These days, online shopping has never been easier but why buy the products when you can get the whole store for cheap? E-commerce platform Shopify (Shopify Stock Quote, Charts, News, Analysts, Financials TSX:SHOP) is down about 35 per cent since the start of the year and down by almost 50 per cent compared to its all-time highs set a few months ago. That puts SHOP in bargain territory, says portfolio manager Kim Bolton of Black Swan Dexteritas, who just named Shopify one of his top picks for the 12 months ahead.

“Shopify is actually on sale today. It’s down about ten per cent,” said Bolton, speaking on a BNN Bloomberg segment on Wednesday. “What we’ve seen is just a lot of option activity on it.”

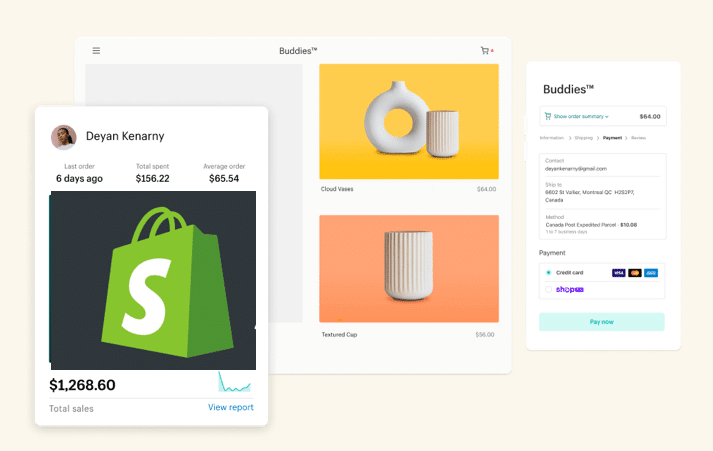

“Everyone knows that Shopify is the big e-commerce as a service company. It’s well managed and has great cash flow. Yes, there was a lot of concern about the new fulfillment centre strategy, but they came out and they explained it very well,” he said.

The pullback on Shopify seems to involve a number of contributing factors, from a general market rotation away from growth stocks to tough year-over-year comparisons in the e-commerce space to concerns over management’s plans to build out its fulfillment network. In particular, the drop on Wednesday — where SHOP fell about ten per cent — appears linked to a strong market reaction to payments company PayPal’s latest earnings, which fell short of expectations and were coupled with weaker than expected guidance.

Shopify fans will be curious to see how the company performed over its fourth quarter 2021, the results for which are due on February 16. But this year’s holiday season numbers will be in tough to match the previous year’s growth. This most recent November and December were part of the pandemic, too, but it was 2020’s holiday period that represented a huge year-over-year acceleration in e-commerce essentially worldwide as shoppers got their fix by clicks and FedEx while stores remained shuttered due to COVID lockdowns.

That scenario made for a fourth quarter 2020 which saw SHOP’s revenue grow by a monster 94 per cent on 99 per cent growth in gross merchandise volume, the dollar value of orders placed on the company’s platform. Total revenue was just under $1 billion at $977.7 million and adjusted net income was $198.8 million o $1.58 per share, up from $50.0 million or $0.43 per share a year earlier.

A near-doubling again of Shopify’s revenue for Q4 2021 would be truly a feat, but analysts are expecting less, calling for a consensus average of about $1.7 billion for the fourth quarter.

In its outlook given with the company’s third quarter 2021 financial report in October, Shopify management said the Q4 will likely turn out much like the other quarters of the year where growth was ‘normalized’ compared to the outsized acceleration of 2020. For the third quarter, for instance, total revenue was up 46 per cent year-over-year to $1.123 billion and adjusted net income was $102.8 million or $0.81 per share compared with $140.8 million or $1.13 per share a year earlier.

As a sign of what the fourth quarter might look like, Shopify announced in late November that its Black Friday sales were up 21 per cent compared to the previous year where sales by SHOP merchants were up a full 75 per cent year-over-year.

“Every year, Black Friday represents one of the largest single-day sales moments for entrepreneurs around the world, and this year it was bigger than ever,” said Harley Finkelstein, President of Shopify, in a press release. “From in-store retailers, to online, and even viral TikTok must-haves, these Black Friday sales show that independent businesses are having a massive impact on global commerce. Consumer support of independent brands is at an all-time high.”

As for Shopify’s fulfillment network, a Reuters article last week noted that investors had been raising concerns over changes to the company’s strategy which involves building out its infrastructure to allow its merchants to better compete with big box stores. That move was said to be questioned as it could signal major capital expenditure for Shopify. The company said more details on its Shopify Fulfillment Network (SFN) buildout will come with its fourth quarter results.

“We will be making changes to the SFN (Shopify Fulfillment Network) to help merchants compete with big-box retailers, such as prioritizing two-day shipping at affordable prices and access to easy returns for U.S. shoppers,” the company said in a January 24 release.

For Bolton, Shopify’s next 12 months should be great for investors.

“Everything is running well not only on their e-commerce as a service but also on their fulfillment and the Shop Pay [app],” Bolton said.

“It’s trading right now at about US$886 and we have a 12 month price target of US$1,550,” he said.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment