Research Capital Corporation analyst Yue Ma has stood firm on Perimeter Medical Imaging AI (Perimeter Medical Stock Quote, Chart, News, Analysts, Financials TSXV:PINK), maintaining his Speculative Buy rating and target price of $4.90, representing a projected return of 63 per cent.

Research Capital Corporation analyst Yue Ma has stood firm on Perimeter Medical Imaging AI (Perimeter Medical Stock Quote, Chart, News, Analysts, Financials TSXV:PINK), maintaining his Speculative Buy rating and target price of $4.90, representing a projected return of 63 per cent.

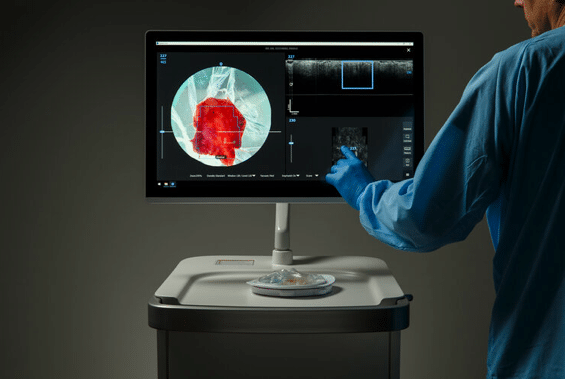

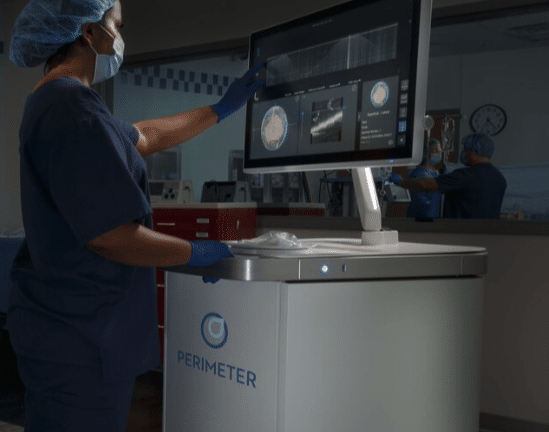

Headquartered in Toronto with its American operations in Dallas, Perimeter Medical is a medical technology company looking to transform cancer surgery with ultra-high-resolution, real-time, advanced imaging tools to address high unmet medical needs.

Perimeter Medical is in a potentially critical moment in its existence, as the company is developing a proprietary, next-gen AI technology product called ImgAssist AI (software as a medical device) to aid surgeons with margin assessment during breast lumpectomy, with a randomized, controlled pivotal trial in over 300 breast cancer patients scheduled for lumpectomy scheduled to begin in September, with results scheduled to be reported in the first quarter of 2022.

According to Research, Perimeter may be on the cusp of becoming a money-maker despite incurring losses in every year of its existence to date. The company projects to be on a similar trajectory through 2023, with projected losses peaking at $16.1 million in the 2021 forecast. However, 2024 projects to be the year Perimeter Medical has a breakthrough from a return standpoint, with a projected positive net income of $1.13 million, with Ma forecasting the net income to reach $16.7 million by 2030 after a peak of $21.2 million in 2029.

Ma has the company’s EBITDA following a similar trajectory, bottoming out at a projected -$17.4 million in 2021 before hitting $130,000 in positive EBITDA by 2024, with a forecasted growth to $20.6 million by 2030.

Ma also projects the company’s valuation ratios to come into clearer focus within the next decade, as his initial projection for 2021 has the company’s price-to-sales ratio at 277.9x before eventually mellowing out through the rest of the 2020s, hitting 2.3x by 2030. The EV/Sales projection is a similar story, as Ma has it forecast to drop from 2021’s projected 242.5x multiple to 2.0x by 2030.

Ma’s analysis comes after the company announced the hiring of Jay Widdig, who brings more than 30 years of experience in the medtech, healthcare, technology, and software-as-a-service industry sectors and brings an extensive array of financial experience to Perimeter, as its new Chief Financial Officer.

“I believe Perimeter’s novel OCT Imaging System – along with the ongoing work on next-generation improvements with AI software – have the potential to be a transformative, disruptive new technology that could help surgeons treat breast cancer,” Widdig said in a July 26 press release. “With FDA clearance to market Perimeter S-Series OCT in the U.S., I am excited to join the Company and help Perimeter realize this great promise.”

Widdig is not the only significant hire for the company this month, as Perimeter Medical also hired Dr. Sarah Butler as its new Vice President of Clinical and Medical Affairs, Previously, Dr. Butler was a RAQA (Regulatory Affairs/Quality Assurance) Executive for IBM Watson Health, where she led the development of clinical strategic programs and products in the Watson Health Imaging Division.

“I am excited to be joining Perimeter as the company embarks upon important clinical development initiatives supporting its OCT technology platform, which has the potential to address clear unmet medical needs in surgical specimen imaging,” Dr. Butler said in a July 13 press release. “I look forward to contributing to the advancement of Perimeter’s clinical programs with the goal of bringing this innovative technology to physicians and surgeons, who are striving to improve patient outcomes and lower healthcare costs.”

Like many medical companies, Perimeter Medical has its own set of risks, with Ma making note of regulatory risks with FDA approval, commercial risk, clinical and developmental risk, patent protection and infringement, software malfunction, competition, litigation, a history of operating losses, foreign exchange risk, limited market awareness, financing risk, share price volatility, potential issues with ownership concentration, the potential for equity dilution, and the company’s status of only having one product at the moment.

At the time of publication, Perimeter Medical Imaging AI was trading at $3.20/share, up 19 cents from its Monday opening of $3.01/share.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment