After reviewing fourth quarter numbers from ProntoForms Corporation (ProntoForms Stock Quote, Chart, News, Analysis, Financials TSXV:PFM), Beacon Securities analyst Gabriel Leung has lowered his target price from C$1.75/share to C$1.50/share while keeping his “Buy” rating, saying in a client update on Thursday that PFM is still a good prospect for investors but that a general market pullback is cause for the target drop.

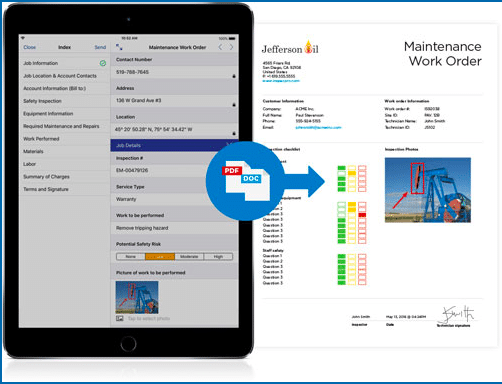

Founded in 2001 and headquartered in Ottawa, ProntoForms researches, develops and markets mobile business solutions to enterprises to automate field sales, field service and other field data collection business processes through its ProntoForms app, which allows workers to collect data on a mobile device, access company data in the field and automatically share the results.

The company’s technology is currently in use in Canada, the United States, Europe and Latin America.

Leung’s latest analysis comes after ProntoForms released its third quarter financial results, which Leung noted to be largely in line with Beacon expectations.

The ProntoForms quarterly report was headlined by $5 million in revenue (all report figures are in US dollars except where noted otherwise), representing a sequential increase of 2.3 per cent and year-over-year growth of 6.3 per cent.

Within its revenue total, $4.8 million was recurring, representing three per cent sequential growth and a year-over-year increase of 11 per cent.

“We expect y/y comparables to improve as we progress through CY22 given that Q4 2020 saw the discontinuation of the previous AT&T channel relationship,” Leung said.

Meanwhile, the company also reported an EBITDA loss of $515,000 in the quarter, a position Leung expects the company to maintain even as recurring revenues scale to help accelerate organic growth (i.e. to take year-over-year recurring revenue growth back to pre-COVID levels greater than 25 per cent).

Looking into further reports, the company maintained a flat gross margin of 84.5 per cent on a sequential basis, while also reporting a $324,000 loss on free cash flow, resulting in quarter-ending cash of $6.1 million against debt of $3.3 million. Leung also noted the company expanded its debt facility in the quarter, raising it from C$6 million to C$10 million to provide more flexibility to execute on its growth strategy in 2022 and beyond.

All told, the company ended the quarter with $19.8 million in ARR, up 2.6 per cent sequentially and 16 per cent on a year-over-year basis.

“Our customers need to accelerate the speed of automation in the field and they see our product’s agility and breadth of use cases as a catalyst in this digital transformation,” said Alvaro Pombo, Founder and Chief Executive Officer of ProntoForms in the company’s March 10 press release. “We have compelling new use case stories and a Wakefield Research customer impact report demonstrating value across many industries and multiple tech stacks. Our focus continues to be on enterprise expansion and we are off to a strong start having added enterprise sales resources and go to market infrastructure in early 2022.”

ProntoForms had itself a busy quarter in terms of contracts, including expanding its deals with three Fortune 500 companies, one in the medical tech sector to expand its implementation by 3,500 subscriptions for a total of over 9,000 subscriptions globally, another with an oil and gas company expanding its implementation by 100 field technicians for a total of 800 to support their asset compliance and leak inspection workflows, and the last coming with a heavy manufacturing organization expanding its implementation by 250 in North America and 130 in EMEA for a total of 7,500+ and 2,000+ subscriptions respectively.

After ending the 2021 fiscal year with $19.4 million in revenue, Leung projects modest year-over-year growth of 13.9 per cent to a $22.1 million estimate in 2022, while his 2023 forecast sees the company hitting $27.4 million, representing a potential year-over-year increase of 24 per cent.

From a valuation perspective, Leung projects the company’s EV/Revenue multiple to drop from the reported 4.1x in 2021 to a projected 3.6x in 2022, then down to a projected 2.9x in 2023.

With Leung’s belief of the company maintaining negative EBITDA into the future, his 2022 forecast dips to a loss of $3.5 million after reporting a $2.9 million loss in 2021, with a further loss of $1.8 million projected for 2023.

“Overall, we believe PFM’s value proposition continues to resonate well, particularly given the increasing complexity of work flow within the enterprise field work force,” Leung said. “We are maintaining our Buy rating, but lowering our target price to C$1.50 (was C$1.75), which is based on 5x CY23e EV/Sales, given a general industry multiple contraction.”

Long-term, ProntoForms investors saw a loss of 33.3 per cent over the last 12 months and 5.9 per cent since the start of 2022, though the stock has rebounded slightly since hitting a 52-week low of $0.70/share on February 24. At press time, Leung’s new C$1.50 target represented a projected one-year return of 88 per cent.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment