Echelon Capital Markets analyst’s Stefan Quenneville has grown more optimistic about DIAGNOS (DIAGNOS Stock Quote, Chart, News, Analysts, Financials TSXV:ADK) after the company announced a new MOU for potential worldwide distribution. In an update to clients on Tuesday, Quenneville reiterated his Top Pick status and “Speculative Buy” rating while raising his target price from $0.95 to $1.55/share for a projected return of 182 per cent.

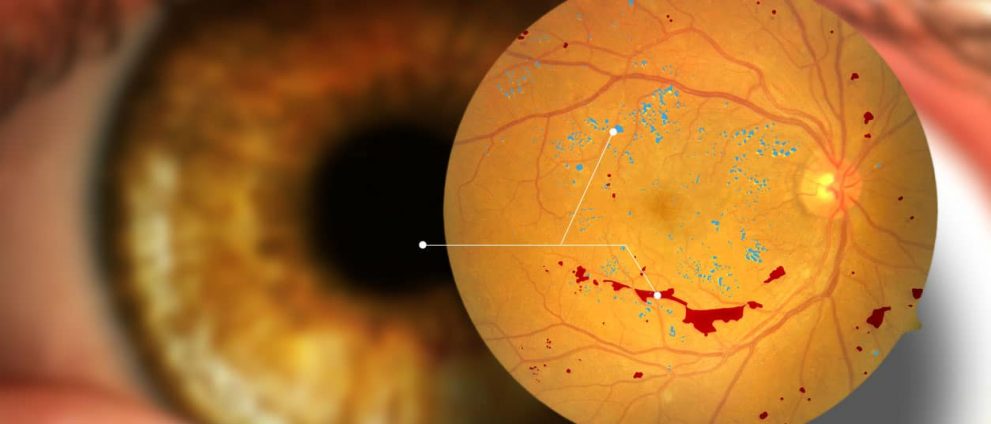

Founded in 1996 and headquartered in Montreal, DIAGNOS is an artificial intelligence company in the commercials of addressing diabetic retinopathy, a leading cause of blindness. Its CARA AI technology, which imports, processes and stores original and enhanced images through computerized networks, is in the process of rolling out in New Look optical retail outlets throughout Canada in the second half of 2021.

Quenneville’s latest analysis comes after DIAGNOS signed a Memorandum of Understanding with EssilorLuxottica subsidiary Essilor International’s instruments division for a potential worldwide distribution agreement for its CARA AI platform.

“While this is not yet a binding agreement, we think this represents a potential base case of $13-67 million-plus in peak sales opportunity for ADK,” Quenneville wrote. “Given this optionality, we are increasing our target price to $1.55/shr (from $0.95) with meaningful further upside should a deal be concluded and a successful roll-out follow in the coming quarters.”

EssilorLuxottica, which came about after a 2017 merger involving Essilor, a French lens manufacturer, and Italian frame producer Luxottica, has major brands Ray-Ban and Oakley in its portfolio, along with approximately 9,000 retail global locations, with plans to potentially add another 6,000 locations to its arsenal through its 7.3 billion euro acquisition of GrandVision.

The Memorandum of Understanding, which Quenneville notes has been in the works since last year, could result in a blue sky opportunity as high as $224 million for DIAGNOS depending on the number of stores it can get its CARA AI technology into.

“DIAGNOS is focused on its commercialization strategy and pursuing opportunities with potential partners. We are very pleased that our AI-based technology has attracted the attention of global eyecare sector leaders such as Essilor International and we are looking forward to our discussions with respect to a mutually beneficial potential worldwide distribution agreement. At the same time, DIAGNOS continues to invest in Research and Development, furthering the creation of our intellectual property by partnering with Quebec government programs and local university (École de Technologie Supérieure) to ensure that we stay ahead of our competition worldwide,” said André Larente, President of DIAGNOS in the company’s August 16 press release.

With 2022 first quarter financial results also recently posted, Quenneville made slight revisions to his financial metrics with the Essilor announcement, projecting the company’s revenue to remain around $100,000 for the second quarter of 2022 before a slight jump to $200,000 in the third quarter, before climbing to an estimated $500,000 in the final quarter of 2022 to put the company at a projected $800,000 in revenue, then increasing to a $7.9 million estimate (previously $7.3 million) in 2023.

He also has EBITDA losses continuing to mount on a quarterly basis, bottoming out at a $900,000 loss in Q3 2022 before eventually rising to an annual figure of positive $2.3 million (previously $1.9 million) by 2023.

Quenneville also modified his valuation data, as his projections now have the EV/Sales multiple dropping from 103.4x (previously 88.4x) in 2021 compared to an 83.3x projection from peers, to 6.4x in 2022 (previously 6.8x) against 14.4x from peers, then dropping again to a projected 2.6x in 2023 (previously 3.4x), in contrast to the 9.5x projection from peers.

Quenneville’s EV/EBITDA multiple projections tell a similar story, registering at a forecasted 41.9x for 2022 (previously 52x) compared to peer projections of -51.2x, then dropping to a projected 4.8x (previously 7.3x) compared to a 20x mark from industry peers.

With conservative estimates in mind, Quenneville is bullish on the potential of DIAGNOS’ continued growth should the memorandum of understanding turn into a more concrete agreement.

“While the timeline and scale of a potential deal remain uncertain for now, concluding a deal with EssilorLuxottica would be a game-changer for ADK given the sizable financial opportunity and the industry validation of its technology platform,” he said. “To address this optionality, we are conservatively assuming a 50 per cent probability that a deal will be concluded, and that the technology will be rolled out to 4,000 locations over 24 months starting in mid-C2022.”

DIAGNOS closed trading on Thursday at $0.50/share on the TSX Venture Exchange, up a cent from Wednesday. Overall, DIAGNOS stocks are down seven cents (13.2 per cent) since January 1, with a high point of $0.75/share on January 13.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment