US biopharm company AbbVie (AbbVie Corp Stock Quote, Charts, News, Analysts, Financials NYSE:ABBV) has gift-wrapped a nice stocking stuffer for its shareholders this month with now a ten per cent rise in share price since the start of December. That plus a healthy dividend will likely leave investors satisfied as we head into the new year, but portfolio manager Gordon Reid thinks there could be rougher times ahead for AbbVie.

“We own AbbVie on behalf of our clients in our US large cap portfolio and it has done very well,” said Reid, president and CEO of Goodreid Investment Counsel, who spoke on BNN Bloomberg on Thursday.

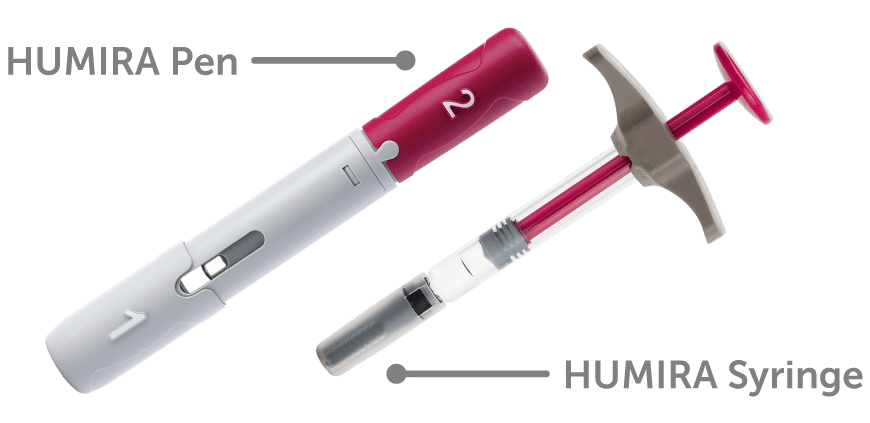

Reid said with AbbVie’s patents on arthritis drug Humira expiring the company will lose a valuable chunk of its revenue going forward, meaning investors will likely want to bail before the impact is truly felt on the company’s financials.

“From a fundamental standpoint, AbbVie still represents good value,” Reid said. “They bought Allergan for about $60 billion a couple of years ago. It gave us some comfort because it lessened the reliance on Humira, which was representative of about 60 per cent of their revenues at one point. It’s now down to about 40 per cent.”

“But Humira is going off patent in 2023 and you have to be careful with the growth rate going forward,” he said. “Abbvie pays a good dividend and we think it will do well, but I think with this one, you want to be plotting an exit at some point because when the market truly believes that the growth rate is going to be in decline, this stock is going to go dormant, if not down.”

The $230-million market cap AbbVie looks like it will close out 2021 on a strong note with the stock currently up about 21 per cent for the year. That’s over top of a dividend currently sporting about a four per cent yield, one which the company has consistently been adding to over the years.

Those share price gains even take into account a pretty big pullback to the stock occurring in early September. There, the FDA ordered AbbVie to slap a heart-risk label on its anti-inflammatory treatment Rinvoq, with ABBV dropping almost eight per cent in value as a result. But the stock rallied over the fall and has put on even more in December despite an announcement earlier in the month from the FDA requiring further label warnings on Rinvoq.

AbbVie is still delivering on a quarterly basis, showing revenue up 11 per cent year-over-year to $14.34 billion in its most recent third quarter 2021, delivered in late October, with adjusted earnings up 38 per cent to $3.33 per share. Both numbers beat analysts’ estimates which were calling for $14.32 billion and EPS of $3.22. Meanwhile, management raised its full-year outlook, now calling for 2021 EPS of between $12.63 and $12.67 per share versus the previous $12.52 to $12.62.

“We continue to deliver excellent results, with balanced performance across our portfolio driving double-digit operational sales and EPS growth,” said CEO Richard A. Gonzalez, in the third quarter press release. “Based upon our strong momentum, we are increasing our full-year 2021 EPS guidance. We remain highly confident in AbbVie’s long-term outlook and are once again raising our dividend, which has grown over 250 percent since inception.”

At the same time, the impact of Humira’s fortunes on AbbVie is clear. Of the $14.34 billion in worldwide revenue for the Q3, over a third, $5.425 billion, came from Humira. Further, its patent for the drug has already run out in Europe, with the results showing an almost 15 per cent year-over-year drop in European sales for Humira in the third quarter, down to $812 million. AbbVie is picking up some of the slack with other immunology drugs Rinvoq and Skyrizi, however, which both saw major year-over-year sales increases over the quarter.

Reid says AbbVie shareholders might want to consider taking some profits if they’ve made money on the stock, in effort to keep their portfolios balanced.

“As a position rises in terms of percentage in your portfolio, look to trim those positions. It’s okay to to take a little money off the table when something is rising,” Reid said. “It’s not a company specific risk aversion technique. It’s a portfolio risk aversion technique, so it’s more systemic and and it really does pay dividends during rough times because the last thing you want to do is the old round trip — it goes up, becomes a big piece of your portfolio and goes down.”

“Those of you who are a little older might remember Nortel and there are a lot of stories stories about Nortel in terms of the round trip. So, look at it from that vantage point,” he said.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment