Inflection points upcoming for NervGen Pharma, says Paradigm Capital

Paradigm Capital analyst Scott McAuley believes NervGen Pharma (NervGen Pharma Stock Quote, Chart, News TSXV:NGEN) could produce a paradigm shift in treating neurodegenerative diseases, initiating coverage on Wednesday with a “Speculative Buy” rating and target price of $5.20/share.

A Vancouver-based pharmaceutical company dedicated to the treatment of nervous system damage, NervGen is in the process of developing NVG-291, a clinical stage candidate to potentially treat spinal cord injuries, multiple sclerosis and Alzheimer’s disease, with preclinical functional data in many disease models based on mechanisms including nervous system regeneration, remyelination, plasticity, as well as autophagy and innate immune modulation.

NervGen initially formed after Harold Punnett and other co-founders obtained an exclusive license to the technology and lead candidate from Prof. Jerry Silver at Case Western Reserve University after a family member suffered a severe injury. Though the initial focus was on a spinal cord injury, additional pre-clinical data and further understanding of the role of chondroitin sulfate proteoglycans (CSPGs) in the central nervous system opened many other opportunities in major indications, significantly expanding the market and investment opportunity.

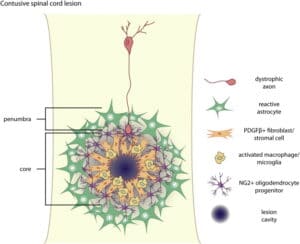

The company’s technology is based on a highly conserved CSPG/PTPσ mechanism involved in controlling nerve growth and development in the central nervous system.

“When the central nervous system is damaged, either from external force or inflammation, the affected tissue is isolated to ensure the damage is contained,” McAuley said. “This isolation creates barriers that prevent regeneration of neurons, reduces maturation of myelin producing cells and inhibits the ability of healthy neurons to take over the function of damaged cells. Releasing this inhibition unleashes the body’s ability to regenerate itself and leads to improved motor, sensory, autonomic and cognitive functions, which could benefit patients experiencing numerous damage or neurodegenerative diseases.”

In his investment thesis for the company, McAuley identified a number of positives for NervGen’s future, namely the company’s novel and differentiated approach to treating neurodegenerative diseases by inhibiting the interaction between CSPGs and PTPσ, a deep collection of pre-clinical data demonstrating multiple pharmacodynamic effects including neuron growth, remyelination and improvements in plasticity, which could further boost NVG-291’s marketability in an environment where it already has significant opportunities in multiple indications, according to McAuley.

McAuley also cites the company’s strong management team, led by Chief Medical Officer Dr. Dan Mikol, who was a practicing neurologist and clinical researcher at the University of Michigan before becoming the clinical development head of neuroscience and nephrology team at Amgen, as well as Chief Executive Officer Paul Brennan, who has held business development and management positions at Aquinox Pharmaceuticals (now Neoleukin Therapeutics), Arbutus Biopharma, Aspreva Pharmaceuticals and AnorMED Inc.

The company recently announced a partnership with Imeka Solutions Inc., a neuroimaging company that combines artificial intelligence and diffusion imaging to obtain high resolution images of white matter in the brain, with NervGen using Imeka’s technology as a sensitive pharmacodynamic biomarker for NVG-291 in its Phase 1b/2 clinical trials.

“Imeka’s imaging technology is state of the art science that allows the very precise measurement of changes to the brain and spinal cord to detect precisely where and how a therapeutic is having its effect,” said Paul Brennan, NervGen’s President and CEO in the company’s September 27 press release. “Imeka has been at the forefront of testing novel therapeutics in the areas of Alzheimer’s disease and multiple sclerosis and has some of the world’s leading neuroscience companies as its clients. Recently, we have also worked closely together on several grant applications to various agencies, including the U.S. Department of Defense. We are immensely impressed with the Imeka team and their technology and believe that this partnership will result in a robust and data rich clinical trial program.”

As the company is still in its clinical stage, it does not have reported revenue, nor does McAuley provide a revenue forecast for the company through the 2022 fiscal year. However, McAuley does project an EBITDA loss of $7.2 million in 2021 after reporting a $7.7 million loss in 2020, with a further $9 million loss projected in 2022.

Meanwhile, McAuley projects further loss in the company’s earnings per share after reporting a $0.35/share loss in 2020, with projected losses of $0.28/share and $0.31/share in play for 2021 and 2022, respectively.

McAuley cites numerous key catalysts for the company’s future growth, including the release of SAD results and launch of the MAD section of the Phase 1 study within the fourth quarter of 2021, followed by additional pre-clinical results in stroke, chronic SCI and Alzheimer’s en route to a potential listing on a major American exchange in the first half of 2022.

“NGEN’s lead candidate, NVG-291, is currently in a Phase 1 study to confirm the safety profile of the drug in humans. This will be a significant de-risking event in advance of planned Phase 2 trials in MS and spinal cord injury and a Phase 1b study in Alzheimer’s patients in H2/22,” McAuley wrote.

“NGEN is a Canadian biotech story set to break through to a global investor audience,” he said.

Overall, NervGen Pharma’s stock price has risen by 6.8 per cent over the course of the year, showing steady growth since bottoming out at $1.30/share on May 31, but not quite reaching the high point of $2.58/share from January 27. At the time of publication, McAuley’s $5.20 target price represented a projected one-year return of 118 per cent.

Geordie Carragher

Writer

Geordie Carragher is a staff writer for Cantech Letter