Rob Goff of Echelon Capital Markets believes MCI Onehealth Technologies (MCI Onehealth Stock Quote, Charts, News, Analysis, Financials TSX:DRDR) has missed its mark in its latest quarter. In an update to clients on Friday, Goff maintained a “Speculative Buy” rating on the company but dropped his target price from $5.50/share to $3.50/share for a projected return at the time of publication of 157.4 per cent.

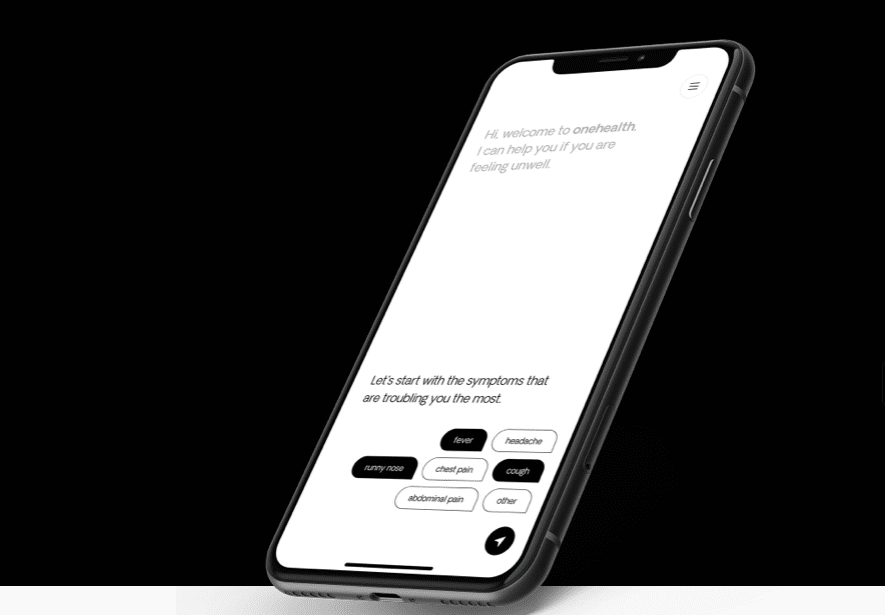

Toronto-based MCI Onehealth provides healthcare and healthcare related services to patients and the employees of corporate customers in Canada, providing service through its network of 25 brick and mortar clinics as well as through a telehealth/virtual care platform.

Goff’s latest analysis came after MCI Onehealth released its fourth quarter financial results to wrap up its 2021 fiscal year.

“While Corporate health services has slowed its trajectory considerably, we are still left encouraged by the organic growth levers at MCI’s disposal, where data and technology-driven initiatives are starting to take hold,” said Goff, who attributed his target drop to significantly reduced peer valuations, a higher cost of capital given the current share price and revised forecasts for 2022.

MCI Onehealth’s financial quarter was headlined by $13.9 million in revenue, providing a slight miss in relation to the Echelon forecast of $14.7 million, as well as the consensus expectation of $14.5 million. Goff primarily attributed the miss to the company’s Corporate Health Services segment, which came in at $1.1 million compared to the Echelon projection of $2.3 million on account of a lighter COVID quarter in terms of testing, though the company did gain momentum by adding new clients in the quarter.

Meanwhile, momentum in MCI subsidiaries Khure Health and brightOS, along with the recently-acquired Polyclinic, helped the company’s Technology segment generate a beat at $1.3 million compared to the $700,000 Echelon projection.

On the margins, the company reported gross profit of $5 million to come just short of the $5.4 million Echelon expectation while matching the consensus outlook, while its $1.6 million adjusted EBITDA loss was in between the consensus projection of a $1.4 million loss and the Echelon forecast of a $1.6 million loss.

“We are continuing to deliver on the strategy that we laid out for investors during our initial public offering,” said Dr. Alexander Dobranowski, CEO of MCI Onehealth in the company’s March 31 press release. “We are making excellent progress towards achieving our vision of empowering patients and doctors with advanced technologies to increase access to and improve the quality of healthcare while reducing healthcare costs.”

The new quarterly results, along with locking in year-end figures, have prompted Goff to revise some of his financial estimates for the company. After posting a 16.7 per cent year-over-year decrease in revenue in 2020, MCI Onehealth finished 2021 at $47.8 million in revenue, good for a 24 per cent year-over-year increase, though it was slightly off from Goff’s forecast of $48.6 million.

Looking ahead to 2022, Goff has lowered his revenue projection from $63.9 million to $60.4 million for a projected year-over-year increase of 26.3 per cent, with a growth expectation of 20.6 per cent to $72.9 million in play for 2023.

In terms of valuation, Goff projects the company’s EV/Revenue multiple to shift from 1.3x in 2021 to 1.1x in 2022, then to a projected 0.9x in 2023 to come in ahead of the peer group estimate of 1.8x and the target of 2.4x.

Of the 2021 revenue, $15 million was gross profit for an implied gross margin of 31.4 per cent. Looking ahead to 2022, Goff forecasts a jump to $22.4 million in gross profit for an implied margin of 37.1 per cent, down from the initial projections of $25 million and a 39.1 per cent margin. Goff forecasts the margin widening to 40.4 per cent in 2023, paired with $29.5 million in gross profit.

From a valuation perspective, Goff estimates the company’s EV/Gross Profit multiple to drop from the reported 4.3x in 2021 to a projected 2.9x in 2022, then to a projected 2.2x in 2023 to come in ahead of the peer group projection of 3.3x and the target of 5.8x.

Meanwhile, Goff expects the company’s adjusted EBITDA to turn positive in the third quarter of 2022, though he now projects an overall loss of $569,000 for the year (previously a $2.1 million positive forecast), then setting adjusted EBITDA at a projected $6.4 million for 2023, suggesting a margin of 8.7 per cent and a positive revaluation catalyst, according to Goff.

MCI Onehealth’s share price has dropped by 50.9 per cent over the last 12 months, though it has produced a 14.2 per cent return since the start of 2022. The stock’s bounceback came after reaching a 52-week low of $1.10/share on December 29 and later matched on January 5, though it is a long way off from the 52-week high of $3.63/share from April 16.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment