The healthcare field has been one of the last sectors to undergo disruption on a major scale, with trends like big data, remote monitoring and telemedicine only recently gaining more sway in the space. In this way, health tech companies have been taking part in the transformation in Canada and elsewhere, coming up with unique products and services and garnering investors’ attention in the process.

Here, Cantech has three such names for readers interested in the space, all with recent positive ratings from analysts.

Starting in no particular order with pharmacy services company CareRx (CareRx Stock Quote, Charts, News, Analysts, Financials TSX:CRRX), which offers specialty pharmacy services to senior care residents and home care operators. The company has been busy consolidating the space, with now over 90,000 residents being served in senior and community care homes across Ontario, Saskatchewan, Alberta and BC.

The company recently announced a 1,500-bed expansion of a contract in Ontario across 19 locations, a move which comes a month after CareRx closed on the more transformative acquisition of the long-term care pharmacy division of Medical Pharmacies Group Ltd (MPGL) for $70 million in cash and 550,359 shares of CRRX. That deal has been estimated by CareRx to add about $150 million in annualized revenue and about $10-12 million in EBITDA.

Looking at CareRx’s progress of late, iA Capital Markets analyst Chelsea Stellick said the company has made “remarkable strides” over the past year and is likely to hit its 100,000 bed goal well ahead of management’s proposed schedule.

“We continue to be impressed by management’s ability to generate rapid growth through consolidating the seniors pharmacy market in Canada, both through successful closing of synergistic acquisitions and organic contract wins as CRRX capitalizes on stronger market leadership and fewer competitors. We believe CareRx’s market position of ~94,000 beds serviced is a sustainable competitive advantage in an industry where profitability is dependent on driving efficiencies through scale,” Stellick wrote in a client update on September 14.

With her update, Stellick reiterated her “Buy” rating for CareRx while upping her target price to $9.25 per share, which represented a projected one-year return of 48.0 per cent. (All returns are listed as of the publication date of the analyst’s report.)

From a different perspective, another medical company looking to expand its reach is Greenbrook TMS (Greenbrook TMS Stock Quote, Charts, News, Analysts, Financials TSX: GTMS), which is a provider of Transcranial Magnetic Stimulation (TMS) therapy in the US for the treatment of Major Depressive Disorder (MDD) and other mental health disorders. The company operates 132 treatment centres where it provides local electromagnetic stimulation to part of the brain associated with mood regulation, with over 675,000 treatments now having been provided to over 19,000 patients.

Recently, Greenbrook bought another TMS provider, Achieve TMS, which has 17 TMS centres in the Eastern and Midwest United States and jointly completed a US$13.2 million bought deal public offering to finance the acquisition.

The COVID pandemic had an impact on Greenbrook’s operations last year but the company seems to have picked it up in 2021, delivering second quarter results last month that Clarus Securities analyst Noel Atkinson called impressive. GTMS saw procedure volumes climb 12 per cent from the previous quarter while revenues grew 21 per cent sequentially, beating Atkinson’s quarterly forecast.

“Greenbrook continues to have a plethora of macro growth drivers for the TMS services sector overall, which should particularly benefit the Company given its positioning as by far the largest independent TMS treatment provider. We believe the expected rollout of Spravato treatments (and other psychedelic treatments once FDA- approved) could eventually have a materially positive impact on facility utilization and profitability and would make Greenbrook by far the largest chain of treatment centers in the U.S. for administering FDA-approved psychedelic drugs to treat depression and other mental illnesses,” wrote Atkinson in an August 9 update to clients.

Atkinson reiterated his “Speculative Buy” rating and $26.00 target with his update, representing a projected one-year return of 101.6 per cent.

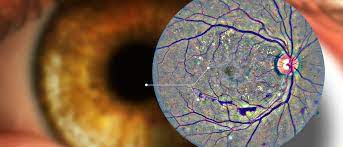

Finally, we have Montreal-based commercial-stage artificial intelligence company Diagnos Inc (Diagnos Stock Quote, Charts, News, Analysts, Financials TSXV:ADK) which has an AI platform used for the detection of critical health problems, where its CARA (Computer Assisted Retina Analysis) is used for addressing diabetic retinopathy (DR), which is the leading cause of blindness.

In addition to recent contract announcements, Diagnos announced in August an MOU with Essilor International, a subsidiary of EssilorLuxottica, the world’s largest eyecare company, for the potential worldwide distribution of the CARA AI platform, a move which Echelon Capital Markets analyst Stefan Quenneville said represents a huge opportunity for Diagnos.

“Concluding a deal with EssilorLuxottica would be a game-changer for ADK given the sizeable financial opportunity and the industry validation of its technology platform,” said Quenneville in an August 17 update to clients.

With his report, the analyst kept his “Speculative Buy” rating and raised his target price from $0.95 to $1.55 per share, reflecting a potential return of 182 per cent.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment