It’s been an up and down past 12 months for medical device stock Perimeter Medical Imaging AI (Perimeter Medical Imaging AI Stock Quote, Charts, News, Analysts, Financials TSXV:PINK), but investors can expect upside from here, according to Research Capital analyst Yue (Toby) Ma, who updated clients in a Thursday report. Ma kept his “Speculative Buy” rating on PINK while lowering his target price from $4.90 to $4.10 due to the close of a recent equity financing.

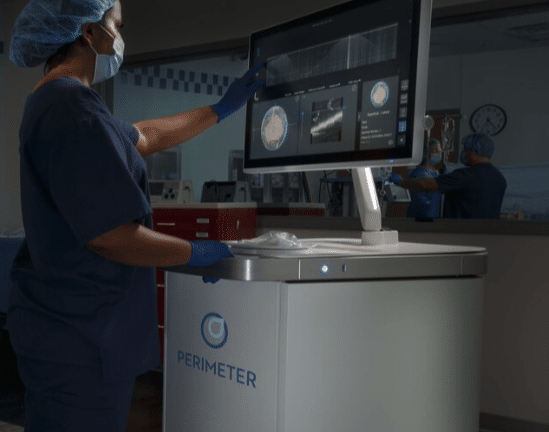

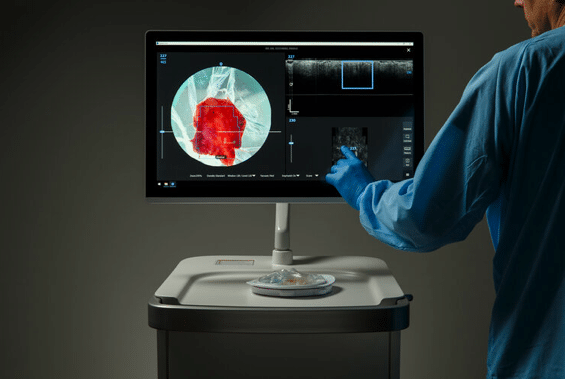

Perimeter Medical is developing and commercializing its Perimeter OCT (optical coherence tomography) system for diagnostic imaging with a range of potential surgical applications. Last year, the company has FDA approval for the S-Series Perimeter OCT to commercially launch in the US for real-time, cross-sectional visualization of excised tissues at the cellular level, while its B-Series OCT with ImgAssist AI is currently under clinical development.

On the B-Series OCT, Perimeter initiated a two-arm clinical trial with over 300 breast cancer patients with the study completion pegged at the end of 2022. The clinical development of the B-Series with ImgAssist AI is being advanced under the company’s ATLAS AI project with US$7.4 million in a funding grant from the Cancer Prevention and Research Institute of Texas.

The company provided a corporate update on Wednesday where Perimeter CEO Jeremy Sobotta spoke of the steps taken in 2021 and the road ahead for 2022.

“Backed by strong support from our existing shareholders, we recently closed a successful equity financing, which included Social Capital, that we anticipate will fuel our commercial efforts and enable us to leverage their expertise in technology and AI,” Sobotta wrote in a press release.

“We believe we have the capital and expertise in place to support us in our journey to deliver best-in-class advanced imaging technologies, with the aim of improving health outcomes and reducing costs. This is an incredibly exciting time for Perimeter, and we look forward to building upon the positive momentum already generated at the beginning of this year,” he said.

On the private placement, Perimeter announced the close on January 27, with gross proceeds of $48.7 million and including a strategic investment by Scotia Capital for $43.4 million. The deal involved about 16.2 million units at $3.00 each with each unit consisting of one share and one warrant to purchase an additional share. Perimeter said the proceeds would go towards working capital, commercialization efforts, clinical studies, further development of its technology and general corporate purposes.

Perimeter, which announced the first commercial installation of its S-Series OCT in December at a North Texas hospital, should see a ramp up of installations over 2022, according to Ma.

“Perimeter OCT remains in the early launch phase, during which PINK is educating and demonstrating the potential of the product to potential prospects (i.e. hospitals). Management expects the lead time from a product demo to the installation of a system to be around 90 days. PINK has a number of Perimeter OCT systems already in its inventory – therefore, the on-going global supply chain disruptions are expected not to impact the sale of the system at least in the near term. We are maintaining our assumption that 21 new systems would be installed and operational in 2022,” Ma wrote.

“With PINK now in the commercial stage, we believe investors should keep an eye on how many Perimeter OCT systems the company can sell and install in each quarter going forward,” he said.

By the numbers, Ma is expecting Perimeter Medical to deliver full 2021 revenue and fully diluted EPS of $0.1 million and negative $0.37 per share, respectively, and 2022 revenue and EPS of $3.7 million and negative $0.25 per share, respectively. The analyst is calling for PINK’s revenue to hit $43.1 million by 2026, with EPS at that point coming in at $0.15 per share. On EV/Sales, Ma thinks the multiple will go from 34.7x in 2022 to 10.4x in 2023 to 5.3x in 2024.

At the time of publication, Ma’s reduced $4.10 target represented a projected one-year return of 36 per cent, with his valuation being based on applying a 25x EV/Sales multiple to his 2023 revenue estimate of $12.5 million discounted by a rate of 20 per cent.

Commenting on the first installation of the Perimeter S-Series OCT in December, Sobotta wrote in a press release, “We are extremely pleased to announce the first commercial installation of our Perimeter S-Series OCT system. This meaningful validation of our ‘go-to-market’ strategy is an historic event for the Perimeter team, our shareholders, the physicians with whom we collaborate, and the patients in their care. By enhancing a surgeon’s ability to visualize margins and microscopic tissue structures during a procedure, we believe our ground-breaking imaging technology will allow for optimal intraoperative decisions that increase the precision of surgeries.”

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment