After getting their balance sheet ducks in a row, the road ahead looks a little clearer for Intermap Technologies (Intermap Technologies Stock Quote, Chart, News TSX:IMP), but investors may be best served by waiting on the sidelines with this one. So says portfolio manager Kim Bolton who would like to see signs of profitability from the name before buying it.

After getting their balance sheet ducks in a row, the road ahead looks a little clearer for Intermap Technologies (Intermap Technologies Stock Quote, Chart, News TSX:IMP), but investors may be best served by waiting on the sidelines with this one. So says portfolio manager Kim Bolton who would like to see signs of profitability from the name before buying it.

“We don't own it,” said Bolton, founder and president of Black Swan Dexteritas, who spoke about Intermap on BNN Bloomberg on Wednesday. “It’s a pretty small company. It's not profitable but it's only got about a $23 million market cap. You can see it on the charts that it's just sort of flowing over the course of the summer. They started many years ago as a mapper especially for the mining industry.”

“It has really come up recently as a result of their debt restructuring and it also got certified by the aviation industry, so it just popped up,” he said. “It’s so very important for Intermap at this stage to prove that it can actually be cash flow positive and that it can make money.”

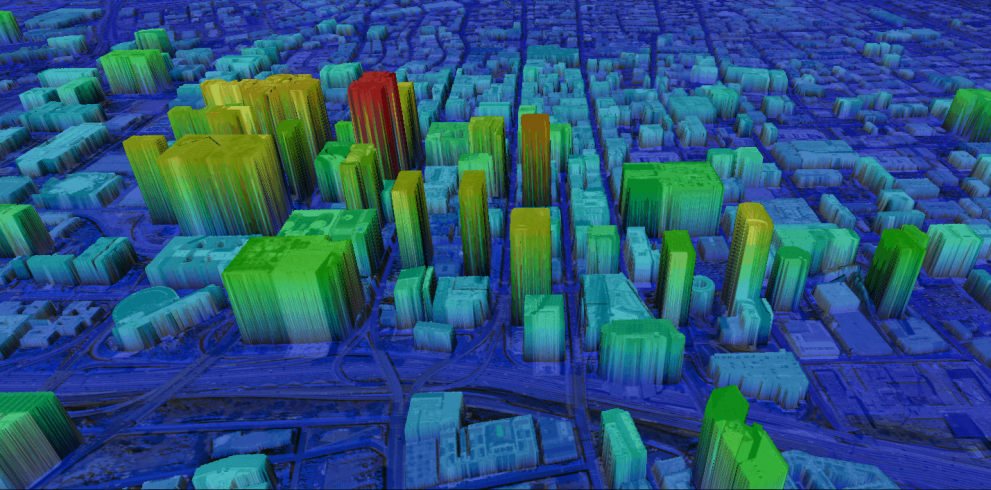

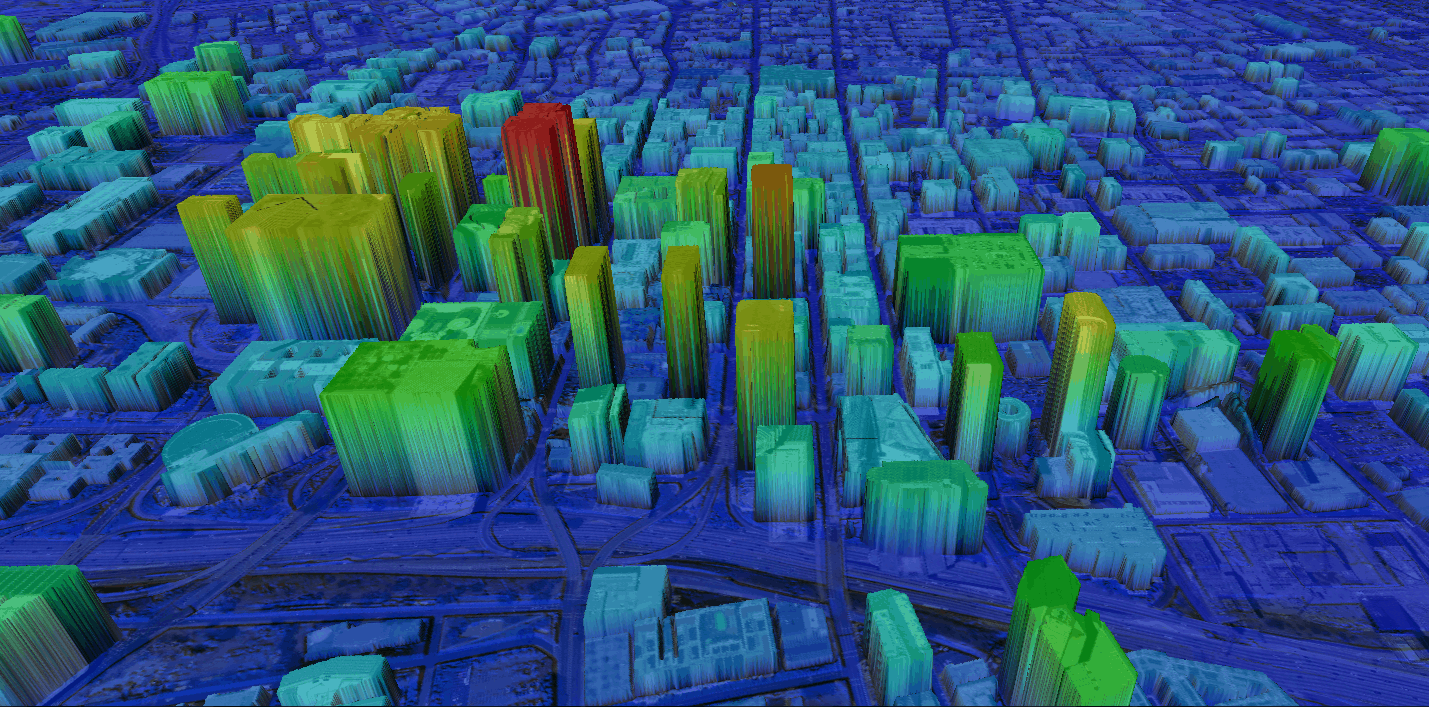

Denver, Colorado-based Intermap is a geospatial data management company serving industries in both the public and private sectors such as aviation, engineering, environmental planning, oil and gas and insurance.

The company’s share price had been living in the C$0.25 range for a while before taking off a couple of months ago as Intermap announced new contract wins with the US National Oceanic and Atmospheric Administration and the State of California. IMP is currently trading around C$1.00 per share.

This week, Intermap shored up its balance sheet through completing the second leg of private placement for proceeds of $329,000 to clear up the terms of a settlement agreement with lender PenderFund Capital. (All figures in US dollars except where noted otherwise.)

“By eliminating debt, combined with tax advantages in multiple jurisdictions, and greater common stock liquidity, Intermap is building the only publicly traded geospatial platform that can leverage three powerful financial currencies – namely, its publicly traded stock, tax attributes, and balance sheet,” said Patrick Blott, CEO and chairman of Intermap, in a press release on August 17.

Last month, Intermap gave a business update, saying business had been impacted negatively by the COVID-19 pandemic, which has caused slowdowns for both its government and commercial customers.

For a preliminary look at its fiscal second quarter ended June 30, Intermap said revenue should come in at $1.1 million compared to $1.9 million a year earlier, while net income should be significantly improved due to the debt settlement. Adjusted EBITDA for the Q2 is expected to come in as a loss of $0.9 million compared to a loss of $0.8 million a year ago.

“During the second quarter of 2020, the Company undertook a significant reduction in its facilities costs in the United States and Canada, reducing the annual cash cost by nearly 50 per cent for its two primary business locations,” the company said in a July 8 press release.

“Many of the Company’s government and commercial customers experienced business interruption and delays as they transitioned to remote-work environments mandated in response to Covid-19. The Company continues to work closely with its customers and has not missed or delayed any contracted delivery milestones,” Intermap said.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment