Netflix stock is finally looking interesting, says Lorne Steinberg

It’s a great thing to see a stock get chopped down to something more affordable — when you’re on the outside looking in, that is — and that’s where we’re at with Netflix (Netflix Stock Quote, Charts, News, Analysts, Financials NASDAQ:NFLX). With the streaming giant’s share price down about a third over the month of January, portfolio manager Lorne Steinberg says NFLX is now one to watch.

“For the first time, we’re actually looking at Netflix because the stock is showing itself to be a more reasonable valuation. Also, they raised prices recently which might not have made consumers happy but which should help the bottom line,” said Steinberg, president of Lorne Steinberg Wealth Management, who spoke on a BNN Bloomberg segment on Thursday.

Netflix and the rest of the Big American tech stocks have been a favourite target over the first stretch of the year, with stocks like Netflix, Amazon and Alphabet taking their lumps as the market continues to be cagey on growth stocks in the current rising interest rate environment.

As for Netflix, the company’s share price has always been at the whim of how the market reacts to its quarterly subscription numbers and that seems to have been the case earlier this month when the company’s fourth quarter 2021 earnings showed slower sub additions on a year-to-year comparison. Netflix’s added 8.28 million global paid net subscribers over its Q4, which was actually ahead of what analysts had on average expected at 8.19 million additions but still looked stagnant when held up against 2020’s fourth quarter additions of 8.5 million.

More disturbing might have been management’s guidance for the first quarter 2021, which called for 2.5 million adds compared to 3.98 million a year earlier. Either way, the stock immediately dropped almost 22 per cent and has yet to bounce back, even as the Q4 top and bottom lines were pretty good: $7.71 billion in revenue compared to the consensus forecast for the same and $1.33 per share in earnings compared to the Street’s call for $0.82 per share.

But Netflix has endured similar dramatic pullbacks in the past, in July of 2018 and 2019, for example, when subscription slowdowns spooked investors. But each time the stock powered forward to higher plains.

And while Netflix — an early pandemic winner as many in the market placed their bets on stay-at-home products and services — had about a year-long stretch over half of 2020 and half of 2021 where nothing much went on with its share price, the back end of 2021 gave investors something to cheer about, with the stock gaining almost 20 per cent over September to November.

But the current pullback has taken a big chunk out of NFLX, going from a high of $691 in mid-November to now around $400.

Questions remain as to how much bigger Netflix can grow in markets like the US and Canada, especially as a number of capable competitors have come online. But while it’s unclear how the battle among the streaming services will play out, Steinberg says after a soon-to-come period of consolidation among the many streaming content providers Netflix is likely to be one of the survivors.

“We already own Disney and Disney is spending twice as much as Netflix is on content over the next few years a massive amount of money their content battle. So right now we do prefer Disney,” Steinberg said.

“We think there are only going to be a few companies left at the end of the day and certainly Netflix should be one of them. They are spending a ton on content and they do have the subs, so we actually own Disney and Discovery at the present time as well BCE in our Canadian portfolio,” he said. “Netflix will still be around and ultimately we think that prices will probably go up as the field narrows which underpin profitability.”

“We expect Disney to overtake Netflix in terms of subscribers over the next three years as well but not at the same price per subscriber, but I have to say Netflix is for the first time since I can remember starting to look interesting as a purchase because the valuation has come off so much,” he said.

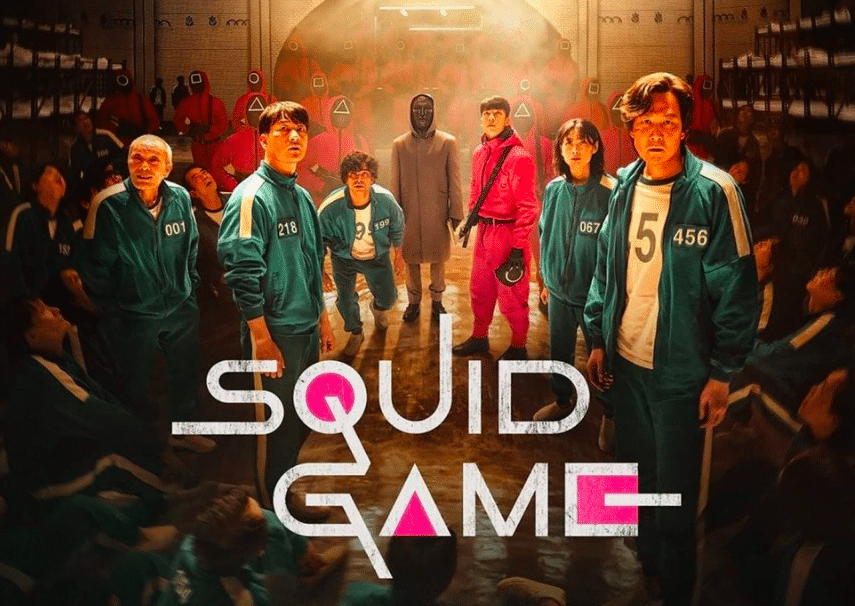

In its letter to shareholders accompanying the fourth quarter 2021 results, Netflix touted its wins over the year, including its two biggest film releases of all time in Red Notice and Don’t Look Up along with its biggest TV show of the year in Squid Game. Meanwhile, among TV and movie studios Netflix triumphed in 2021 as the most winning and nominated TV network at the Emmy Awards and as the most winning and nominated at the Oscars.

“Even in a world of uncertainty and increasing competition, we’re optimistic about our long-term growth prospects as streaming supplants linear entertainment around the world.,” the company said in its January 20 letter to shareholders. “We’re continually improving Netflix so that we can please our members, grow our share of leisure time and lead in this transition.”