MCI Onehealth keeps Buy rating with Echelon

The stock has fallen a long way but Rob Goff of Echelon Capital Markets is still bullish on MCI Onehealth Technologies (MCI Onehealth Stock Quote, Charts, News, Analysis, Financials TSX:DRDR), maintaining a “Speculative Buy” rating on the company while dropping his target price from $3.50/share to $2.80/share for a projected return of 154.5 per cent in an update to clients on Tuesday.

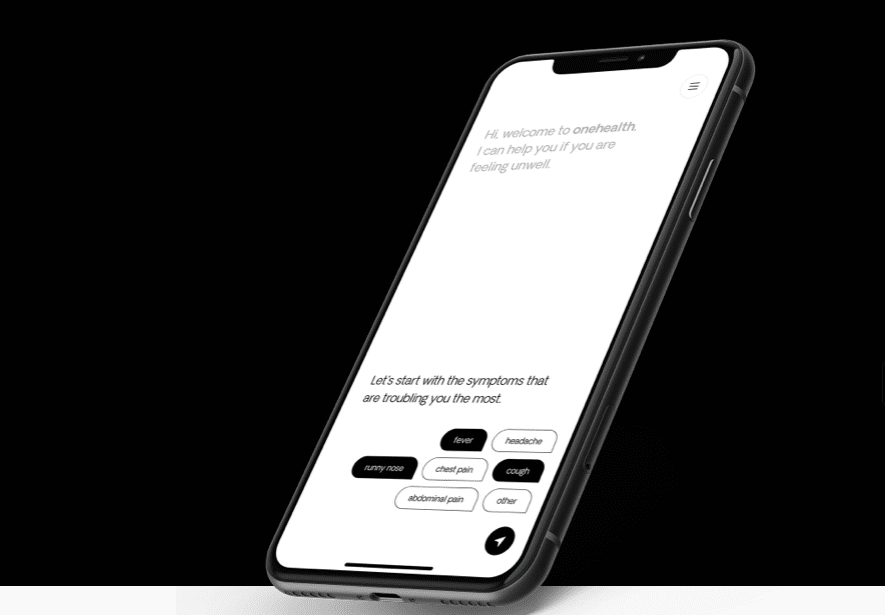

Toronto-based MCI Onehealth provides healthcare and healthcare related services to patients and the employees of corporate customers in Canada. The company has 25 brick and mortar clinics as well as a telehealth/virtual care platform.

Goff’s latest analysis comes after MCI Onehealth released its opening quarter results for the 2022 fiscal year, with Goff noting the 30 per cent topline growth and rising patient volume.

“With Q122’s results largely in line with expectations, albeit with somewhat heavier costs, the focus turns to the data announcements and the organic momentum across the core clinics,” said Goff, whose target trim came on account of reduced digital health peer valuations along with a lower near-term EBITDA outlook for the company.

MCI’s Q1 was headlined by $13 million in revenue to directly match the Echelon projection while producing 29.8 per cent year-over-year growth, though the number came in slightly behind the consensus projection of $13.6 million.

MCI Onehealth’s fortunes were boosted by organic year-over-year growth of 12 per cent in its patient volume growth in the quarter, which helped to offset transitory softness in Corporate Health and at Khure Health, where the winding down of COVID-19 testing and cyclicality in pharmaceutical spend affected the respective segments.

“The mix shift of revenues toward lower-margin primary care clinics impacted margins, but the Company and mix support should improve gross/EBITDA margins throughout the year,” Goff said.

MCI’s report of $4.1 million in gross profit for a margin of 31.4 per cent was a miss in relation to the Echelon estimate of $4.6 million and a margin of 35.7 per cent, as well as falling short of the consensus target of $4.9 million and a margin of 36.4 per cent.

Meanwhile, in terms of adjusted EBITDA, the company reported a loss of $2.4 million, which missed against the Echelon estimate of a $2 million loss, as well as the consensus projection of a $1.6 million loss, though the company is aiming toward being cash flow positive by the third quarter of 2022.

“We’re seeing terrific growth in patient visit volumes, which are significantly on the rise from the increasing availability of MCI health services across multiple platforms, including our clinic network, MCI Connect and telehealth, and from added convenience for the patients that come to us from our corporate relationships,” said Dr. Alexander Dobranowski, CEO of MCI in the company’s May 16 press release. “Importantly, we’re seeing not just more patients, but returning patients getting the comprehensive care they deserve, efficiently and effectively delivered by the integration of specialist health care directly within the MCI network. Our high-performance healthcare network is delivering our goal: more preventative, more personalized medicine with continuity of care that creates a more satisfying patient journey.”

Looking ahead, the company is optimistic in regards to a series of new pilot projects around its coveted healthcare data referred to as the company’s data lake, according to Goff.

“Management is confident the pilots will convert to commercial contracts in Q3/Q422, representing up to $4 million worth of commercial revenues within the first 6-12 months, while we look for associated gross profit margins between 80 to 85 per cent,” Goff said. “We believe the three-year contract with the “global leader in data science and security” (from MCI’s Q421 earnings press release) has expedited the Company’s path to commercialization and its traction.”

Despite the release of the financial results, Goff has largely left the remainder of his future financial projections untouched, as he still projects 2022 revenue to come in at $60.5 million for a projected year-over-year increase of 26.4 per cent, followed up by a 2023 projection of $72.4 million for a projected year-over-year increase of 19.7 per cent.

From a valuation standpoint, Goff forecasts the company’s EV/Sales multiple to dip from the reported 1.1x in 2021 to a projected 0.9x in 2022, then to a projected 0.7x in 2023, which outpaces the peer group average of 1.4x and the target of 1.9x.

Goff slightly lowered his gross profit targets for 2022, shifting from a $22.4 million estimate to a new projection of $21.2 million for a gross profit margin of 35.1 per cent, with 2023’s projection remaining at $28.8 million for an implied margin of 39.8 per cent.

In terms of valuation, Goff projects a dip in the EV/Gross Profit multiple to 2.5x in 2022, then to 1.9x in 2023, presenting a discount to the peer group average of 2.3x and the target of 4.8x.

MCI Onehealth has seen its stock price drop by 10 per cent over the course of 2022, coming back down after hitting a peak of $1.59/share on March 21 and closing Tuesday trading at a 2022 low of $1.08/share.

Geordie Carragher

Writer

Geordie Carragher is a staff writer for Cantech Letter