the consensus.

Mogo also experienced a wider than expected adjusted EBITDA loss in the quarter after reporting a $5.5 million loss compared to the $4.8 million loss projection from Eight Capital and the $4.5 million loss forecast set by the consensus.

The company saw its membership grow to 1.94 million at the end of the quarter for a jump of 88,000 members sequentially, as well as being an increase from the 1.2 million reported in the opening quarter of 2021. According to Kadve, while member additions were evenly split between organic and acquisitions and driven by broad-based interest in Mogo’s product suite in the quarter, the company sees an opportunity to accelerate member additions with the rollout of MogoTrade, which saw its rollout delayed for regulatory reasons, though there is optimism for the company to get out of its waitlist and invitation mode before the end of June.

“During periods of market volatility, the recurring nature of our revenue base continues to serve us well,” said David Feller, Mogo’s Founder and CEO in the company’s May 12 press release. “Looking ahead, we remain as committed as ever to bringing Canadian consumers the best tools and products to help them achieve financial freedom, while making a positive impact with their money. Our team continues to be focused on building out the leading next gen digital wealth platform, including the upcoming rollout of MogoTrade, our commission-free stock trading app. The current challenging conditions in equity markets do not change our view of the long-term growth potential for MogoTrade given the massive addressable market and the opportunity for digital disruption, and we couldn’t be more excited about the products we are building.”

The quarterly financial results have prompted Kadve to revise some of his financial projections, lowering his 2022 revenue target from $78.3 million to $70.7 million for potential year-over-year growth of 23 per cent. Looking ahead to 2023, Kadve lowered his revenue projection from $98.6 million to $88.2 million, suggesting a year-over-year increase of 25 per cent.

In terms of valuation, Kadve forecasts the company’s EV/Sales multiple to drop from the reported 1.6x in 2021 to a projected 1.2x in 2022, then to a projected 1x in 2023.

From a margin perspective, Kadve forecasts gross profit of $50.4 million and a 71 per cent margin in 2022, with a slight jump to a 72 per cent margin and gross profit of $63.1 million in 2023. Meanwhile, Kadve forecasts further losses in his adjusted EBITDA forecast, with estimated losses of $18.8 million and $8.6 million in place for 2022 and 2023, respectively.

Mogo’s stock has dropped off steeply in 2022, as the company has reported a 69.4 per cent loss in that time. With the update, Kadve has moved his target price from $10.25/share to $3.75/share which represented a projected one-year return of 168 per cent at the time of publication.

Geordie Carragher

Writer

Geordie Carragher is a staff writer for Cantech Letter