UGE International is an acquisition target, this fund manager says

Looking for an undervalued renewable energy play? You should be thinking about solar energy company UGE International (UGE International Stock Quote, Chart, News, Analysts TSXV:UGE), says portfolio manager Robert McWhirter.

Looking for an undervalued renewable energy play? You should be thinking about solar energy company UGE International (UGE International Stock Quote, Chart, News, Analysts TSXV:UGE), says portfolio manager Robert McWhirter.

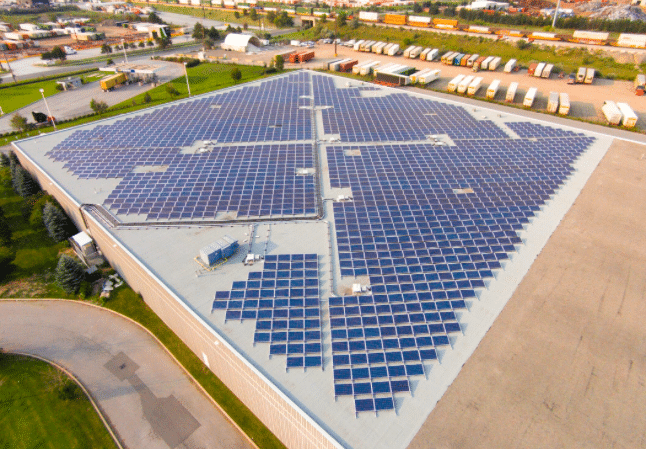

UGE, which specializes in installing solar on commercial buildings and parking lots, calls itself a low-cost provider of distributed renewable energy solutions, now with over 400 MW under its belt and a growing backlog.

UGE on Tuesday announced a contract with Central Maine Power for another community solar project (UGE completed last year a 156 kW project in Monson, Maine). The new project would be the company’s largest to date with a rated capacity of 5.4 MW and a net present value of $9.9 million. UGE said it will complete the project within two years. (All figures in US dollars except where noted otherwise.)

“Our latest project highlights the importance of market knowledge and site selection, located on under-utilized space near the interstate highway and transmission corridor,” said UGE CRO Tyler Adkins in a press release. “2021 will bring continued growth in Maine, and we plan to carry this momentum across the U.S. northeast, home to many of the country’s established and emerging community solar markets.”

In the same release, UGE commented on the recently passed spending bill in the US on clean energy which among other things put a two-year extension on the Investment Tax Credit for solar power, likely giving a boost to the industry. The extension will see the tax credit for 2021 and 2022 increase to 26 per cent whereas it was previously at 22 per cent for 2021 and ten per cent for 2022.

“The ITC extension directly increases the value of our current project development backlog, while also expanding the addressable market for our offering,” said UGE CEO Nick Blitterswyk. “Along with increasing support across the United States for community solar and expectations for additional support and initiatives from the Biden administration, our goals, backlog, and opportunities across the U.S. northeast continue to climb, as well.”

McWhirter said the numbers on UGE show the stock to be undervalued.

“I own UGA personally and participated in the recent financing at C$1.80,” said McWhirter, president of Selective Asset Management, who spoke on BNN Bloomberg on Tuesday. “The stock [on Tuesday] is somewhere around C$2.00-C$2.10, in part because they put out a press release saying that they’ve now booked another $5.4-million worth of community solar in Maine. They’re also very happy because there’s an extension for two years of the solar credit United States.”

“The contract that they talked about in Maine was $9.9 million which is C$12.6 million dollars Canadian, which compared to their market cap of C$54 million is about 20 per cent of the market cap,” McWhirter said.

“So you look at the current $109-million-plus backlog, where their backlog has grown significantly quarter-on-quarter and relative to the C$54 million market cap, I think the stock continues to be significantly undervalued, to the point where you would expect that Brookfield, Algonquin, Boralex or many of the other publicly-traded companies that are in the solar space should end up saying, ‘You know what, the stock is trading at two bucks, we should just offer $2.50 to $3 cash and be done with it, gather up all their opportunities and do really well,’” McWhirter said.

UGE reported third quarter earnings in late November, where revenue fell to $494,000 compared to $943,000 a year ago and adjusted EBITDA ended up at $93,000 compared to $251,000 a year earlier. UGE reported its backlog to be at $112 million, up from $83 million at the end of the previous quarter. The company said that when fully deployed over the next 24 months, the backlog represents $11 million of long-term annual recurring revenue over an average lifespan of 25 years.

“2020 has seen UGE reestablish itself as a developer, builder, and owner/operator of commercial and community solar projects,” said Blitterswyk in a November 24 press release. “Through unprecedented challenges in the global economy, this year we have grown our project backlog by over 200 per cent, reaching $112 million by the end of the third quarter. With our first self-financed projects now operational, and several more under construction, we are preparing to accelerate our growth in 2021.”

After staying around the C$0.20 mark for the first half of 2020, UGE started climbing in July as the company started picking up more contracts and settled on a debt obligation.

For 2020, UGE’s share price grew by 1484 per cent, but McWhirter says there’s more upside to come.

“I think the company continues to be undervalued and that’s why I continue to own it. The original investment I made in the stock about a year ago was at 20 cents with a warrant at $0.33. I think there’s still a great opportunity either by themselves or under someone else’s umbrella going forward,” McWhirter said.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.