Raymond James analyst Rahul Sarugaser on Thursday initiated coverage of Alpha Cognition (Alpha Cognition Stock Quote, Chart, News, Analysts, Financials TSXV:ACOG), a Vancouver-based clinical stage pharmaceutical company. Sarugaser started off Alpha Cognition with an “Outperform” rating and $2.50 price target, which at the time of publication represented a projected 12-month return of 212.5 per cent.

Raymond James analyst Rahul Sarugaser on Thursday initiated coverage of Alpha Cognition (Alpha Cognition Stock Quote, Chart, News, Analysts, Financials TSXV:ACOG), a Vancouver-based clinical stage pharmaceutical company. Sarugaser started off Alpha Cognition with an “Outperform” rating and $2.50 price target, which at the time of publication represented a projected 12-month return of 212.5 per cent.

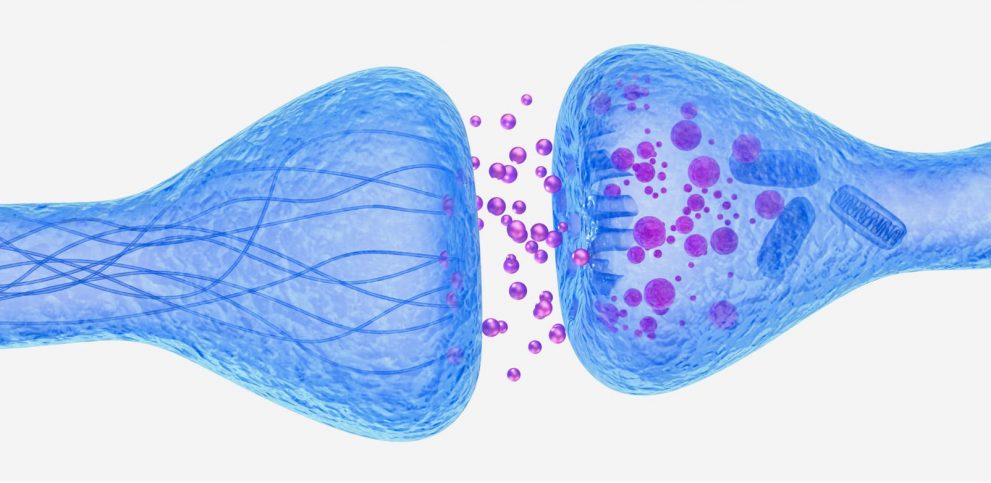

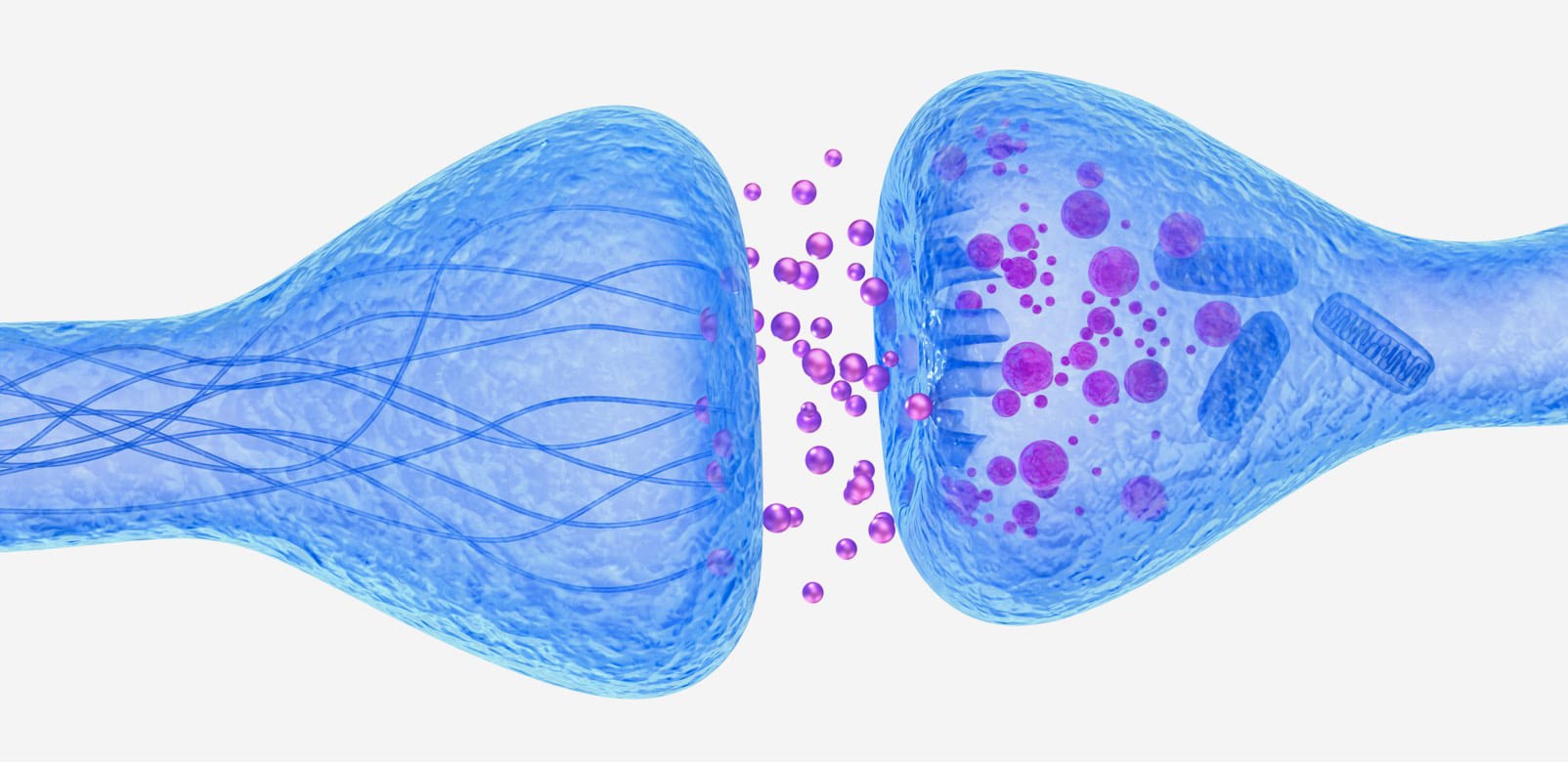

Alpha Cognition, which completed its qualifying transaction on March 22, 2021, and began trading on the Venture Exchange a week later, is in the late stages of clinical development of a treatment for severe neurodegenerative disorders, including Alzheimer’s disease (AD). Currently, about 80 per cent of patients diagnosed with AD are started on medication from the class of drugs called acetylcholinesterase inhibitors (AChEIs).

The drug galantamine is an AChEIs that has been demonstrated to have efficacy in reducing cognitive decline in AD patients and has been shown to improve patients’ capacity to live independently post-diagnosis. Galantamine is widely used as was prescribed 12 million times in the United States alone in 2019. Yet it and other AChEIs come with GI-related side effects including nausea, vomiting and diarrhea which can contribute to patient non-adherence and treatment failure.

Alpha Cognition’s proprietary molecule Alpha-1062 pro-galantamine is a pro-drug, meaning it requires a transformation to become active. In Alpha-1062, chemical groups called benzoyl esters are bonded to galantamine so as to prevent interaction with the small intestine, leaving the drug to be metabolized by the liver and then activated for circulation into the brain. The result is a drug which Alpha Cognition hopes will become the best-in-class standard of care for AD.

On its clinical program, Alpha Cognition is on track to start a bioavailability/bioequivalence (BABE) study in the third quarter of this year with quick topline data ready by the fourth quarter. Because Alpha-1062 is a pro-drug of galantamine, its New Drug Application to the US FDA can rely on data generated by galantamine’s original developers, putting Alpha-1062 on the FDA’s 505(b)(2) pathway which requires just the BABE trial.

Following positive BABE data, Alpha Cognition aims to submit its NDA during the first half of 2022, which the company said could lead to FDA marketing approval and commercial launch by 2023.

In his coverage launch, Sarugaser said by bringing innovation to a treatment area that hasn’t seen innovation in decades, Alpha Cognition is “solving the outcomes-hindering, adoption-limiting problem of AChEIs’ low tolerability” to the potential benefit of a large and rapidly growing population of AD patients. Sarugaser quoted stats that say in the United States, for example, there were about 5.8 million diagnosed AD patients, which is projected to grow to about 8.4 million by 2030 and about 13.8 million by 2050.

“With Alpha-1062, we believe ACOG has the potential to provide clinically meaningful symptom improvements to large populations of patients with AD by increasing the tolerability and bioavailability of a known efficacious drug: an elegant, inexpensive, de-risked solution to a big, challenging problem,” Sarugaser wrote.

Sarugaser said he has confidence in Alpha Cognition’s veteran management team and its capacity to bring Alpha-1062 to market expeditiously and to great effect. ACOG recently appointed a new CEO in Michael McFadden, who has over 30 years of experience overseeing clinical development in bringing over 12 therapies to market.

“ACOG’s flagship product, Alpha-1062, has already demonstrated strong clinical data through pilot studies suggesting its capacity to improve tolerability and is following a derisked, truncated, and relatively inexpensive regulatory path, potentially leading to marketing approval by 1H23,” Sarugaser wrote.

“In the meantime, we expect ACOG’s next 12 months to be stacked with Alpha-1062 news flow: the company intends to initiate its pivotal BABE study, publish top-line results for the same, and then submit its NDA to US FDA before 1H22. And, once on market, Alpha-1062 will benefit from patent protection extending to 2040, including composition of matter IP,” he said.

With his forecast, Sarugaser is projecting ACOG to generate $0 revenue in 2021 and 2022 and EBITDA losses of $11 million in 2021 and $7 million in 2022. The analyst said as a pre-revenue company with limited capacity to service debt, equity is ACOG’s most likely financing route, although the company has not commented on this explicitly.

“We value ACOG using a risk-adjusted NPV (rNPV) analysis of its AD clinical asset, Alpha-1062, deriving a present day rNPV of ~$350 million, escalating to ~$750 million should Alpha-1062 make it to market in the US in 2023,” Sarugaser wrote.

“Adding assumed dilution from ~$25 million in equity raises, we calculate a per share valuation of $2.45. We round this to our target price of $2.50/share and given that our target represents a >200 per cent premium to the company’s share price of ~$0.80 at the time of writing, we ascribe a rating of Outperform,” he said.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment