Canadian cannabis consumer packaged goods company Auxly Cannabis (Auxly Cannabis Stock Quote, Chart, News TSXV:XLY) just wowed with its quarterly earnings, and Raymond James analyst Rahul Sarugaser thinks the stock should be heading higher.

Canadian cannabis consumer packaged goods company Auxly Cannabis (Auxly Cannabis Stock Quote, Chart, News TSXV:XLY) just wowed with its quarterly earnings, and Raymond James analyst Rahul Sarugaser thinks the stock should be heading higher.

In a company brief to clients on Monday, Sarugaser reiterated his “Strong Buy 1” rating for Auxly, saying the breakout quarter is a sign of things to come.

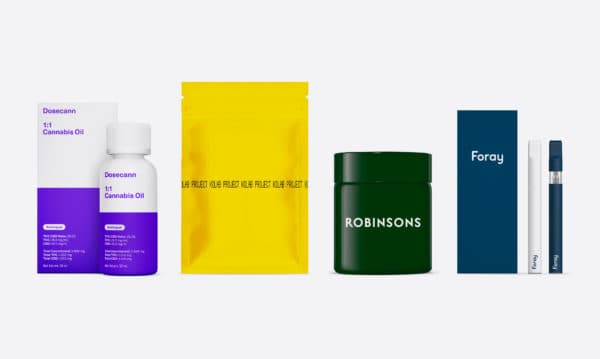

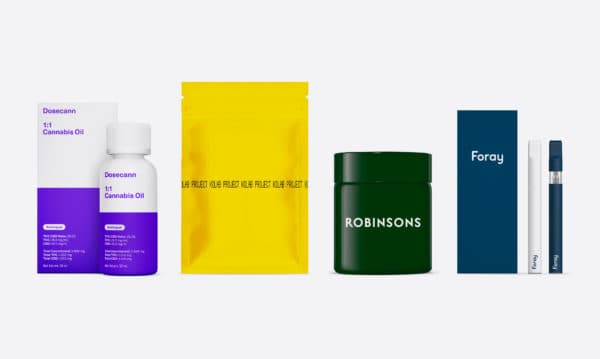

Toronto-based Auxly Cannabis, which has the brands Dosecann, Kolab and Foray, signed a major deal last year with UK tobacco company Imperial Brands, giving Imperial a 19.9 per cent ownership of Auxly and making Auxly Imperial’s exclusive global partner in cannabis.

The company announced its first quarter ended March 31, 2020, financials on Monday, showing net revenues of $9.9 million on strong sales in BC, Alberta and Ontario and with vape products accounting for more than 65 per cent of Auxly’s cannabis sales.

The quarter saw Auxly gain a sales license from Health Canada for its artisanal flower line by subsidiary Robinsons Cannabis, as well as the securing of up to $25 million in convertible debentures financing and a supply agreement with Shoppers Drug through subsidiary Dosecann. Auxly finished the quarter with a net loss of $13.2 million and cash and equivalents of $21.4 million.

“We delivered on our promise to launch a compelling portfolio of cannabis products that deliver on our consumer promise of quality, safety and efficacy – and consumers across the country have responded with phenomenal feedback,” said Auxly CEO Hugo Alves in a press release. “We remain focused on the continued execution of our corporate strategy and are committed to expanding our capabilities, both nationally and internationally, as we continue to fuel growth and generate value for our stakeholders.”

In his review of the quarter, Sarugaser said the $10-million in revenue was a match to his $10-million estimate and better than the consensus $7.8 million, while Auxly’s EBITDA loss of $8.2 million was better than the analyst’s $13.4-million estimate as well as the consensus loss of $10.5 million.

Here’s Sarugaser on the numbers: “It’s hard to overstate how impressive these results are. With its 1Q20 earnings, XLY just posted the highest Cannabis 2.0 sales of any Canadian LP, including its multi-billion dollar market cap peers,” Sarugaser said. For comparison’s sake on Cannabis 2.0, the analyst pointed to industry leaders Canopy Growth with about $2.2 million in derivatives sales in its latest quarter, Aurora Cannabis with $5.6 million, Aphria with $6.2 million and Organigram Holdings with $3.0 million.

“In sum, we believe this revenue and EBITDA outperformance has not yet been priced into XLY’s stock price, so we expect the company to be rewarded in the coming days and should continue to outperform the sector in the short and medium-term,” Sarugaser wrote.

“With its very strong management team, its flagship alliance with tobacco giant IMB, its sector-leading expertise in developing and manufacturing high-value Cannabis 2.0 products, we believe this quarter’s results are just the beginning,” Sarugaser said.

Looking ahead, Sarugaser thinks XLY will generate 2020 revenue and EBITDA of $59 million and negative $51 million, respectively, and 2021 revenue and EBITDA of $108 million and negative $39 million, respectively.

Year-to-date, Auxly Cannabis is down 24 per cent.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment