Echelon Capital Markets analyst Stefan Quenneville’s eyes are wide open in regards to DIAGNOS (DIAGNOS Stock Quote, Chart, News, Analysts, Financials TSXV:ADK), awarding the company Top Pick status while reiterating his “Speculative Buy” rating and target price of C$1.55/share for a projected return of 356 per cent in an update to clients on Tuesday.

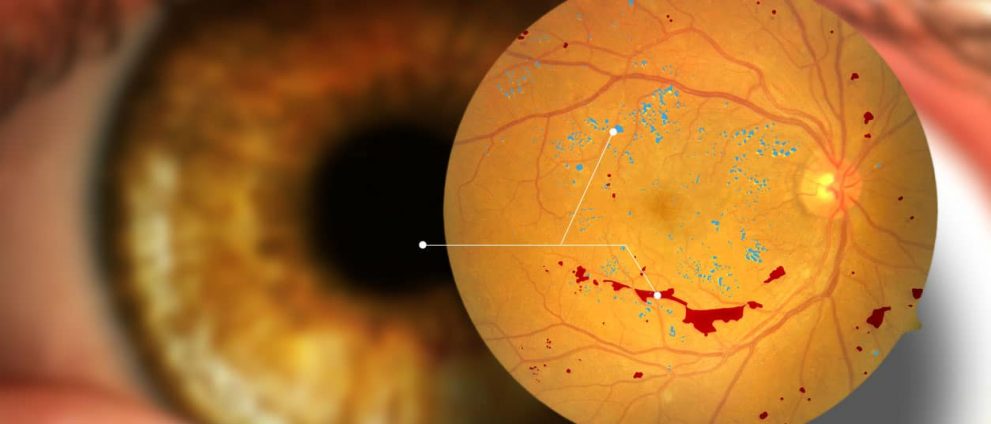

Founded in 1996 and headquartered in Montreal, DIAGNOS is an artificial intelligence company in the commercial stage of addressing diabetic retinopathy, a leading cause of blindness, with its Computer Assisted Retinal Assessment (CARA) platform.

Quenneville’s Top Pick designation for DIAGNOS comes in anticipation of the finalizing of the August 2021 memorandum of understanding with EssilorLuxottica/GrandVision, the world’s largest eye care company, to use CARA to offer diabetic retinopathy screenings across 8,000-10,000 of their worldwide locations.

“We view the EssilorLuxottica MoU, along with the previously announced deal with New Look Vision, as validation of the AI-based platform’s detailed output, low cost, and ease of implementation,” Quenneville said. “The technology, which is currently being rolled out across New Look Vision locations in Quebec, is clearly ready for broad commercial acceptance, particularly in the optical retail segment.”

Diabetic retinopathy, the leading cause of adult blindness, is present in 20 to 40 per cent of the estimated 500 million diabetics around the world, with five to 10 per cent of patients developing or seeing a progression in the severity of DR within 12 months. DIAGNOS aims to integrate its technology with existing optometry equipment and processes to enable early detection and monitoring of DR by grading the severity of indicators found in retinal imaging.

In addition, in early December, the company began a clinical trial with the intent of demonstrating that its CARA-ST (CARA STROKE) product will be able to predict the early signs of the condition leading to a stroke, based on the microcirculation analysis of the retina image of the patient, with the trial being done under the direction of Dr. Thomas Devlin, Director of the Stroke and Neuroscience Center at CHI Memorial Hospital in Chattanooga, Tenn.

“This year, our new stroke management application will be field tested in multiple countries,” said Andre Larente, President of DIAGNOS in the company’s November 23 press release. “For our investors, this ground-breaking test comes at an ideal time in terms of shareholder value creation as the combination of both CARA-DR and CARA-ST tools will be transformational in helping to monitor the health of existing and future patients with cardiovascular disease.”

Quenneville projects solid financial prosperity for the company, forecasting growth to $800,000 in revenue in 2022 for a year-over-year increase of 167 per cent, then soaring to a projected $7.9 million in revenue in 2023, a growth rate just shy of 900 per cent.

Accordingly, Quenneville’s EV/Sales multiple takes a sharp dive in that time, plummeting from the reported 67.1x in 2021 to a projected 4.2x in 2022, then to a projected 1.7x in 2023. The projected multiple performance compares favourably to DIAGNOS’s peer group, which is expected to drop from 50.5x in 2021 to 14.7x in 2022, then to a projected 8.7x in 2023.

Meanwhile, after three consecutive years of losses, both reported and projected in the case of 2022 at $2.4 million, Quenneville forecasts the company’s EBITDA to turn positive in 2023 at $2.3 million.

Quenneville introduced an EV/EBITDA multiple in 2022 at 20.7x before dropping to a projected 3.3x in 2023, both years significantly outdoing the peer group projections of 115.6x in 2022 and 35.9x in 2023.

“While the timeline and scale of a potential deal remain uncertain for now, concluding a deal with EssilorLuxottica would be a game-changer for ADK given the sizeable financial opportunity and the industry validation of its technology platform,” Quenneville said.

DIAGNOS’s stock price has dropped by 45.9 per cent over the last year, having fallen gradually from its 52-week high of $0.75/share set nearly a year ago on January 13, and hitting a 52-week low today at $0.33/share.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment