Critical Elements Lithium has a 46 per cent upside, says Beacon

Beacon Securities analyst Amhad Shaath believes in Critical Elements Lithium Corp (Critical Elements Lithium Corp Quote, Chart, News, Analysts, Financials TSX:CRE), initiating coverage with a “Buy” rating and target price of $2.00/share for a projected return of 46 per cent in an update to clients on September 20.

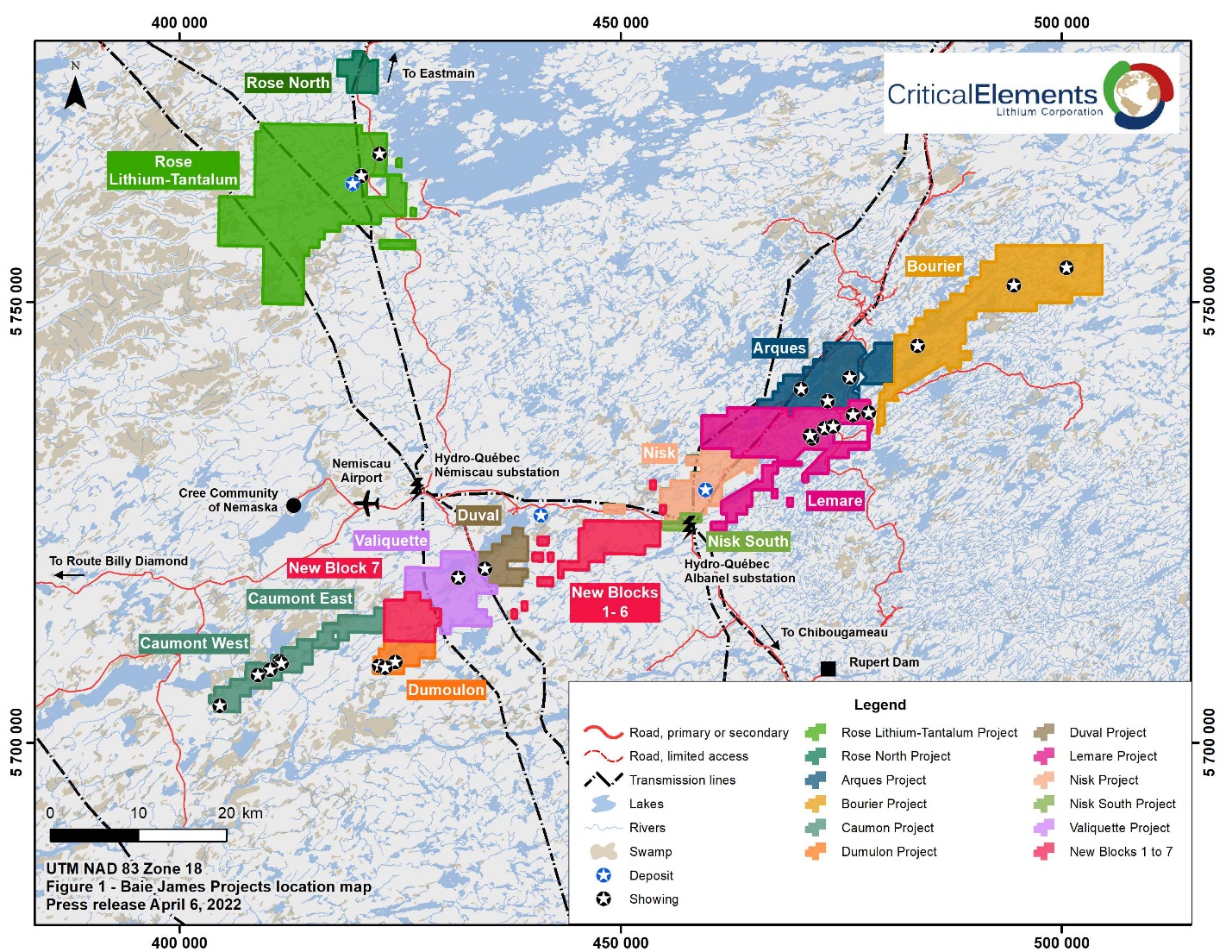

Headquartered in Montreal, Critical Elements Lithium Corporation is a mining company whose primary operation is the Rose-Tantalum Project in James Bay, Quebec, which is expected to produce one of the world’s purest concentrations of lithium spodumene to potentially help develop the EV supply chain, with metallurgical testing of the ore confirming exceptionally low iron and mica content in the substance.

“Potential production from Rose will rank favourably in the market and should command premium pricing,” Shaath said. “Examining spodumene concentrate pricing from recent entrants into the market, the premium could be upwards of $130 per tonne vs. inferior products even in an oversupplied market. Coupled with expected industry leading recovery rates, we believe Critical Elements is exceptionally positioned to develop Rose into a top-tier hard-rock lithium asset.”

The company’s primary focus on spodumene for its Rose-Tantalum Project is a strong strategy, according to Shaath, who also noted the strategy’s success in western Australia, which is considered a primary hub for lithium products today.

“This approach is favoured as it reduces development and technical risks,” Shaath said. “It also accelerates value realization and CRE’s path to cashflows, capitalizing on current strength in lithium prices that are near all-time highs.”

The company has been busy in its pursuit of lithium targets, working actively with GoldSpot Discoveries to use GoldSpot’s AI Exploration technologies in the Nemiscau belt in Quebec, also using the technology in a joint venture with Lomiko Metals to identify approximately 15 high to moderate prospectivity lithium targets, also within the Nemiscau belt.

In addition, the company has also begun a Phase II engineering study for a chemical plant to produce high quality lithium hydroxide monohydrate for the electric vehicle and energy storage system battery industries, retaining Taipei-based consultant Gerrit Fuelling, a former expert with Rockwood Lithium, to serve as a lithium markets and contracts expert for the company.

Critical Elements recently scored another victory with its Rose-Tantalum Project, as Jonathan Wilkinson, Canada’s Minister of Environment and Climate Change, ruled that the project is not likely to cause significant adverse environmental effects when mitigation measures are taken into account.

“We are very pleased with the decision regarding the Rose Lithium-Tantalum Environmental Assessment process, which brings us closer to the day when the project can move forward. Critical Elements has made stakeholder relations a priority since the Company’s inception. We are excited about the prospect of moving forward with our plans in the James Bay Eeyou Istchee region,” stated Jean-Sébastien Lavallée, CEO of Critical Elements in the company’s August 11 press release.

Shaath does not expect the company to bring in any revenue until a projected $11 million in 2023, though he follows up with a nearly tenfold year-over-year increase to a projection of $119 million in revenue for 2024, followed by a bump to $271 million in 2025 before settling in at $299 million for both 2026 and 2027.

He also has net income numbers coming in on the negative side, estimating a $1.8 million loss in 2021, then projecting further losses of $11.4 million in 2022, $66.3 million in 2023 and $93.4 million in 2024.

Valuation data for price-earnings and price/cash flow did not produce anything meaningful in Shaath’s projections, though he did project NAV to be $2.02 in 2022, increasing to $2.50 in 2023 and $3.30 in 2024. Subsequently, Shaath’s P/NAV projections decreased, moving from a projected 0.7x in 2022 to a projected 0.5x in 2023, then to a projected 0.5x in 2024.

Shaath’s EV/EBITDA multiple projections also come into effect in 2024 at a projected 44.6x, followed by a precipitous drop to a projected 4.9x in 2025, 3.6x in 2026, and 2.9x in 2027.

The company currently has $7 million in cash available, compared to $2 million in debt, with a market cap of $277.6 million.

The success of the Rose-Tantalum Project to date has Shaath excited about the company’s future prospects.

“We believe Critical Elements sits at the forefront of the development projects funnel to address the need for local lithium supply in North America,” Shaath said. “The project is in the final stages of obtaining its full mining permits following the favourable decision by Canada’s federal authorities.”

“We also emphasize Rose’s favourable ESG profile stemming from the planned reliance on clean hydropower and strong community engagement from day 1 of project development. This should play a pivotal role as the EV supply chain evolves and where we expect increased scrutiny paid to ESG practices,” Shaath wrote.

Overall, the stock price for Critical Elements has risen by 79.7 per cent for the year to date, reaching a high point of $1.72/share on June 10.

Geordie Carragher

Writer

Geordie Carragher is a staff writer for Cantech Letter