DIAGNOS remains a Top Pick at Echelon Capital

Look for Montreal-based artificial intelligence company DIAGNOS (DIAGNOS Stock Quote, Chart, News, Analysts, Financials TSXV:ADK) to reach profitability by next year, says Echelon Capital Markets analyst Stefan Quenneville, who delivered an update to clients on DIAGNOS on Wednesday.

Look for Montreal-based artificial intelligence company DIAGNOS (DIAGNOS Stock Quote, Chart, News, Analysts, Financials TSXV:ADK) to reach profitability by next year, says Echelon Capital Markets analyst Stefan Quenneville, who delivered an update to clients on DIAGNOS on Wednesday.

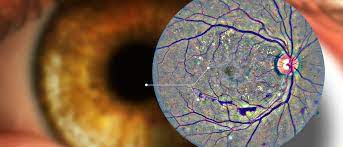

Commercial-stage AI company DIAGNOS is addressing the problem of diabetic retinopathy (DR), currently the leading cause of blindness. The company has developed an image enhancement and AI analysis platform, FLAIRE, which allows for quick modifying and developing of applications such as Computer Assisted Retina Analysis (CARA), which allows for sharper, clearer and easier to analyze retinal images.

DIAGNOS aims to secure agreements with optical retailers, networks of healthcare facilities, private and public payors and strategic partners like pharma and optometry equipment companies.

To that end, the company announced on Wednesday a seven-year agreement with New Look Vision, Canada’s largest optical retailer, to use DIAGNOS’ platform to screen for DR across the company’s 406 stores in Canada and the US.

DIAGNOS President André Larente said launching their global sales campaign over the first half of 2021 “has allowed the Company to achieve very tangible results for its shareholders already this year, including, but not limited to, the New Look Vision agreement.”

“Clinics, optical stores, and diagnostic and research centers are expected to emerge as crucial end users of our image analysis solutions, owing to rising demand for our extremely efficient solutions for better patient outcomes,” said Larente in a press release.

“In the future, these segments will account for larger DIAGNOS revenue shares as they increasingly rely on imaging services like CARA (Computer Assisted Retina Analysis), creating significant growth potential for DIAGNOS during its recently launched monetization strategy,” Larente said.

New Look, which was recently taken private by FFL Partners, a San Francisco-based private equity firm, the Caisse de dépôt et placement du Québec and the Dr. H. Doug Barnes Family, has stores under the New Look Eyewear, Vogue Optical, Greiche & Scaff and IRIS brands in Canada and the Edward Beiner brand in 12 locations in Florida.

Quenneville said having New Look sign up with DIAGNOS at this time is meaningful.

“With the closing of the take private deal occurring less a week ago, clearly this partnership with DIAGNOS is being viewed by New Look as a growth initiative and a differentiator in the marketplace as the company looks to rebound from the challenges of the past year. A successful launch of the service will likely draw the interest of other optical retailers with similar objectives, and we would not be surprised if DIAGNOS announces similar deals in the upcoming quarters,” Quenneville said.

Looking at the numbers on the deal, Quenneville estimates with an average of seven examinations per day at a price of $3.00 per exam and 320 working days a year, the result is about $2.7 million in annual revenues by 2023 once fully implemented.

“The key drivers of value for DIAGNOS in a deal of this structure are the price and volume of examinations and our assumptions are based on discussions with the Company as well as our own research on pre-COVID visit numbers at optometry clinics,” Quenneville said.

“We anticipate that the rollout will take place over the next year as the software is installed at retail locations. Should the roll-out occur as expected, we anticipate that the deal will allow ADK to become profitable in calendar 2022 (F2023 starts April 1, 2022), given its SaaS business model and lean operating structure,” he said.

Quenneville said a deal of this size and type had already been baked into his estimates for ADK but it’s still notable validation of the company’s technology and shows that it’s ready for broader commercial acceptance, particularly in the optical retail segment.

“While optical retailers have had a challenging year due to the pandemic, DIAGNOS has been actively targeting these players in pursuit of additional deals that could provide upside to our estimates in the coming quarters,” Quenneville wrote.

By the numbers, Quenneville thinks DIAGNOS will generate fiscal 2022 and 2023 revenue of $1.0 million and $7.3 million, respectively and fiscal 2022 and 2023 EBITDA of negative $2.9 million and positive $1.9 million, respectively.

With the update, the analyst has maintained his “Top Pick” and “Speculative Buy” ratings for ADK while upping his target from $0.85 to $0.95, which at the time of publication represented a projected one-year return of 53 per cent.

On valuation, Quenneville is using a 10x multiple of his calendar 2022 EV/Sales estimate which he sees as representing a discount to ADK’s healthcare IT peers at 13x.

Along with the New Look announcement, DIAGNOS concomitantly released its operating results for the fiscal year 2021, which featured revenue of $0.3 million, EBITDA of negative $2.3 million and operating cash burn of $1.4 million for the year.

Last year, ADK went from $0.22 in January to $0.59 by the end of December, while so far in 2021 the stock is now even as of Wednesday’s close.