Greenlane Renewables wins bullish new price target at Haywood

New contracts and a strengthened balance sheet should keep cleantech company Greenlane Renewables (Greenlane Renewables Stock Quote, Chart, News, Analysts, Financials TSX:GRN) in the fast lane, says Haywood Capital Markets analyst Colin Healey. Healey delivered an update to clients on Friday where he maintained his “Buy” rating and “Top Pick” status for GRN and bumped up his target from $3.25 to $3.75, which at the time of publication represented a projected 12-month return of 40 per cent.

New contracts and a strengthened balance sheet should keep cleantech company Greenlane Renewables (Greenlane Renewables Stock Quote, Chart, News, Analysts, Financials TSX:GRN) in the fast lane, says Haywood Capital Markets analyst Colin Healey. Healey delivered an update to clients on Friday where he maintained his “Buy” rating and “Top Pick” status for GRN and bumped up his target from $3.25 to $3.75, which at the time of publication represented a projected 12-month return of 40 per cent.

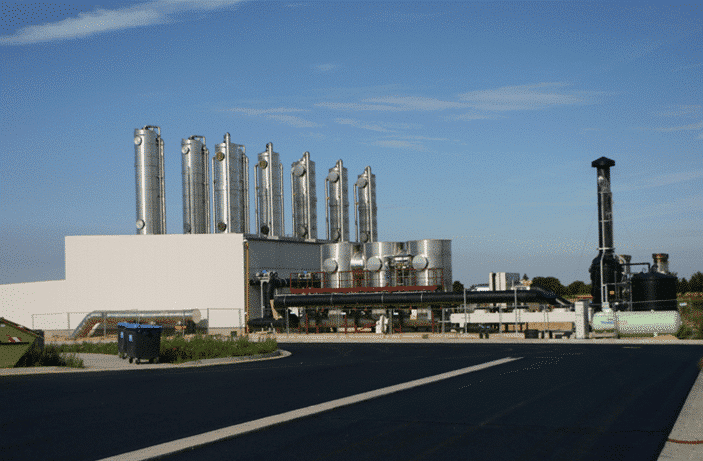

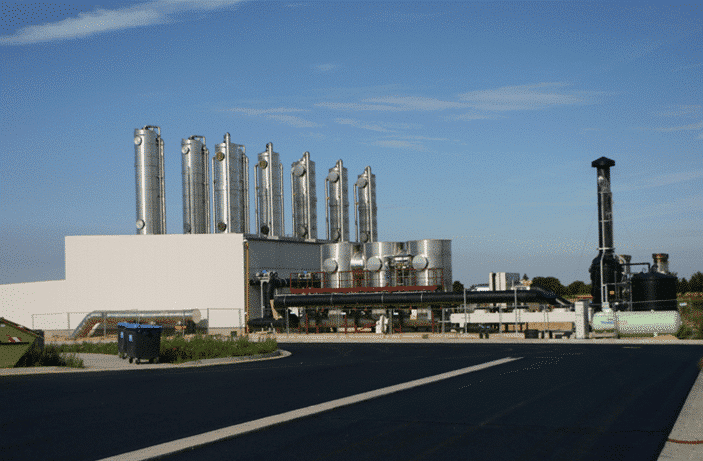

It’s been a busy week for Vancouver-based Greenlane, a global provider of biogas upgrading systems. The company graduated to the TSX senior board, announced the early retirement of a roughly $6.0-million promissory note set to mature on June 30, 2021, and signed two new contracts worth about $3.6 million.

The new contracts involve a project in the Midwest US for upgrading biogas to renewable natural gas from dairy operations and an agreement to supply biogas upgrading equipment in Brazil. The latter represents Greenlane’s fifth contract for upgrading equipment in Brazil.

“The transition to renewable natural gas as an essential solution to decarbonize transportation and the natural gas grid continues to build momentum,” said Brad Douville, President and CEO of Greenlane, in a Thursday press release.

“We’re seeing new opportunities progress through our sales pipeline at an increased pace and we’re seeing results from the investments we made in product development, marketing and sales over the last 12 to 18 months. These two new contract wins demonstrate continued success in sectors where we see additional upside potential and a unique position in the market for Greenlane,” Douville said.

Greenlane’s share price spiked over the last quarter of 2020, climbing 463 per cent over that period. So far in 2021, the stock is up a further 16 per cent.

But Healey thinks there’s more upside to Greenlane, saying in his report, “With the building RNG sector momentum and a strong balance sheet at GRN, the potential for near-term catalysts in H1/21 remains high and we continue to see Greenlane, with its strong growth profile and market positioning, as a great way to play the ‘green energy’ theme.”

On the three events this week, Healey said retiring the $6.0-million promissory note further strengthens and simplifies GRN’s balance sheet, while the up-listing to the TSX main board is a “positive evolution” which should stimulate further momentum in the stock and increase its visibility with a wider audience. On the contract wins, Healey said they’re also a positive demonstration of “the strength of GRN’s sales and marketing strategy.”

The analyst also noted Greenlane’s closing earlier this year on an over-subscribed bought deal for about $26.5 million, which gives the company ample dry powder to execute on accretive opportunities in M&A as well as investments in build, own and operate projects.

On growth in the sector, Healey said the RNG market is still relatively small at about 0.3 per cent of the North American natural gas network, but it’s growing rapidly as consumer demand increases for reduced carbon intensity for their energy usage and as governments continue to mandate growing percentages of renewable energy as part of their respective energy mixes.

For examples, Healey pointed out BC’s regulation for five per cent RNG by 2022 and 15 per cent by 2030, Quebec’s regulation for one per cent RNG in 2020 and five per cent by 2025.

“In the US, federal and select states (California, Oregon) are driving uptake of RNG as fuel for transportation,” Healey said. “In Europe, France’s ENGIE is said to invest €800 million over five years to develop ten per cent RNG in gas network by 2030; in Italy, the European Commission has approved €4.7 billion in a public support scheme for advanced biomethane and biofuels; and Denmark aims for 100-per-cent RNG by 2035.”

Looking ahead, Healey thinks Greenlane will generate full 2020 revenue and EBITDA of $27.3 million and $2.2 million, respectively, 2021 revenue and EBITDA of $46.6 million and $8.8 million, respectively, and 2022 revenue and EBITDA of $64.9 million and $12.4 million, respectively.

“With a robust backlog of sales, sector momentum and the potential for a number of catalysts in 2021, we continue to like the outlook for Greenlane,” Healey wrote. “Our target increase to $3.75 per share is based on an EV/2022 Revenue target multiple of 8.0x (previously 9.9x EV/2021 Revenue. Our 2022 revenue forecast of $64.9 million reflects our view that Greenlane will continue to accelerate growth within its pipeline of opportunities through 2021 and into 2022, leveraging the same product development, sales and marketing strategy that is responsible for the current momentum.”

“This is backstopped by $50 million in existing orders (18-month execution) and a balance sheet to support accretive opportunities. An evolving focus on a ‘Build, Own, Operate’ model adds another dimension to the story. Greenlane remains a Top Pick,” Healey wrote.