The stock has rebounded nicely in recent months but investors hoping for more upside in the near future from LifeSpeak (LifeSpeak Stock Quote, Charts, News, Analysts, Financials TSX:LSPK) may be out of luck. That’s the take from Desjardins Capital Markets analyst Jerome Dubreuil, who lowered his rating from “Buy” to “Hold” on Thursday after reviewing the company’s latest quarter.

Toronto-based digital health solutions company LifeSpeak reported its second quarter earnings on Wednesday, coming in with revenue up eight per cent year-over-year to $13.2 million and adjusted EBITDA up 38 per cent to $3.3 million.

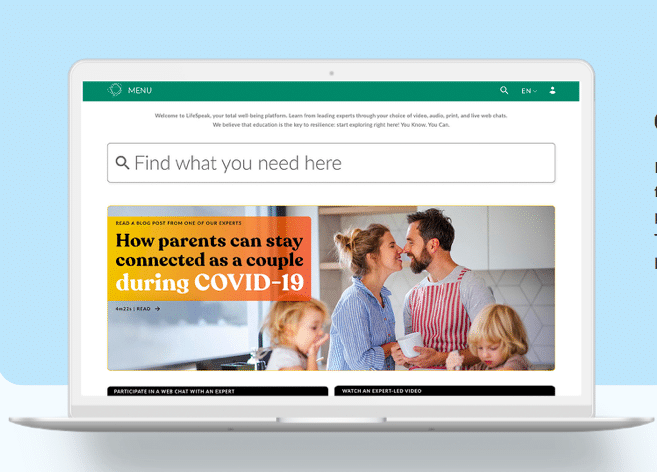

LifeSpeak, which has a line of wellbeing products for mid-size and enterprise businesses said its total number of clients rose by eight per cent year-over-year to 996 as of June 30.

“During the reporting period, our overall sales integration initiatives progressed with the successful closing of several multi-product opportunities,” said CEO and Founder Michael Held in a press release. “The success was led by the ramp-up of our Torchlight product into the Canadian market, an initiative that continues to gain traction.”

Dubreuil said the Q2 had misses at the top and bottom, with the $13.2 million in revenue coming in below the consensus call at $13.7 million and adjusted EBITDA at $3.3 million also missing the Street’s forecast at $3.7 million.

“The sequential decline in ARR as well as management guidance suggest zero to modest revenue growth in the next two quarters,” Dubreuil wrote.

“We are moving to a Hold rating (from Buy) on LSPK as we believe the company’s tight balance sheet situation and general macro uncertainty hinder its near-term growth prospects. While we continue to forecast decent EBITDA growth and acknowledge solid operational leverage, we are hesitant given the stock has rebounded 80 per cent since bottoming in the spring (still down 34 per cent year-to-date) and is trading at 7.3x 2024 EBITDA,” he said.

The analyst has lowered his forecast for LSPK, now calling for full 2023 revenue and adjusted EBITDA of $52.9 million and $14.0 million, respectively, and for 2024 revenue and EBITDA of $55.3 million and $15.3 million, respectively.

Dubreuil lowered his target price from $0.80 per share to $0.65, which at press time represented a one-year projected return of three per cent.

Dubreuil said LifeSpeak’s leverage currently stands at 5.4x last 12 months EBITDA, which represents a “major burden” due to the current interest rate environment.

“Lenders have agreed to lift the requirement to test covenants for June and July, but we believe continued flexibility will be required from lenders in the coming months. While interest payments remain covered by EBITDA, we forecast that deleveraging prospects are limited for the coming quarters,” he said.

Share

Share Tweet

Tweet Share

Share

Comment