Good-looking quarterly numbers are keeping Canadian air cargo company Cargojet (Cargojet Stock Quote, Charts, News, Analysts, Financials TSX:CJT) on the right path, according to Beacon Securities analyst Ahmad Shaath, who retained his “Buy” rating and a $275/share target price on CJT in a May 2 report to clients.

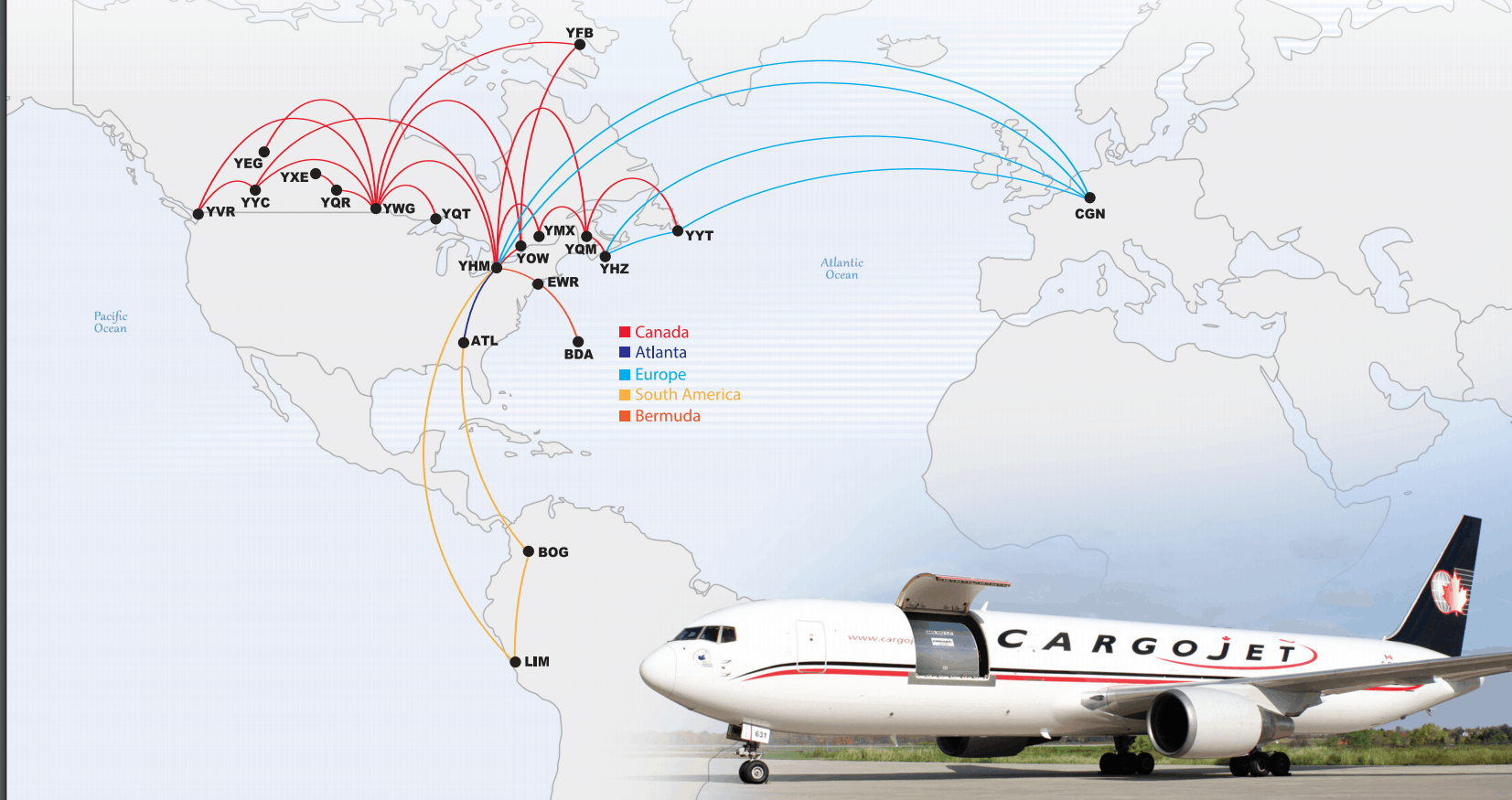

Mississauga-based Cargojet is a scheduled cargo airline with services in Canada and internationally, providing overnight service and operating domestic air cargo network services between fourteen cities in North America.

Shaath’s latest analysis comes after the company released its first quarter financial results for its 2022 fiscal year, which Shaath noted to be ahead of expectations with topline revenue of $234 million, outpacing the consensus projection of $209 million and the Beacon Securities estimate of $203 million while producing a 46 per cent year-over-year improvement.

While domestic network revenue was the biggest overall contributor to the mix at $85 million (36.3 per cent), a large portion of the revenue beat came from its All-In Charter stream at $41 million (17.5 per cent), which more than doubled the $20 million estimate set out by Beacon Securities while also producing a 298 per cent year-over-year increase. Shaath attributed the All-In Charter success to continued strength in demand from transatlantic and Asian markets, with a particular emphasis on charter flights for COVID-19 rapid test kits.

As another function of the revenue beat, Cargojet’s adjusted EBITDA also outperformed expectations at $83 million compared to the consensus estimate of $75 million and the Beacon Securities forecast of $74 million.

“Ever since March 2020, we have been constantly adapting to the changing air-cargo landscape. The recent geo-political events have further added pressure on the already strained traditional supply chains but they are also creating new opportunities for air-cargo.” said Dr. Ajay Virmani, President & CEO of Cargojet in the company’s May 2 press release. “We are acutely aware of the uncertainties and are well positioned to not only tackle them but capitalize wherever new opportunities are emerging. The investments we made in aircraft acquisition, technology and in attracting and retaining top talent are paying off, allowing us to scale up the business in a seamless manner.”

Cargojet also announced a ten per cent increase in its dividend beginning with the second quarter of 2022, as well as a share buyback program through an NCIB in which Cargojet can repurchase approximately 155,000 shares over the next 12 months with a total aggregate limit of approximately $15.5 million.

On its conference call announcing the results, Cargojet management acknowledged the slowing of certain e-commerce trends, but indicated they would not be a going concern for the company. In particular, company management reflected somewhat positive sentiment from its customers when compared to the trends in the US, given the relative lag in ecommerce penetration as percentage of total retail sales, while also indicating a benefit in shifting consumer habits and behaviours in becoming more reliant upon ecommerce.

“The extent of the impact that the full reopening will eventually have on this pocket of demand remains to be seen, but we don’t believe a full reversion to the mean will occur,” Shaath said. “From CJT’s perspective, management made a point of highlighting the increased fleet flexibility that should allow them to right-size network segments in just-in-time fashion to help preserve profitability.”

With the release of the quarterly results, Shaath has slightly modified his financial projections for Cargojet, raising his revenue target for 2022 from $889 million to $971 million for a potential year-over-year increase of 28.1 per cent, with fuel and other passthroughs accounting for the lion’s share of the increase. Looking ahead to 2023, Shaath raised his revenue forecast from $927 million to $950 million, though the new figure still represents a year-over-year decrease of 2.2 per cent.

From a valuation perspective, Shaath forecasts the company’s EV/Sales multiple to drop from the reported 3.9x in 2021 to a projected 3x in 2022, though he expects a small increase to 3.1x in 2023.

Meanwhile, Shaath forecast a minor increase in adjusted EBITDA for 2022 from $347 million to $355 million, though it comes with a slightly compressed margin of 36.6 per cent compared to the initial 39.1 per cent projection. Looking forward to 2023, Shaath maintained a projection of $382 million, though the margin slightly compressed from 41.2 per cent to 40.2 per cent.

In terms of valuation, Shaath projects the company’s EV/EBITDA multiple to fall from the reported 10x in 2021 to a projected 8.3x in 2022, then to a projected 7.7x in 2023.

“We made a minor tweak to our forecast, mainly reflecting higher fuel costs which is a pass-through item and doesn’t have a major impact on our profitability forecasts. We maintain our target price of $275.00 per share, using an unchanged 15.0x multiple to our FY23E forecasts. At current valuation of just 7.7x FY23E EBITDA with 2-year revenue and EBITDA CAGR’s of 12 per cent and 14 per cent, respectively, CJT shares have never represented a better risk-reward trade. We maintain our BUY recommendation,” Shaath wrote.

At press time, Shaath’s $275 target represented a projected one-year return of 80 per cent.

Share

Share Tweet

Tweet Share

Share

Comment