UGE International should be on your radar, this investor says

Microcap stock UGE International (UGE International Stock Quote, Chart, News TSXV:UGE) is perhaps not a familiar name to investors but the stock should be on your radar if you’re interested in renewable energy names.

Microcap stock UGE International (UGE International Stock Quote, Chart, News TSXV:UGE) is perhaps not a familiar name to investors but the stock should be on your radar if you’re interested in renewable energy names.

So says portfolio manager Robert McWhirter, who argues that the company’s impressive backlog is a real selling point.

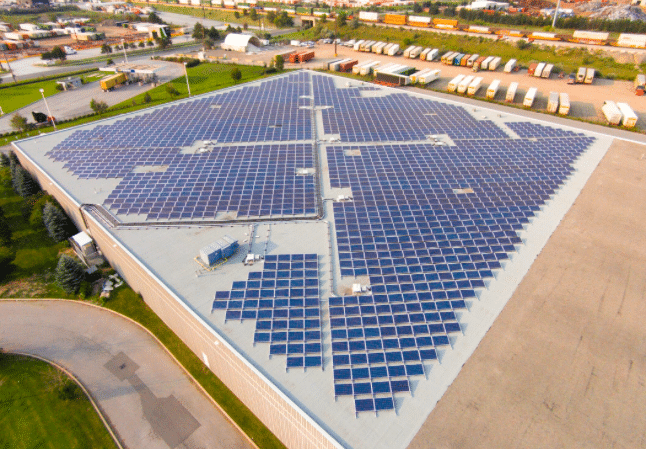

“Their specialty is solar locations that are installed on commercial buildings and parking lots in New York City,” said McWhirter, president of Selective Asset Management, who spoke on BNN Bloomberg on Friday. “The New York government has basically put a huge incentive in place for people to end up saying yes we'll sign a 20-year offtake agreement with the local power provider, and UGE has changed from previously just building locations, developing them and then selling them to now they said, ‘You know

what? There’s a lot more dough to be made if we end up doing the build, own and operate.”

“They have a very significant backlog. It’s a very small market cap but the size of their backlog is huge. and the company has basically said that within two years if they have the projects that are on the books up and going, they will have $11 million worth of annual, high-margin, recurring revenue — and that compares to the current market cap of $12 million today,” McWhirter said.

UGE’s shares have been climbing both on Friday and on Monday, with the stock up over 30 per cent since Thursday. UGE reported its quarterly numbers recently, delivering its second quarter 2020 results on August 25 with that impressive backlog taking centre stage.

Over the Q2 UGE grew its backlog from $72 million to over $83 million, which, if fully deployed would represent $15 million of upfront revenue and over $8 million of annual recurring revenue for the next 20-plus years.

For the quarter, UGE saw revenue drop almost in half, from $943,000 to $494,000, while adjusted EBITDA went from negative $251,000 to negative $93,000

And while the COVID-19 pandemic slowed down its projects, UGE ’s business is now getting back on track, according to CEO Nick Blitterswyk.

“During the first half of 2020, COVID-19 disrupted the economy, bringing unprecedented delays to our customers, prospects, and some of UGE's business activities. Such restrictions temporarily slowed UGE's construction activities from March through May, but our sales activities, project development, and contractor discussions were minimally disrupted,” Blitterswyk said in a press release. “Our business activity is gradually returning to normal, and we’re pleased with the progress we're making post

quarter-end on increasing deployment of our turnkey solar projects.”

McWhirter said there’s real potential in UGE.

“It’s a thin-trader but one that we think has a very significant opportunity, particularly when you look at the kinds of opportunities for 15-20 years worth of high recurring revenue,” McWhirter said.

Disclosure: Mr. McWhirter owns shares in UGE and has participated in two financings with the company over the last 12 months.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.