Raymond James launches coverage of Opsens

There’s still lots of room to grow for medical technology company Opsens (Opsens Stock Quote, Chart, News, Analysts, Financials TSX:OPS), says Raymond James analyst Rahul Sarugaser who launched coverage of the stock on Monday with an “Outperform 2” rating and $2.50 target price.

There’s still lots of room to grow for medical technology company Opsens (Opsens Stock Quote, Chart, News, Analysts, Financials TSX:OPS), says Raymond James analyst Rahul Sarugaser who launched coverage of the stock on Monday with an “Outperform 2” rating and $2.50 target price.

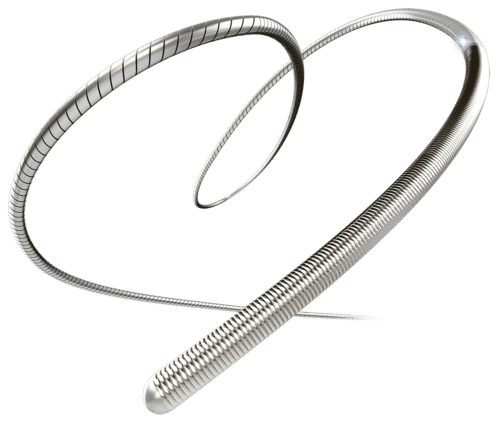

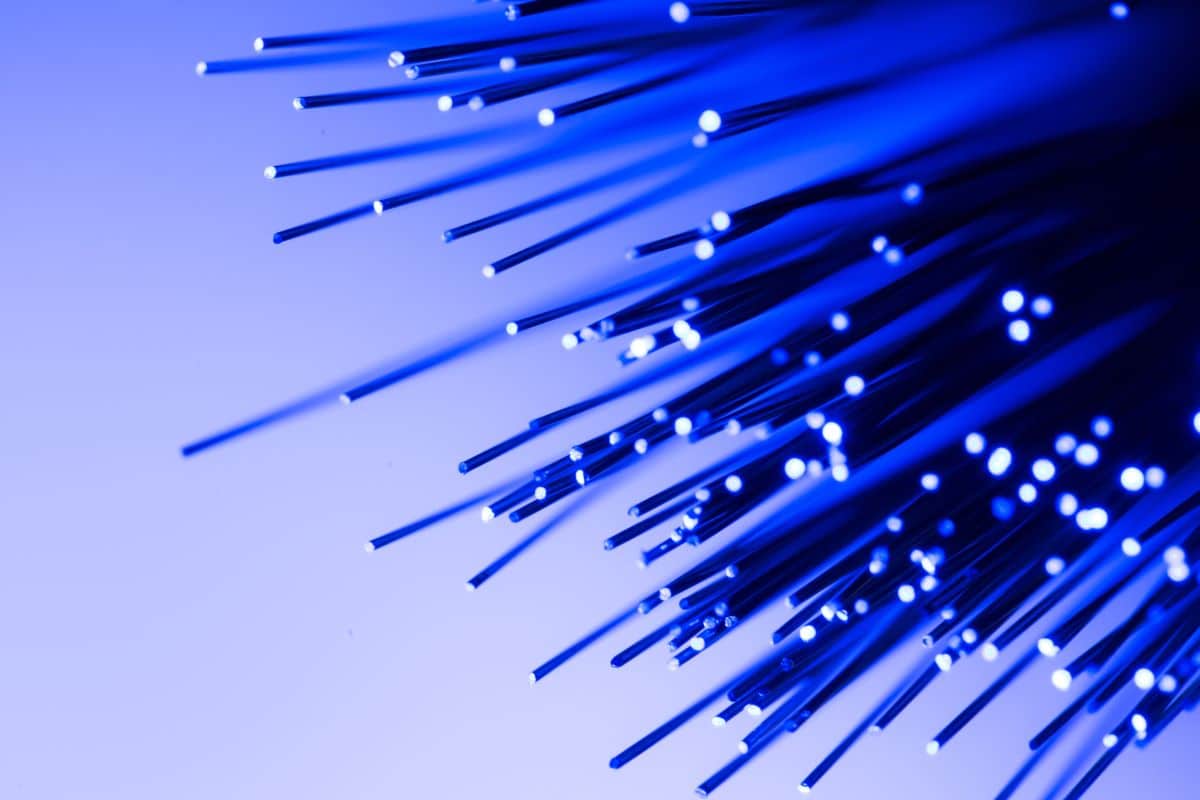

Quebec City-based Opsens develops, clinically validates and commercializes optical devices including the OptoWire, a fibre optic pressure guide wire used in diagnosis and treatment of coronary artery disease (CAD).

The company delivered first quarter fiscal 2021 results on January 13 where it posted revenue up 19 per cent year-over-year to $8.3 million and net income of $0.6 million, with Opsens recording its first group purchasing agreement in October for the OptoWire, a three-year contract with a major American group purchasing organization.

Opsens saw its share price take off from late October onwards, with the stock going from about $0.70 to $1.87 by the end of January.

Sarugaser said while historical sales have been slow to grow, OptoWire revenue should begin to gain momentum over the next four to six quarters. This, the analyst said, is due to:

“The combined effect of OPS’ growing market share — increasing adoption of OPS’s superior technologies (particularly its newly-approved OptoWire III), strengthened sales force, and expanding contracts with powerful US group purchasing organizations (GPOs)— and the rapid secular growth of the CAD assessment market itself: ten per cent CAGR; ~US$1 billion 2025 market for FFR assessment only. Presently, OPS owns a three-per-cent global market share and is making headway into Philips’ and Abbott’s ~88-per-cent share,” Sarugaser wrote.

But Sarugaser also thinks there is upside to come from Opsens applying its fibre optic measurement tech to other fields. The analyst pointed to three key areas, namely, transcatheter aortic valve repair, where OPS expects to commercialize in the growing (about US$8 billion by 2025) market by mid-2022; medical device partnerships, where OPS has developed a number of partnerships as a provider of miniature optical sensors; and heavy industry partnerships where Opsens is providing measurement solutions for sectors such as aerospace, semiconductors, oil and gas, mining and nuclear energy.

“We appreciate OPS for its now-profitable core OptoWire business (>60 per cent of FY20 revenue), but see OPS’s capacity to apply its highly-accurate, highly-reliable fibre optic measurement technologies to applications beyond CAD,” Sarugaser said.

The analyst is forecasting Opsens to hit fiscal 2021 revenue of $36 million and EBITDA of $3 million and fiscal 2022 revenue of $44 million and EBITDA of $6 million. (All figures in Canadian dollars except where noted otherwise.)

On valuation and comparison with its peers, Sarugaser wrote, “Given the breadth of relevant comparable companies to OPS, we undertake a comparables analysis of similarly-themed med-tech companies to drive our valuation.”

“According to our revenue estimates, OPS trades at just 4.8x, 4.0x, and 3.3x 2021, 2022, and 2023 EV/Revenue, respectively, representing a ~25-per-cent discount to peers. As such, we derive an average EV/Revenue valuation of $2.50 per share,” he said.

At the time of publication, Sarugaser’s $2.50 target represented a projected one-year return of 30 per cent.

In its fiscal Q1 update in January, Opsens said sales of products for measuring coronary artery stenosis and diastolic pressure ratio were $5.3 million compared to $4.3 million a year ago, with the uptick coming from growth in its Japanese, American, European and Canadian markets. Sales of optical medical systems hit $2.0 million compared to $2.2 million for the Q1 fiscal 2020. Cash and equivalents at the quarter’s end stood at $12.2 million compared to $10.9 million at the end of the previous quarter.

“During the first quarter, we made strong progress to increase the adoption of the OptoWire in the coronary artery stenosis measurement market, particularly in the United States where we executed our first group purchasing agreement,” said Louis Laflamme, President and CEO, in a press release. “We are in discussions with others and believe this, coupled with the introduction of the OptoWire III, will be key to the expansion of the OptoWire going forward.”

On the contract with the US group purchasing organization announced in October, Laflamme said working with hospital purchasing groups is “a critical initiative” for the commercial rollout of OptoWire across the US as it gives access to more catheterization labs.

“This contract is recognition that the OptoWire improves efficiency and saves significant costs while aligning with our partner’s mission to better treat their patients,” Laflamme said. “The accuracy of the device, or absence of drift, cuts time and costs from the procedure and provides confidence in the diagnosis with consistent and repeatable measurements.”

Up to date, the OptoWire has been used in diagnosing and treating over 100,000 CAD patients across 30 countries worldwide with an installed based of about 2,000 proprietary monitors.