Research Capital Corporation analyst André Uddin has revised his view on Bellus Health (Bellus Stock Quote, Chart, News, Analysts, Financials TSX:BLU), changing his rating from “Hold” to “Speculative Buy” while raising his target price from $3.50/share (CDN) to $6.00/share, representing a projected return of 71 per cent.

Research Capital Corporation analyst André Uddin has revised his view on Bellus Health (Bellus Stock Quote, Chart, News, Analysts, Financials TSX:BLU), changing his rating from “Hold” to “Speculative Buy” while raising his target price from $3.50/share (CDN) to $6.00/share, representing a projected return of 71 per cent.

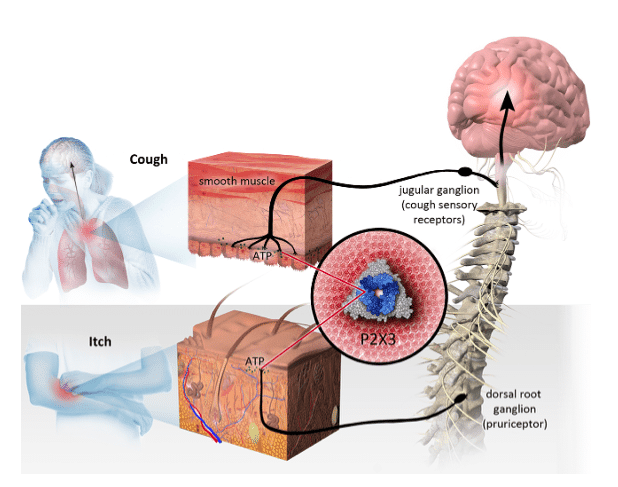

Based in Laval, Quebec, Bellus Health is a clinical-stage biopharmaceutical company developing novel therapeutics for the treatment of chronic cough and other hypersensitization-related disorders.

Uddin’s optimism comes from expected results in the company’s two ongoing clinical trials with its BLU-5937 product: the BLUEPRINT trial, a randomized, double-blind, placebo-controlled Phase 2a study to evaluate BLU-5937 in 128 chronic pruritus patients with atopic dermatitis (AD), which an estimated 10 per cent of Americans eventually develop, meaning the potential for a market of up to 2.4 million patients, and the SOOTHE trial, a Phase 2b trial in patients with a baseline cough frequency of ≥25 coughs/hour.

With top-line results on both trials expected in the fourth quarter of 2021, Uddin is particularly optimistic about the SOOTHE trial, which demonstrated through a subgroup analysis of the company’s Phase 2 RELIEF (Randomized, Double-Blind, Placebo-Controlled, Crossover, Dose Escalation in subjects with Unexplained or Refractory Chronic Cough) study that BLU-5937 could significantly reduce awake cough frequency in RCC patients with cough frequency of over 20 coughs/hour.

“Based on this analysis, we believe BLU5937 has a decent shot of meeting its primary endpoint in the SOOTHE trial in RCC patients with a cough frequency of over 25 coughs/hour,” Uddin said.

Bellus Health CEO Roberto Bellini has been happy with the progress the BLU-5397 trials have made over the last year.

“Both our Phase 2b SOOTHE trial in refractory chronic cough and our Phase 2a BLUEPRINT trial in chronic pruritus associated with atopic dermatitis are progressing well,” he said in the company’s May 10 press release announcing its first-quarter results. “We look forward to clinical, regulatory and corporate updates across the entire P2X3 antagonist class during this catalyst-rich year ahead, including expected topline results from both our Phase 2 trials in the fourth quarter.”

According to Research Capital’s estimates, the company may be on the cusp of becoming a money-maker in three years. The company projects to be on a similar trajectory through 2023, with projected losses bottoming out at $61 million in the 2021 forecast. However, 2024 projects to be the year Bellus Health has a breakthrough from a return standpoint, with a projected positive net income of $36.1 million, with Uddin forecasting the net income to reach $43.2 million by 2027 after a peak of $51.3 million in 2025.

Uddin has the company’s EBITDA following a similar trajectory, bottoming out at a projected -$61.4 million in 2021 thanks to increased research and development spending, then rebounding to hit $35.9 million in positive EBITDA by 2024, with a forecasted growth to $56.4 million by 2027.

Earnings-per-share, both basic and diluted, also project to bear returns beginning in 2024, with basic EPS hitting a high projection of $0.65/share in 2025, and $0.60/share diluted in the same year.

Like many medical companies, Bellus Health has its own set of risks, with Uddin making note of potential failure of pre-clinical and clinical studies with BLU-5937 (development risk), delay or failing to obtain regulatory approval (regulatory risk), inability to raise sufficient capital on a timely basis or under favourable terms, potential infringement upon the patents of others, inability to out-license BLU-5937, foreign exchange fluctuation, potential failure to meet the FDA standards in manufacturing processes (manufacturing risk), share price volatility, operating losses, competition, high ownership concentration of Bellus, and other potential risks related to Bellus’ intellectual property.

However, despite the risks, Uddin is still exceedingly positive regarding the company’s growth in both the immediate and distant future, with second-quarter results expected in August.

“We expect BLU to trade up for its two key catalysts expected in Q4 2021,” he said.

At the time of publication, Bellus Health was trading at $3.41/share on the Toronto Stock Exchange, down nine cents from its Monday opening figure of $3.50/share.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment