Technology by Perimeter Medical Imaging AI (Perimeter Medical Imaging AI Stock Quote, Chart, News TSXV:PINK) has the potential to become part of the standard of care in breast cancer treatment, according to healthcare research firm Encode Ideas’ Hogan Mullally, who initiated coverage of the stock on October 21.

Technology by Perimeter Medical Imaging AI (Perimeter Medical Imaging AI Stock Quote, Chart, News TSXV:PINK) has the potential to become part of the standard of care in breast cancer treatment, according to healthcare research firm Encode Ideas’ Hogan Mullally, who initiated coverage of the stock on October 21.

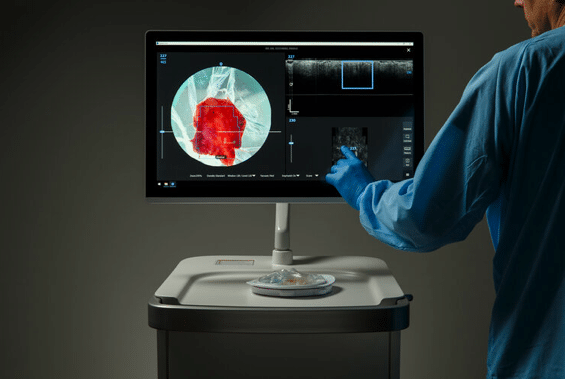

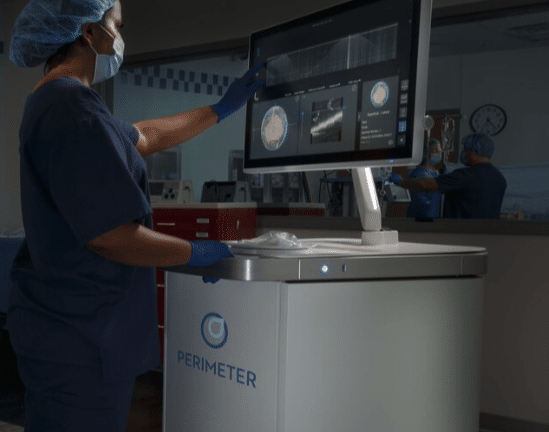

Toronto-based Perimeter Medical with US headquarters in Dallas, Texas, has a imaging platform, an optical coherence tech called OTIS for providing real-time, ultra-high resolution, subsurface imaging of excised tissue. OTIS can rapidly image large tissue surfaces such as an excised tumour at ten to 100 times the resolution of ultrasound or MRI.

On the OTIS platform, Mullally said breast conservation surgery is the near-term commercial focus for Perimeter but that once installed he expects surgeons will use OTIS in other intraoperative settings.

“OTIS can fit seamlessly within a surgical suite, allowing for intraoperative tumor tissue imaging, in order to determine if positive margins remain, and additional tissue should be removed,” Mullally wrote.

“Initially, Perimeter will be focused on breast conservation surgery, also known as lumpectomy, where it is estimated that between 20 and 30 per cent of women will require a repeat surgery due to positive margins (cancer left behind) being found via histology two to five days after the initial surgery. Currently, there are limited options for intraoperative tissue assessment, and those available are expensive, inconvenient, and cannot be scaled easily. OTIS has the potential to become part of the BCS standard-of-care, which we estimate to be an annual addressable market of $400 million in the US,” Mullally said.

Perimeter will be launching OTIS in 2021 with an eight to ten-person commercial team, initially focused on high-volume breast conservation surgery hospitals, while the company is also scheduled to complete in 2021 their clinical development of an artificial intelligence (AI) plug-in for OTIS, called ImgAssist AI. The company is currently running a 400-patient sample study on ImgAssist to determine its accuracy versus histology and will also run a 600-patient randomized clinical trial comparing breast conservation surgery reoperation rates for OTIS with ImgAssist versus the current standard-of-care, with data anticipated to be available in the fourth quarter 2021.

Mullally said there should be an FDA De Novo 510(k) submission in early 2022 and potential commercial clearance for ImgAssist by the second half of 2022. Mullally said at a price of $150,000 per OTIS unit and with a $750 per treatment consumable, Perimeter can build a “meaningful commercial business” with peak annual sales of $50 million by 2025. With ImgAssist available in 2022, that projection grows to peak annual sales of $160 million by 2025.

Mullally wrote, “We believe there is a high probability that ImgAssist AI will be FDA-cleared and commercialized, and therefore ascribe a 70-per-cent probability to our best case scenario playing out. Probability adjusted, we get to a $11.45 implied stock price which would equate to a return of ~567 per cent from today’s level.”

Micro cap stock Perimeter Medical, with a current market capitalization of $85 million, went public in early July via reverse takeover of New World Resources, announcing in late June the closing of an oversubscribed $10-million private placement financing round. The stock has done well since its debut at $1.50 per share, now climbing to $2.19 by Friday, November 6.

Perimeter has a main shareholder in Toronto-based private equity firm Roadmap Capital, which controls about 16.7 million shares or 44 per cent of shares outstanding, with Roadmap’s principal, Hugh Cleland, sitting on Perimeter’s board of directors.

“We have achieved a number of key milestones in the last few months, including successfully transitioning to a public company and raising approximately $9.4 million in net proceeds from a private placement offering,” said president and CFO Jeremy Sobotta in an October 15 press release.

“With the potential for further capital proceeds of approximately $13.5 million from the exercise of associated warrants, along with approximately $8 million of available funding from the grant received from the Cancer Prevention and Research Institute of Texas, we believe Perimeter is well capitalized in order to support our clinical development and commercialization plans,” Sobotta said.

As of the end of June, Perimeter had a cash balance of $11.2 million, not including a US$7.4-million grant from the Cancer Prevention Research Institute of Texas for the company’s Atlas AI Project, a two-stage clinical program for ImgAssist.

Mullally said, “We believe Perimeter’s cash balance is sufficient to fund operations into 2022. We anticipate the company could raise additional capital in the second half of 2021 as part of a listing on a US national exchange and to support the commercial ramp from the anticipated FDA-clearance of ImgAssist AI.”

In the company’s second quarter 2020 release, delivered on October 15, Perimeter reported operating expenses for the Q2 of $2.0 million compared to $2.2 million a year earlier and a net loss of $4.6 million compared to a loss of $3.7 million a year earlier. (All figures in Canadian dollars except where noted otherwise.)

Mullally said, “Although Perimeter will be generating revenue in 2021 off a small but growing OTIS install-base, we caution investors from putting too much emphasis on the income statement during this initial commercialization phase. Rather, we feel emphasis should be on where OTIS is being installed, and who are the surgical champions / key opinion leaders (KOLs) driving OTIS adoption.”

Disclosure:

Never invest in any stock featured herein unless you can afford to lose your entire investment. Neither Encode Ideas LP, nor its employees and affiliates are registered as investment advisors or broker/dealers in any jurisdiction whatsoever. The information contained herein is based on sources that Encode Ideas LP believes to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. Readers should always do their own due diligence and consult a financial professional. Encode Ideas LP encourages readers and investors to supplement the information in this report with independent research and other professional advice. All information on the featured company is provided by the company profiled, or is available from public sources and Encode Ideas LP makes no representations, warranties or guarantees as to the accuracy or completeness of the disclosure by the profiled company. Any opinions expressed in this report are statements of judgment as of the date of publication and are subject to change without further notice, and may not necessarily be reprinted in future publications or elsewhere. None of the materials or advertisements herein constitute offers or solicitations to purchase or sell securities of the company profiled herein and any decision to invest in any such company or other financial decisions should not be made based upon the information provide herein. Instead, Encode Ideas LP strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Encode Ideas LP does not offer such advice or analysis, and Encode Ideas LP further urges you to consult your own independent tax, business, financial and investment advisors. Investing in micro-cap and growth securities is highly speculative and carries and extremely high degree of risk. It is possible that an investor’s investment may be lost or impaired due to the speculative nature of the company profiled. Encode Ideas LP. its operators, owners, employees, and affiliates may have interests or positions in equity securities of the companies profiled on this website, some or all of which may have been acquired prior to the dissemination of this report, and may increase or decrease these positions at any time. This report may contain forward-looking statements, which involve risks and uncertainties. Accordingly, no assurance can be given that the actual events and results will not be materially different than the anticipated results described in the forward-looking statement. There are a number of important factors that could cause actual results to differ materially from those expressed in any forward-looking statements made by Encode Ideas LP about the company profiled. These factors include that company’s success in their business and operations; the activities of new or existing competitors, the ability to attract and retain employees and strategic partners, the ability to leverage intangible assets, the ability to complete new projects at planned costs and on planned schedules and adoption of the Internet as a medium of commerce, communications and learning. If applicable, investors are also directed to consider other risks and uncertainties discussed in documents filed by the profiled company with the Securities and Exchange Commission. Encode Ideas LP undertakes no obligation to publicly release the result of any revisions to these forward looking statements, which may be made to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. In no event shall Encode Ideas LP, its operators, owners, employees, and affiliates be liable (jointly or severally) for any special, incidental, indirect or consequential damages of any kind, or any damages whatsoever resulting from loss of use, data or profits, whether or not advised of the possibility of damage, and on any theory of liability, arising out of or in connection with this report. If any applicable authority holds any portion of this section to be unenforceable, then liability will be limited to the fullest possible extent permitted by applicable law.

One or more of the Encode Ideas, LP general

partners is long shares of PINK.V. Encode Ideas, LP is engaged with Perimeter Medical Imaging AI, Inc. to provide research coverage and awareness. Please visit our website for full disclosure. Following publication of any report or update note, Encode Ideas, LP intends to continue transacting in the securities covered therein, and we may be long, short, or neutral thereafter regardless of our initial recommendation. Encode Ideas, LP general partners, consultants,and / or any affiliates may not transact in the security covered therein in the two market days following publication.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment