Raytheon is a good long-term bet, says this portfolio manager

The merger between Raytheon Technologies (Raytheon Technologies Stock Quote, Chart, News NYSE:RTX) and United Technologies may have been good news for United shareholders but it may take a while for Raytheon’s share price to head north again. So says portfolio manager Gordon Reid who likes RTX for the longer term.

The merger between Raytheon Technologies (Raytheon Technologies Stock Quote, Chart, News NYSE:RTX) and United Technologies may have been good news for United shareholders but it may take a while for Raytheon’s share price to head north again. So says portfolio manager Gordon Reid who likes RTX for the longer term.

Defense contractor Raytheon completed its merger with United in early April, which was certainly a unique time to be joining forces with an aerospace company, seeing as that industry was in the middle of a tailspin like no other. As everyone knows, the COVID-19 pandemic caused a global shutdown in air travel and put both commercial airlines and engines and parts companies like United Technologies in a serious holding pattern for the foreseeable future, as it’s anyone’s guess when customers will start flying again in sizeable numbers.

Raytheon’s share price tells the tale —the stock, which had been rising steadily for much of the past half-decade, is currently down about 30 per cent for 2020, and has stalled in its attempt to make up ground lost in the general market pullback of February and March.

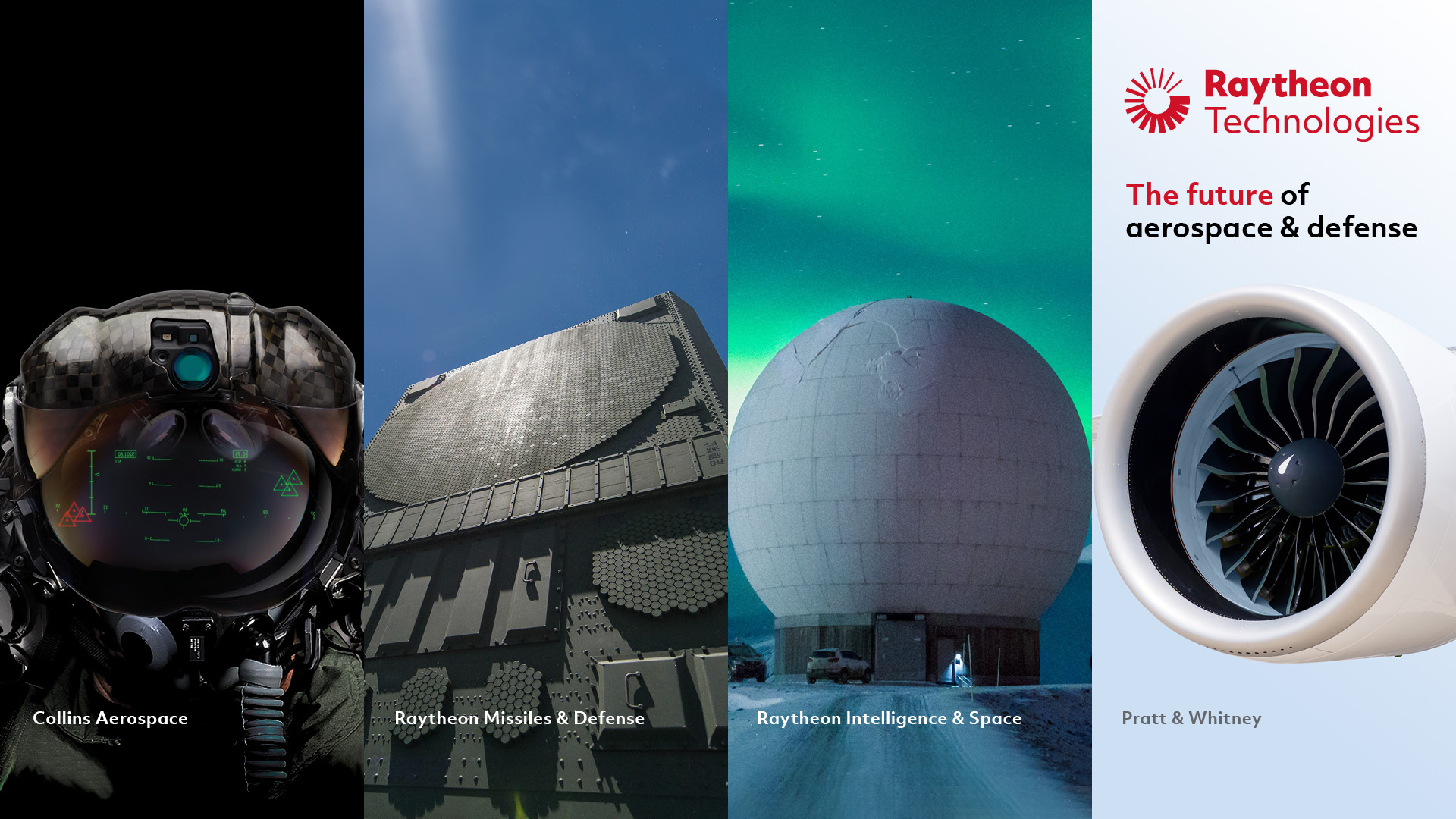

Source: Raytheon

But the newly-formed Raytheon Technologies, which delivers its quarterly earnings on July 28, has all the makings of a great buy, says Reid, who says investors will need to be a little patient for this stock to turn around.

“We own Raytheon in our large-cap portfolio and we’re quite high on it,” said Reid of Goodreid Investment Counsel, who spoke on BNN Bloomberg on Thursday. “Obviously, there are some near-term bumps in the road. UTX, United Technologies, is highly correlated with the commercial aerospace business in that they own Pratt and Whitney, they own Collins and they own Goodrich as divisions, while the Raytheon portion is

much more insulated. Most of their revenue comes from government and commercial contracts, defense business and so on.”

“But if you put the two companies together … The stock is trading in the $60 range and we see in the fairly near term earnings in the $8 to $9 per share range,” Reid said. “We think they can generate a lot of cash, about $5 to $6 billion a year, so we're quite high on Raytheon, but you might have to show a little bit of patience.”

“It tends to trade with the opening trade — there's the two groups that are trading, the momentum companies that are made up of technology and communication services companies that we know so well and then the opening trade, the more value-oriented companies, that will do well when the economy gets its footing again. And Raytheon would be in that latter camp,” Reid said.

Raytheon, which currently has a dividend yield of about three per cent, last reported earnings on May 7 where its first-quarter financials showed net sales down one per cent year-over-year to $18.2 billion and adjusted EPS down seven per cent to $1.78 per share.

Analysts had been calling for earnings of $1.22 per share. (All figures in US dollars.)