Alpha Cognition keeps buy rating with iA Capital

Chelsea Stellick of iA Capital Markets is calling the upcoming summer a pivotal one for Canadian drug developer Alpha Cognition (Alpha Cognition Stock Quote, Chart, News, Analysts, Financials TSXV:ACOG). Stellick maintained a “Speculative Buy” rating and target price of $5/share for a projected return of 400 per cent in an update to clients on Tuesday.

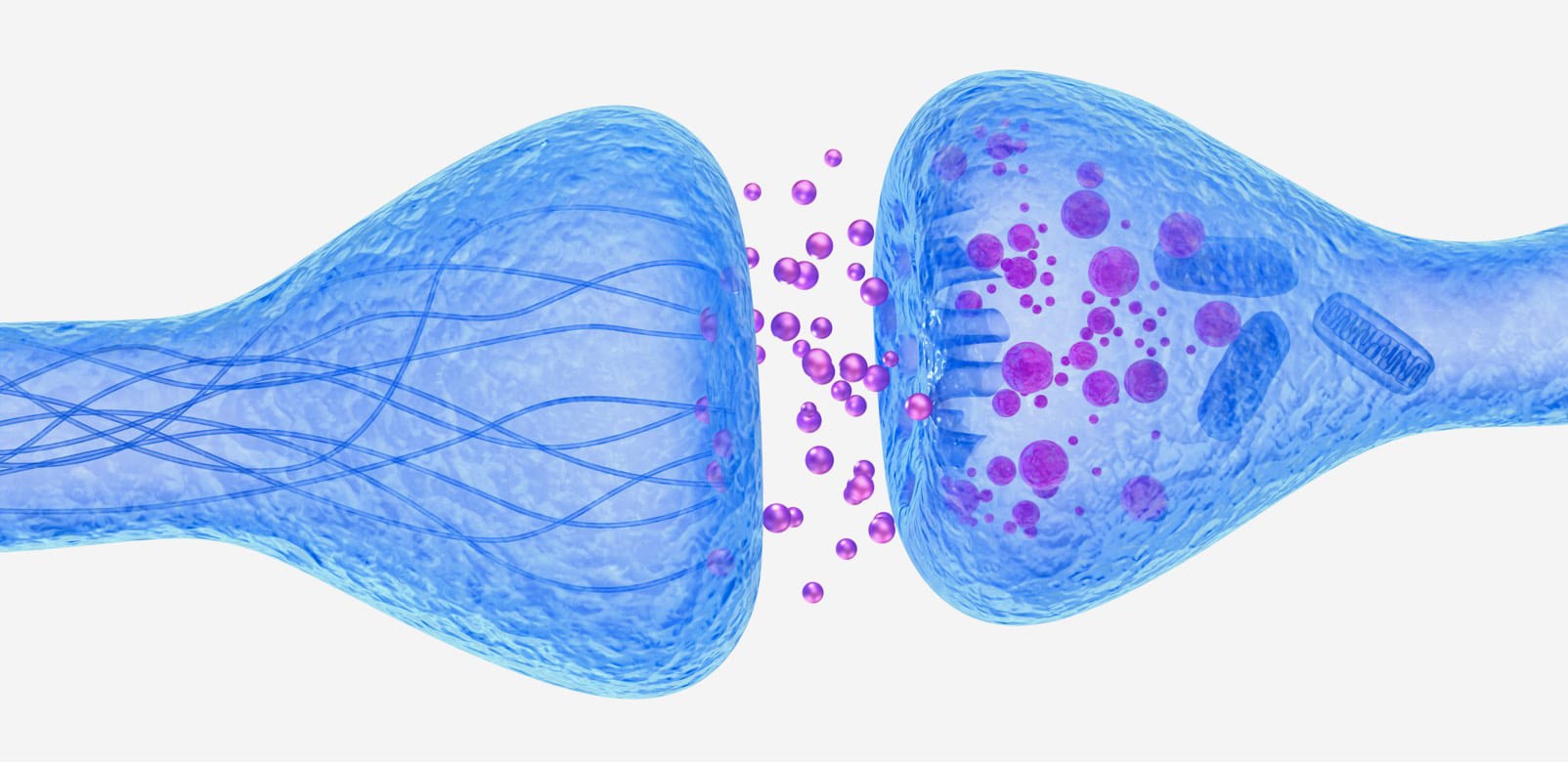

Founded in 2000 as Neurodyn Cognition and headquartered in Vancouver, the company rebranded to Alpha Cognition Inc. in 2020. Alpha is a clinical stage, biopharmaceutical company dedicated to developing treatments for under-served neurodegenerative diseases such as Alzheimer’s Dementia as well as Amyotrophic Lateral Sclerosis (ALS) or Lou Gehrig’s Disease.

Stellick’s latest analysis comes after Alpha Cognition released its fourth quarter financial results along with 2021 year-end figures.

“We are encouraged by the positive ALS and TBI preclinical data thus far this year and we especially look forward to the catalyst-rich summer ahead, with the bioequivalence and bioavailability pivotal trial data readout, initiation of a tolerability trial, and finally an NDA submission,” Stellick said.

Alpha Cognition’s overall financials for 2021 were headlined by $10.6 million in cash burn, doubling the $5.3 million cash burn from 2020 with an expectation for that number to continue growing as the company continues to conduct large trials and begins to build a commercialization team to manage manufacturing and distribution ahead of a forecasted 2024 ALPHA-1062 commercial launch.

However, the company also had $11.3 million in cash available at the end of the year, which Stellick believes will be sufficient until the company’s planned NDA submission in the third quarter of this year.

For the quarter, Alpha Cognition’s general and administrative expenses came in at $1 million compared to the $0.4 million reported in the same quarter of 2020, with the main catalysts for the difference being increased professional fees, insurance costs, and employee compensation expenses. Meanwhile, the research and development expenses increased 29 per cent sequentially and 125 per cent year-over-year to $2.7 million, with spending being higher primarily due to expanding preclinical and clinical studies for its ALPHA-0602 and ALPHA-1062 offerings.

“We have delivered positive pre-clinical results for the ALPHA-1062 mild-TBI program and have delivered positive pre-clinical results for ALPHA-0602, our progranulin gene-therapy for ALS,” said Michael McFadden, Chief Executive Officer of Alpha Cognition in the company’s May 2 press release, in which he also labelled the previous year transformational for the company. “The second quarter will be eventful, with the company expected to report top-line results from the pivotal bioavailability and bioequivalence registration trials of ALPHA-1062 required for approval for the treatment of mild to moderate dementia of the Alzheimer’s type. Positive data will set the stage for a third quarter NDA submission. Our team continues to execute according to plan in this transformational year for the Company.”

Alpha Cognition has initiated significant trials for its ALPHA-1062 program to combat Alzheimer’s Disease, with the upcoming trials including fed and fasted conditions for a single-dose cross-over study, which are to be read out in the second quarter of 2022, after which the company will meet with the U.S. Food and Drug Administration to discuss proposed tolerability and dosing trials with the intention of pursuing label expansion following top-line data in 2023.

“The timelines set by management are aggressive, putting the Company within a year of potential marketing approval,” Stellick said. “Although we account for modest delays in our model, we do note that ACOG’s management has been successful in meeting its timelines to date.”

From an EBITDA perspective, Stellick projects Alpha Cognition to turn positive in 2025 at $8.2 million, with a PV of $5.8 million. From there, Stellick has a fairly steep growth curve in place for the company’s EBITDA, as she forecasts it to reach $285.9 million by 2030, accompanied by a present value of $125 million.

Stellick also expects Alpha Cognition’s free cash flow to turn positive in 2025 at an unlevered value of $5.5 million and discounted value of $3.9 million, setting up a ramp to an unlevered free cash flow projection of $204.5 million ($89.4 million discounted) in 2030.

With the progress the company has made to this point and its ability to meet timelines, Stellick is confident in Alpha Cognition’s path forward, particularly with a commercial launch potentially being on the horizon.

“We reiterate that Alpha Cognition is de-risked, late stage, and offers a unique combination of high reward with less-than-usual risk thanks to the well-established AChEI market and our evaluation of its preclinical and clinical data in the context of a 505(b)(2) pathway to approval,” Stellick said.

Alpha Cognition’s stock price has dropped off by 20.2 per cent since the start of 2022, having experienced an early high of $1.13/share on January 18 before dropping off to its 2022 low of $0.87/share, which was reached today.

Staff

Writer