Sabio Holdings is a “compelling investment opportunity,” says Paradigm

A new pickup looks good on Sabio Holdings (Sabio Holdings Stock Quote, Charts, News, Analysts, Financials TSXV:SBIO), according to Paradigm Capital analyst Daniel Rosenberg, who updated clients on the company in a Wednesday research report.

Toronto-based Sabio announced on Tuesday that it has entered into a definitive agreement to acquire the assets of Vidillion, a US-based CTV supply side platform. The deal is valued at up to $3 million, broken down to $1.75 million in shares and $1.25 million in cash and subject to customary working capital, indemnity and tax adjustments. (All figures in US dollars except where noted otherwise.)

Vidillion aggregates CTV publishers and monetizes their inventory and it streams over 1,200 TV channels and 10,000 movies and video clips via Amazon FireTV, AppleTV, Roku and Smart TVs. The company has scale and distribution across about 120 countries and had revenue of over $2 million in 2021.

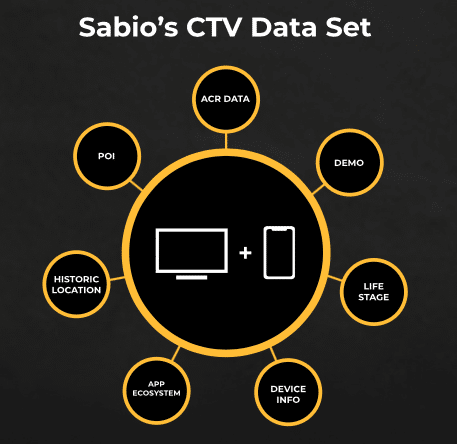

Sabio said its AppScience analytics platform will benefit from the integration of unique data sets from Vidillion.

“We have been working closely with Vidillion for over a year with a shared belief that consumers, content providers and brands deserve a better and more accountable CTV experience,” said Aziz Rahimtoola, CEO and co-founder of Sabio, in a press release. “The versatility, scalability and granular level of insights of combining our existing AppScience’s analytics and Sabio’s proprietary Demand-Side Platform (DSP) with Vidillion’s publisher level data and monetization capabilities is expected to enhance our current CTV offering, making it one of the first full-stack CTV solution for marketers and suppliers.”

Looking at the deal, Rosenberg said Vidillion will give improved data around the publisher ecosystem, and he has increased his Sabio forecast accordingly, calling for 2021 revenue of $23.6 million (unchanged) and $33.0 million for 2022 (was $31.5 million). Adjusted EBITDA is expected to go from $1.1 million in 2021 (unchanged) to $1.2 million in 2022 (was $1.1 million).

“The acquisition will vertically integrate Sabio closer into the publisher ecosystem, which is valuable for Sabio’s strategic positioning of its AppScience platform that will benefit from unique publisher-level data from Vidillion. With premium CTV inventory in-house, we expect to see incremental margin improvement,” Rosenberg said.

“Sabio has built a comprehensive technology portfolio and is trusted by some of the world’s leading brands and agencies. The industry has substantial tailwinds including shifting viewer habits that are supportive of continued rapid growth. Sabio is in the early stages of commercializing its analytics platform, App Science. We see meaningful optionality to monetize App Science in the attractive TV analytics market, estimated to be a $1.9 billion opportunity,” he wrote.

With the update, Rosenberg has reiterated his “Buy” rating on SBIO and 12-month target of C$3.25, which at the time of publication represented a projected return of 162 per cent.

“Sabio is growing rapidly and its differentiated insights around CTV are seeing significant traction with blue-chip customers. We believe the commercialization of App Science, along with double-digit growth and strong SaaS margin potential, make Sabio a compelling investment opportunity in a very attractive space. We reiterate our Buy recommendation,” Rosenberg wrote.

Disclosure: Sabio Holdings is an annual sponsor of Cantech Letter.