Is Telus the best Canadian telco stock?

If it’s a solid bet in the utilities space, you might want to look at Telus (Telus Stock Quote, Chart, News TSX:T). Scotia Wealth Management’s Greg Newman says it’s the best of the bunch for a number of reasons, starting with the fat dividend yield.

If it’s a solid bet in the utilities space, you might want to look at Telus (Telus Stock Quote, Chart, News TSX:T). Scotia Wealth Management’s Greg Newman says it’s the best of the bunch for a number of reasons, starting with the fat dividend yield.

Choosing between Canada’s big telecom companies has never been easy. BCE, Rogers Communications, Shaw, Quebecor and Telus tend to move in a bunch as market preferences shift back and forth depending on where interest rates and the broader economy are headed.

The five have nearly identical charts since the start of the pandemic, for example, showing the big drop in February and March with the broader market pullback, followed by a quick recoup of about half of those losses and then a lot of drifting sideways.

Quebecor has done a bit better than the others and Rogers a bit worse, but the gist remains the same: whereas in earlier periods of market volatility investors turned to the relative safety of utilities like the Canadian telcos, the market response to COVID-19 has been otherwise. US tech giants like Amazon and Apple have become the de facto security blankets this time around, while the telcos have been more or less ignored.

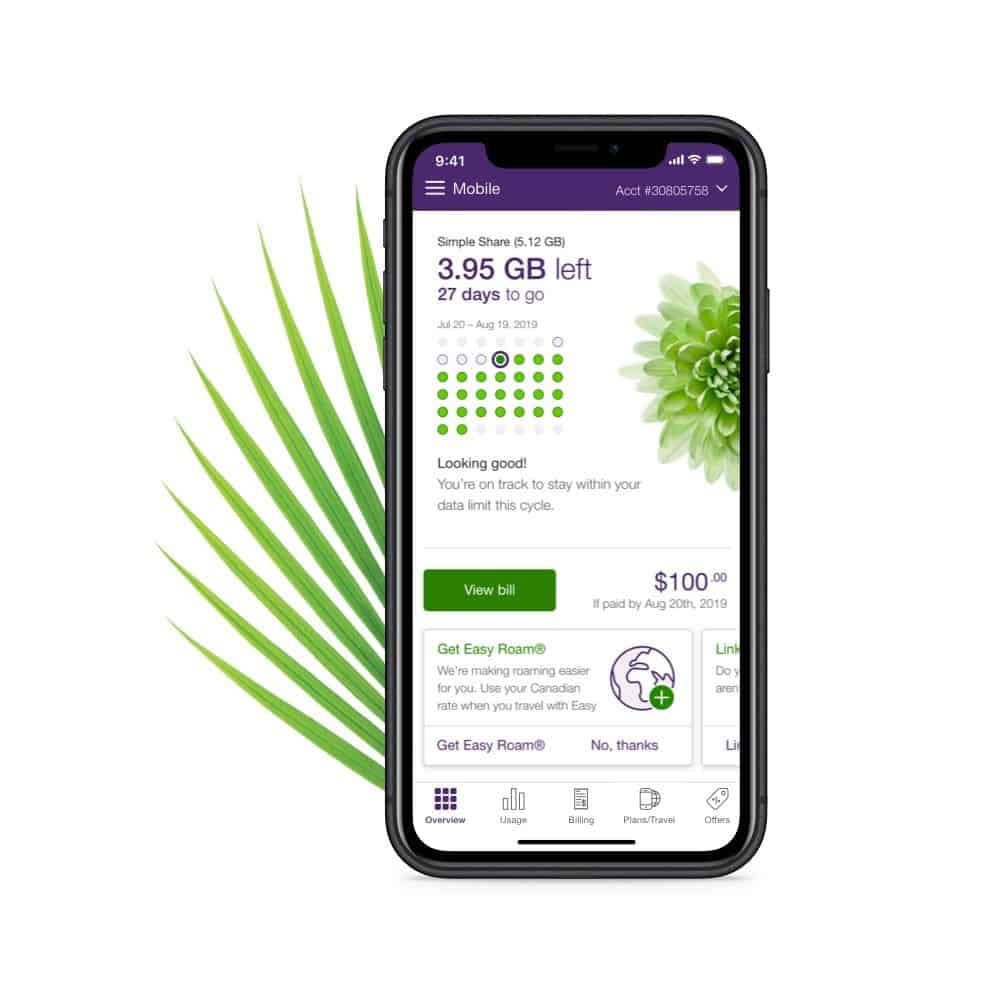

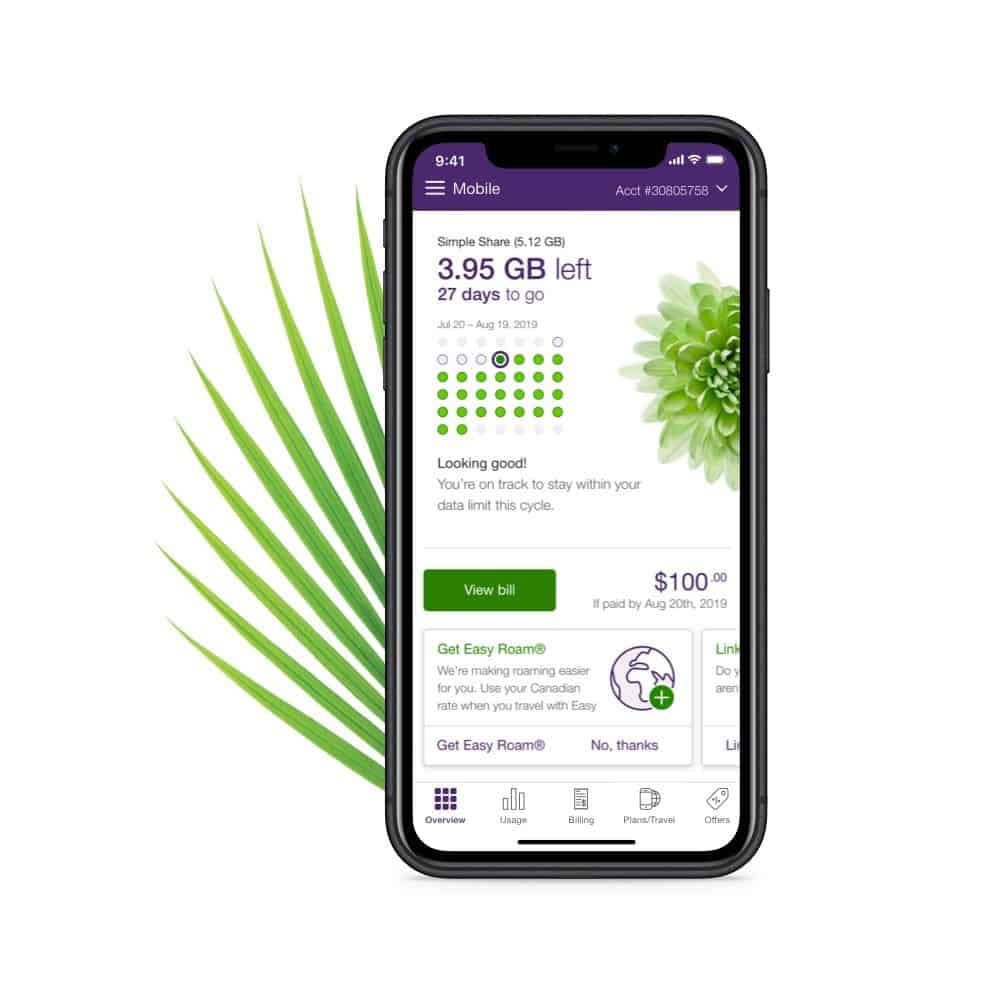

But Newman, senior wealth advisor at Scotia, says there’s good value in owning a Canadian stock like Telus, which along with its core business has a number of strong assets with which to grow the company.

“Telus International is probably worth another $1.60 in shareholder value that they haven’t really harnessed yet, and Telus Health is really going well for them,” said Newman, speaking on BNN Bloomberg on Thursday. “They’ve only had a small impact from COVID versus, for example, Rogers, who has had a much bigger one.”

“In terms of dividend it’s got a high dividend and we do forecast six per cent dividend growth. This is a great name. Like the other telecom stocks, like BCE, for example, they’re not cheap, but if you’re allocating new money to the market and you want something that is part of the solution in terms of thirst for data and proliferation of 5G, I think the telecom stocks longer term set up nicely,” Newman said.

“And Telus is probably the best one of the bunch right now,” he said.

Telus is continuing its national rollout of 5G networks across the country, with the company announcing this week expanded coverage in BC beyond home city of Vancouver to the Stony Plain and areas of Parkland County. Telus began in June with 5G coming online for its customers in major Canadian cities like Toronto, Montreal and Edmonton, with the company now touting its recent designation as the fastest network not just in Canada but the world in terms of download speed, this through a new industry

report from UK-based Opensignal.

“This global recognition from Opensignal, in concert with our rapidly expanding next-generation 5G network, reinforces the TELUS team’s unparalleled commitment to providing Canadians with access to superior technology that connects us to the people, resources and information that make our lives better,” said Darren Entwistle, President and CEO of Telus, in an October 7 press release.

The COVID-19 pandemic has taken a toll on the telecoms, including Telus, whose latest quarterly report came at the end of July and featured a slight year-over-year uptick in revenue but a significant drop in profits. Telus’ second quarter 2020 featured consolidated revenue of $3.7 billion compared to $3.6 billion a year ago and net income of $315 million, down from $520 million for Q2 of 2019. Lower wireless roaming revenue and reduced business at its retail stores, both due to the pandemic, were said to

be contributing factors. (All figures in Canadian dollars except where noted otherwise.)

At the same time, the company highlighted its ability to retain customers and even grow its base over the pandemic months, with Entwistle saying in the second quarter press release, “TELUS achieved resilient financial and operational results in the second quarter, characterized by strong customer growth of over 141,000 net new additions, despite the challenges we faced in the quarter with respect to the COVID-19 pandemic … This was supported by strong and enhanced customer loyalty across our key growth product lines, including historically low postpaid churn of 0.59 per cent, backed by the TELUS team’s longstanding dedication to delivering premium customer experiences over a world leading network.”

Analysts have come out in favour of Telus, as well, with Barclays recently launching coverage with an “Overweight” rating and US$21.00 price target, representing a projected 12-month return of 19 per cent.

And after the second quarter results, Scotiabank analyst Jeffrey Tan said in an update to clients , “We think Telus’s wireless results were a relief and point to strong execution during the early stages of the pandemic.”

Staff

Writer