LifeSpeak keeps “Buy” rating at Desjardins

Desjardins analyst David Newman is maintaining his views on LifeSpeak Inc (LifeSpeak Stock Quote, Charts, News, Analysts, Financials TSX:LSPK), keeping a “Buy” rating and $13/share target price for a projected return of 133 per cent in an update to clients on Tuesday.

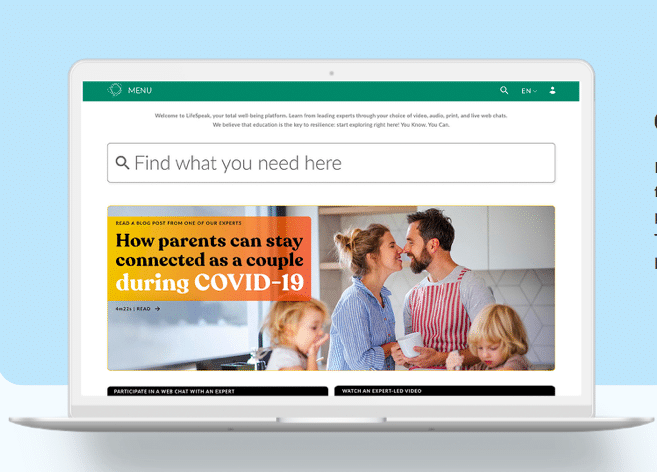

Toronto-based LifeSpeak provides software-as-a-service solutions for mental health and total well-being education for mid and enterprise-sized organizations. The company also creates plenty of content, including videos, podcasts, tip sheets, quizzes, tailored articles, and expert-led educational resources for mental health, as well as training and development for employees and managers.

Newman’s newest analysis comes after LifeSpeak released its fourth quarter financial results, along with 2021 year-end updates and a reiteration of its 2022 management guidance.

Despite ending the quarter with 422 clients compared to the Desjardins projection of 390 clients, the financial quarter was headlined by a pair of misses, with the company’s revenue of $6.8 million being just slightly off the Desjardins estimate of $7 million and the consensus projection of $7.2 million.

Meanwhile, the $900,000 in adjusted EBITDA was further off from the $1.8 million Desjardins estimate and the consensus forecast of $2 million.

In explaining the misses, Newman pointed to greater investment in sales and marketing and G&A ahead of revenue as the primary rationale.

“Management noted significant cross-selling opportunities across all of its sub-brands, which enables LSPK to offer a broader array of options to its enterprise customers for greater retention, and potentially aids the ramp of embedded contracts (land-and-expand),” Newman said. “While some deals are taking longer to sign, the pipeline remains strong. LSPK should benefit from the reopening and back-to-work (hybrid) as employers look for ways to aid employees in the transition.”

Lifespeak management also maintained its financial guidance for 2022, including revenue growth between 180 and 200 per cent, suggesting a range between $65 million and $70 million, with ARR ranging between $75 million and $85 million, along with an adjusted EBITDA margin between 30 and 40 per cent.

Since the start of 2022, Lifespeak has stepped up in its client base, adding over 100 new clients through its subsidiaries LIFT, ALAVIDA and Torchlight, bringing in an additional 25 of its own with the headliner being Shopify, and bringing in a number of embedded clients to bring its total base above 800 on a pro-forma basis when including Wellbeats, which just closed on February 28.

In relation to the company’s recent acquisitions, Newman notes that the company identified $1.9 million in cost saving synergies, including $400,000 in the fourth quarter, with those numbers also excluding any Wellbeats involvement.

“2021 was an incredibly transformative period for Lifespeak,” said Michael Held, CEO and Founder of Lifespeak in the company’s March 22 press release. “We strongly believe that the strategic growth undertaken over the past six months makes Lifespeak an increasingly attractive partner for existing and new clients. The cross-sell opportunity generated by our 800+ clients, as well as our geographic diversification, has dramatically increased the presence of our industry leading mental health and total wellbeing platform.”

The release of the fourth quarter and year-end figures has prompted slight revisions to Newman’s financial projections. Lifespeak ended 2021 with $23.3 million in revenue for a 131 per cent year-over-year increase, and Newman expects 2022 to be even better as he forecasts $66.1 million in revenue (previously $66 million) for a projected year-over-year increase of 183.7 per cent. Looking ahead to 2023, Newman has raised his projection from $91.7 million to $96.6 million for a projected year-over-year increase of 46.1 per cent.

From a valuation perspective, Newman forecasts the company’s EV/Revenue multiple to drop from the reported 15.2x in 2021 to 5.4x in 2022, then to a projected 3.7x in 2023.

Meanwhile, after Lifespeak ended 2021 with $6.6 million in adjusted EBITDA, Newman has lowered some of his future forecasts in that category, as he dropped his 2022 projection from $23.5 million to $22.1 million for an implied margin of 33.4 per cent. Looking ahead to 2023, Newman lowered his forecast from $42.9 million to $41.3 million, implying a margin of 42.8 per cent.

Despite the lower targets, Newman still sees the company’s EV/adjusted EBITDA multiple dropping from the reported 53.6x in 2021 to a projected 16x in 2022, then dropping again to a projected 8.6x in 2023.

Lifespeak’s stock has produced a 34.4 per cent loss over the last 12 months, accelerated by a 12.1 per cent loss over the first three months of 2022. After hitting a 52-week high of $8.88/share on August 9, the stock had been maintaining momentum until early February, when it started dropping to the point of hitting a 52-week low of $5.08/share on March 14.

Geordie Carragher

Writer

Geordie Carragher is a staff writer for Cantech Letter