UGE International has a 171 per cent upside, says iA Capital

Naji Baydoun of iA Capital Markets continues to keep his eyes on UGE International (UGE International Stock Quote, Chart, News, Analysts TSXV:UGE), maintaining a “Speculative Buy” rating and target price of C$3.25/share for an implied return of 170.8 per cent in an update to clients on Tuesday.

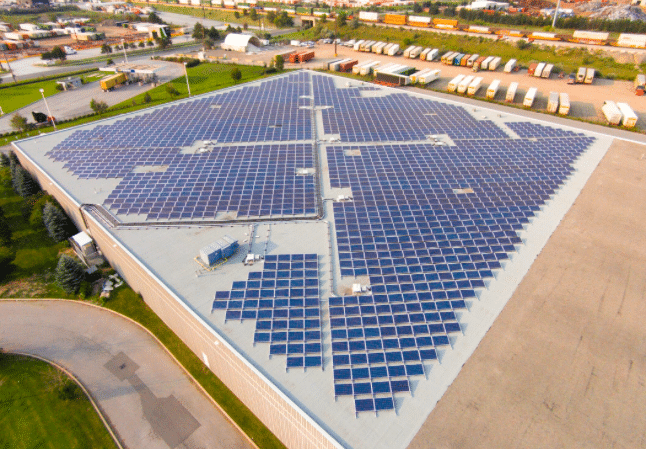

Founded in 2008 and headquartered in New York City, UGE International provides commercial and community solar energy solutions to commercial and industrial clients in Canada, the United States and the Philippines. The company also develops, builds, owns, operates, deploys and finances solar projects as well as offering engineering and consulting services.

Baydoun’s analysis comes in the wake of the company providing updates on a number of its growth and financial milestones from the first quarter of 2022.

“UGE offers investors improving growth and cash flow fundamentals (driven by its strategic pivot towards contracted project development), exposure to the high-growth community solar market in the US (approximately 20 to 30 per cent+ CAGR through 2030), attractive risk-adjusted project returns (double-digit equity IRRs), and a discounted valuation compared with peers,” Baydoun said.

One of the key highlights from the update came in the company’s development pipeline, which has now exceeded 1GW to provide a longer-term growth runway. In terms of backlog, the downsizing of a few projects in Maine has shrunk the overall backlog from 158MW at the end of 2021 to approximately 144MW now, though the downsizing was partially offset by execution on other project development milestones, with plans to move a number of other projects forward.

On the acquisition front, UGE has signed commitments to enter the Arizona market through the acquisition of two late-stage rooftop solar development projects with a capacity greater than 1MW, which Baydoun believes could pave the way for other tuck-in acquisitions of similar projects in other jurisdictions.

In terms of financing, the company had originally intended to pursue a $15 million capital debt facility, only to opt for a green bond offering valued at C$3 million instead, with the coupons having a four-year maturation period at a rate of eight per cent.

“Overall, this capital raisewill provide some near-term financing for UGE’s project development expenses.We expect additional updates from UGE alongside its Q4/21 results in late April,” Baydoun wrote.

Baydoun expects the company’s financial picture to clear up over the next few years, projecting 2021 revenue to come in around $2 million for year-over-year growth of 42.9 per cent. From there, he projects 2022 revenue at approximately $2.6 million for a year-over-year increase of 30 per cent before experiencing a surge to a projected $8.4 million in 2023, an implied 223 per cent year-over-year increase. (All figures in US dollars except where noted otherwise.)

Meanwhile, Baydoun projects the company’s EBITDA will turn positive in 2023 at $1.6 million for an implied margin of 19 per cent, following the reported $2.4 million loss in 2020, and the projected losses of $3.9 million and $3.1 million in 2021 and 2022, respectively.

UGE International’s share price has come down by 44 per cent over the last 12 months and by 26.1 per cent since the start of 2022. The stock has fallen off from its 52-week high of C$2.18/share from April 6 of last year, having closed yesterday just one cent above its 52-week low of C$1.19/share, which was posted on June 8.

Geordie Carragher

Writer

Geordie Carragher is a staff writer for Cantech Letter